[Column] ₩1.5 Trillion Liquidation in ‘Bitcoin Whale Hunting’... The Paradox of Transparency

Summary

- A major $1.1 billion leveraged Bitcoin position was exposed and faced liquidation on Hyperliquid, demonstrating how absolute on-chain transparency can become a vulnerability for investors.

- As seen with the Terra collapse and corporate asset tracking cases, in blockchain-based Web3, exposure of large positions can become a market target, with AI and analysis platforms exploiting this information in real time.

- Demand for privacy-enhancing solutions to address this paradox of transparency is surging, and future Web3 Dark Pool infrastructure may become a major investment opportunity.

Kim Seo-joon, CEO of Hashed

Recently, shocking news swept through the virtual asset (cryptocurrency) community. An anonymous trader named James Wynn was reportedly on the verge of liquidation with a $1.1 billion (about ₩1.5 trillion) long Bitcoin (BTC) position built on the decentralized exchange Hyperliquid, using 40x leverage.

This trade, traced to wallet address '0x507', was opened at $108,084 with the liquidation price set at $103,640. Traders around the world monitored this position in real time, while blockchain analytics platforms publicly revealed every movement with full transparency.

This is not merely a crisis for an individual trader. It is a symbolic event showcasing a new type of information warfare born within the world of absolute transparency that Web3 has created.

In the realm of traditional finance, such information would have only been accessible to a handful of institutional investors. There’s no rational reason to reveal large leveraged positions, but in Web3, hiding anything is nearly impossible. The inherent characteristic of blockchain transparency has paradoxically become the greatest vulnerability for traders—a paradox now realized.

Blockchain’s Fatal Contradiction: When Transparency Becomes Poison

Web3 promises decentralization and privacy, yet in reality, it has created the most transparent surveillance system in history. Every transaction is recorded permanently, visible to anyone, and analyzed by AI. Even though there’s no sensible reason to reveal large leveraged positions, in Web3 it is almost impossible to keep them secret.

In traditional finance, at least banks or brokers can protect client information. In Web3, such intermediaries do not exist. Once a single wallet address is connected, all transactions are instantly public, the position size is exposed transparently, and AI learns the trader’s patterns. Even more threatening, all this information is permanent. In traditional finance, you can close accounts or change brokers, but blockchain records last forever.

Case Study: Strategy—Tracking is Inescapable, Even for Corporations

While James Wynn illustrates the exposure of individual traders, the example of Strategy—a Nasdaq-listed company famous for its Bitcoin holding strategy—demonstrates that corporations are no exception. Strategy founder Michael Saylor strongly warned about the risks of wallet address disclosure, saying, "An enterprise-grade security analyst wouldn’t think it’s a good idea to make all wallet addresses publicly traceable." He emphasized that if you were to ask AI about wallet address disclosure, it would yield a 50-page list of security issues.

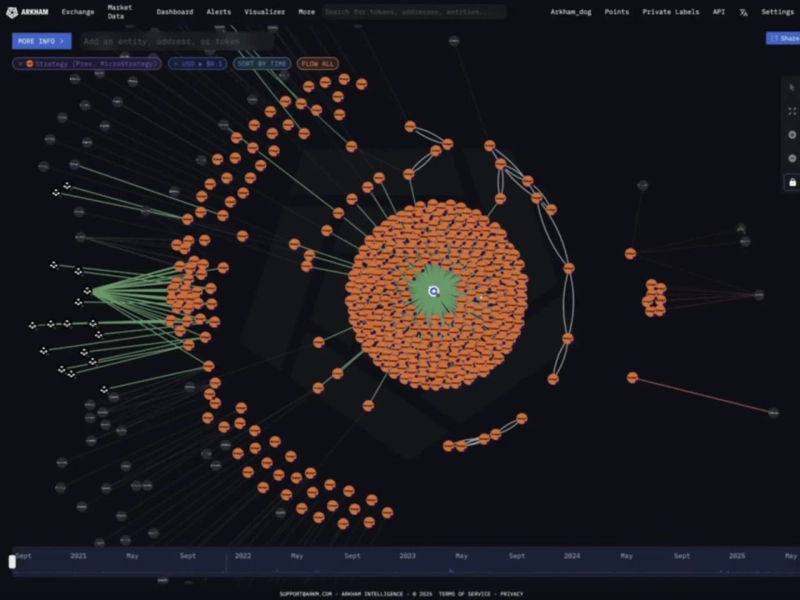

Nonetheless, despite Saylor’s cautious approach, blockchain analytics platform Arkham Intelligence gradually tracked the company’s Bitcoin holdings. By February 2024, they announced the identification of 98% of Strategy’s Bitcoin holdings, and by May 2025, they had discovered an additional 70,816 BTC, bringing the total traceable amount to 525,047 BTC (about $54.5 billion). This accounts for 87.5% of the company’s entire holdings.

Arkham provocatively announced on Twitter, "Since Saylor said he’d never reveal his addresses, we did it instead." The reality that even publicly-listed companies with dedicated legal and compliance teams end up being traced reveals the seriousness of the risks faced by individual traders. In the Web3 environment, no matter how careful you are, you can still be tracked—this is now a proven fact.

Web3’s Unique Information Exploitation Mechanism: New Attack Vectors

When large positions are exposed in Web3, attacks more sophisticated than in traditional finance become possible. Smart contract analysis makes DeFi (Decentralized Finance) position collateral ratios and liquidation parameters transparent by code, and MEV (Maximal Extractable Value) bots can front-run large trades to extract profit. Flash loans enable instantaneous funding to manipulate prices and trigger liquidations, or mass token holders’ governance voting patterns can be analyzed to predict outcomes.

In decentralized exchanges like Hyperliquid, organized attacks known as ‘whale hunting’ occur. When a trader disclosed a $520 million Bitcoin short position in March, others collaboratively attempted to drive the price up to force a liquidation. A trader called ‘Cbb0fe’ publicly solicited recruits on X (formerly Twitter) stating, "If you’re interested in hunting this guy, DM me. The team is being formed and significant resources have already been secured."

Blockchain analysis platforms go beyond simple trade tracking. AI analyzes tendencies within specific times and price ranges, learns loss recovery patterns and profit-taking timings, and uncovers hidden relationships through cross-wallet transfers, predicting future trade sizes and timings based on past data. This means that problems traditional finance’s Dark Pool set out to solve are structurally impossible in Web3.

Weaponization of Transparency: When Information Becomes an Instrument of Attack

In Web3, transparency itself becomes a weapon. When the liquidation price for a large position is exposed, numerous traders target it—some driving prices down with short positions, others waiting for cascade sell-offs upon liquidation. Real-time public information coordinates mass attacks.

Such attacks, impossible for individuals alone, become feasible as blockchain transparency enables crowds to organize. Analyst Markus Thielen of 10x Research called this the "democratization of stop-loss hunting." Market manipulation, once only possible for large institutions, is now within reach of organized retail traders.

The Collapse of Terra: Disaster from Exposed Positions

The most extreme case is the 2022 collapse of Terra. The Luna Foundation Guard (LFG)’s reserves—80,394 BTC (about $2.4 billion at the time) and other crypto assets held for UST (TerraUSD) peg defense—were all public. Attackers knew the precise scale of Terra’s Bitcoin reserves and exploited the fact that LFG would need to sell BTC into the market to defend UST. The resulting $10 billion in BTC selling pressure drove Bitcoin prices down, and attackers profited by shorting BTC.

Although Terra's algorithmic stablecoin mechanism was deeply flawed, what was most fatal was the full transparency of all reserve information, allowing attackers to calculate exact attack scenarios. As a result, $45 billion in market cap was wiped out in a week, and millions of investors lost money.

Even more insidious is the emergence of ‘self-liquidation’ strategies. Analysts suggest that some large traders intentionally expose their positions to attract market attention, induce a price rally, and then profit from other positions. Transparency ironically becomes a tool for orchestrated market manipulation.

New Survival Strategies: Adaptation vs. Concealment

Perfect privacy may be impossible, but it’s possible to maximize the cost of tracking. Successful Web3 traders utilize a multi-wallet strategy: completely segregating main positions, test wallets, and DeFi experiment wallets, generating dummy trades to obfuscate real intentions, avoiding direct interactions via proxy contracts, and maintaining irregular patterns to thwart analysis.

Information security principles are also evolving. Beyond traditional OPSEC (Operations Security), security strategies tailored for Web3 have become necessary. Protecting IP via VPN or Tor, trading on dedicated devices, and dispersing activity across times of day are now basic practices. Crucially, strategies must be established under the premise that "sooner or later, you will be discovered" to minimize potential loss.

Yet some traders choose ‘strategic exposure’ over elaborate concealment—deliberately exposing positions to attract market attention, using it as a tool for psychological warfare. The key is not perfect invisibility, but minimizing damage assuming exposure will occur.

Infrastructure of the Future: Major Opportunities in Web3 Dark Pools

Even amid this dire reality, massive business opportunities persist. The cases of James Wynn and Strategy illustrate not just isolated issues, but a fundamental unmet market need. Just as traditional finance’s Dark Pools (alternative trading systems where trade information is not public) created a market worth trillions of dollars, demand is exploding in Web3 for privacy layers for institutions and professional investors.

Today’s Web3 infrastructure was built with retail investors in mind. But as companies like Strategy move billions of dollars onto Web3, the need for institution-grade privacy solutions has become urgent. Cryptographic technologies such as Zero-Knowledge Proofs, Homomorphic Encryption, and Multi-Party Computation can help solve these problems.

The Web3 Dark Pool of the future will offer more than simple trade obfuscation. It will provide innovative solutions that verify creditworthiness without revealing position size, offer collateral without revealing underlying assets, and manage risk without exposing strategy. Envision infrastructure that allows you to prove holdings of a particular token while keeping the rest of your portfolio fully anonymous. Technically, this is already possible and is just one example of the kinds of privacy solutions institutions desperately need.

Teams solving Web3’s transparency challenges aren’t merely embracing a technical problem. They’re laying the foundation for the next-generation financial infrastructure and are positioned to create far more value than traditional Dark Pools ever did. The greater the problem, the more valuable the solution.

Those Who Solve the Paradox of Transparency Will Be the Winners

The exposure of large positions to the global market could happen at any time. But this reality doesn’t have to be a limitation for Web3—it could be the very driver for the next evolutionary phase.

Looking back at Web3’s history, clear patterns emerge. When major positions are made public on-chain, the outcome is rarely good: Terra’s $45 billion collapse, Strategy’s $54.5 billion position being tracked, and the recent $1.1 billion liquidation risk—all these cases deliver the same warning.

Blockchain’s transparency is a double-edged sword. Technologically, it guarantees trust, but strategically, it creates vulnerabilities—especially with large leveraged positions. Once recorded on-chain, that information is forever, analyzed by AI, and targeted by sharks.

The most successful Web3 traders share a clear trait: they remain invisible. True professionals still rely on multi-wallet strategies, proxy contracts, and diversified patterns to wipe their digital footprints as much as possible. Because they know—exposure in Web3 means being targeted.

The choice remains simple: understand and adapt to the rules of this new game, or become another victim of Web3’s transparency trap. But true innovators go one step further, aiming to solve the problem itself. Those who resolve Web3’s transparency paradox will become the architects of next-generation financial infrastructure. What kind of player will you be?

■ About Kim Seo-joon, CEO of Hashed

△Early graduation, Seoul Science High School

△Graduated from Pohang University of Science and Technology (POSTECH), Department of Computer Science

△Chief Product Officer (CPO) and co-founder, Nori

△CEO, Hashed

△Venture Partner, SoftBank Ventures

△Advisory Member, National Assembly Special Committee on the Fourth Industrial Revolution

△Committee Member, Ministry of Education Future Education Committee

Contributions from outside writers may differ from this publication's editorial direction.

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)