Bitcoin rises 7% last month amid United States of America’s crypto-friendly policies

Summary

- Crypto-friendly policies in the United States of America, such as the integration of stablecoins into the regulatory system, have boosted trust and led to a nearly 7% rise in Bitcoin’s price last month.

- It is expected that Bitcoin’s price will remain highly volatile depending on changes in the United States of America's tariff policies.

- Net inflows of funds into Bitcoin spot ETFs have continued for 10 consecutive trading days since May 14.

Signs of Stablecoin Integration into the Institutional System

The Appeal of 'Diversified Investment' due to U.S. Fiscal Deficit

Likely to Move in Line with Tariff Policies for the Time Being

Spot ETF Investment Funds Continue to Grow

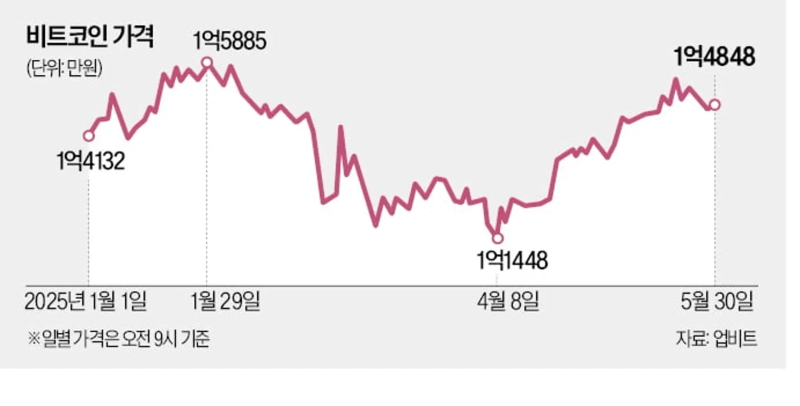

Bitcoin's price rose nearly 7% last month. Analysts suggest that the series of crypto-friendly policies released by the United States of America, including its moves to embrace stablecoins within the mainstream financial system, has propelled Bitcoin's price upward. The stabilization of global tariff wars has also contributed to increased global capital inflow into Bitcoin, a risk asset. With Bitcoin trading around ₩150,000,000, attention is focused on whether it can break through its previous high and surpass ₩160,000,000.

◇ United States of America Announces Crypto-Friendly Policies

According to Upbit, Korea's No. 1 cryptocurrency exchange, on June 4, the price of Bitcoin rose from ₩139,140,000 (as of 9 a.m. on May 1) to ₩148,480,000 on May 30, up ₩9,340,000 (6.7%). On May 22, it even went up to ₩154,860,000. In United States of America Dollar terms, Bitcoin started at $96,000 on May 1, surpassed $110,000 on the 22nd to reach an all-time high, and traded around $105,000 on the 30th.

The main driver behind the clear rise in crypto prices in May was the United States of America government’s crypto-friendly approach. On May 19, the U.S. Senate passed the Stablecoin Act, which strengthens regulations on the issuance and collateral requirements for stablecoins and imposes obligations to comply with anti-money laundering laws. This effectively means the United States of America is absorbing stablecoins into its regulatory framework.

Stablecoins are cryptocurrencies with values fixed 1:1 to certain assets such as the Dollar, and serve as a kind of key currency within the crypto ecosystem, facilitating payments, exchange, and asset transfers. With the United States of America, the world’s largest capital market, recognizing stablecoins, expectations have grown for increased trust in Bitcoin, the representative crypto asset.

Even after this, officials from the U.S. administration have consistently issued crypto-friendly statements. United States of America Vice President J.D. Vance attended the 'Bitcoin 2025 Conference' held in Las Vegas on May 28 and emphasized, “The Biden administration’s crackdown on virtual assets is over,” and, “(Cryptocurrencies) serve as a hedge against bad policy, inflation, and discrimination.” He also stated, “Stablecoins do not threaten the Dollar, but rather strengthen it.”

◇ Bitcoin Price Swings with United States of America Trade Policy

Concerns over the United States of America’s fiscal deficit have put downward pressure on traditional financial assets like stocks and bonds, thereby boosting Bitcoin’s investment appeal. Because Bitcoin’s price often moves separately from traditional financial assets, investors have increasingly turned to it as a means of diversifying their portfolios. Kim Min-seung, Head of Research at Korbit, said, “In these times when trust in the United States of America government is being shaken, Bitcoin’s appeal is coming to the fore again.”

The easing of the global tariff war led by the United States of America also served as a positive for Bitcoin’s price last month.

Bitcoin prices drew a downward curve from January to April, after President Trump took office, as concerns mounted that the global tariff war could trigger a recession. In early April, when the United States of America announced high reciprocal tariffs on other countries, Bitcoin’s price fell below $80,000.

However, after the United States of America postponed the imposition of reciprocal tariffs and trade tensions subsided, Bitcoin prices began to curve upward. Especially on May 8, when the United States of America and United Kingdom announced their first trade agreement, Bitcoin’s price rose more than 5% in a single day, recovering to $100,000 per coin.

◇ Inflows of Funds into Bitcoin Spot ETF Continue

Many predict that Bitcoin’s price will remain highly volatile depending on changes in United States of America’s tariff policies. On May 23, when United States of America President Donald Trump announced he would impose a 50% tariff on the European Union due to stalled trade negotiations, Bitcoin’s price slid 3.6% in a single day. Consequently, the price of Bitcoin dropped from $110,900 on May 22 to $106,950 on the 23rd.

Since then, Bitcoin has been hovering around ₩150,000,000 without a significant rebound. This is due to increased uncertainty, as the United States of America’s Federal International Trade Court ruled on May 28 that the Trump administration’s reciprocal tariffs were invalid, and the next day, the government appealed, resulting in the reinstatement of tariffs.

Joel Kruger, Market Strategist at LMAX Group, commented, “As the trade negotiation deadline set by the Trump administration draws near and tariffs come back to the forefront, we expect further market volatility.”

However, even as Bitcoin prices stalled, investment funds continued to flow into Bitcoin. According to crypto analytics firm Soso Value, net inflows into spot Bitcoin ETFs reached $433,000,000 (about ₩6,000,000,000) on May 28 alone.

Net inflows into spot ETFs have continued for 10 consecutive trading days since May 14. Total net inflows into spot Bitcoin ETFs during these 10 days are estimated at $4,260,000,000 (about ₩5,900,000,000,000).

By Jeong Euijin justjin@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.