Editor's PiCK

Fed Beige Book: "Economic Activity Slows in Most U.S. Regions… Tariff Concerns" [Fed Watch]

Summary

- According to the U.S. central bank (the Fed) Beige Book, economic activity slowed in most regions of the U.S.

- It was reported that uncertainty about tariffs has led to widespread declines in expected profit margins and increases in costs for businesses.

- With deteriorating employment indicators, market expectations for a rate cut are rising, but caution is advised due to the Fed's independence.

The U.S. economy showed some contraction over the past month and a half.

According to the Beige Book from the U.S. central bank (the Fed) released on the 4th (local time), economic activity slowed across most regions of the U.S. during the six weeks following the end of April. This is considered the first report indicating economic trends after a series of reciprocal and itemized tariffs.

This is due to uncertainty related to tariffs. As employment stagnates and concerns over rising prices grow, both businesses and households are becoming more cautious with their spending. In addition, increased costs due to tariffs have been widely reported.

The Fed divides the nation into 12 districts, each overseen by a regional reserve bank. Of the 12 regions, half reported an economic slowdown and three reported no change.

Only Chicago, Atlanta, and Richmond reported economic expansion. In contrast, New York, Philadelphia, Kansas City, Boston, and other areas reported declining business activity or increased uncertainty. All districts reported a decrease in labor demand.

Tariffs were mentioned 122 times in this report, up from 107 mentions in the April report. Notably, companies were reported to be responding to increased tariff-related costs by lowering expected profit margins or introducing various fees to preserve margins.

The report noted, however, that overall price increases were moderate. Although the tariff rates are causing cost pressures and demand for higher prices, wage growth pressure is easing overall as employment becomes less stable.

Overall, the U.S. economy is showing heightened instability due to the Trump administration’s tariff policies. Several indicators released recently have also not been very good. The U.S. services sector index has fallen below 50 for the first time in a year. The service PMI was 51.6 in April but dropped to 49.9 in May. Since a reading above 50 indicates expansion and below 50 signals contraction, falling below 50 is symbolic.

The ADP non-farm private employment number, which indicates changes in private sector employment, also hit a two-year low. The forecast was for over 110,000 jobs but in reality only about 37,000 were created. While this figure tends to fluctuate, the fact that it has dropped to a two-year low is raising concerns in the markets.

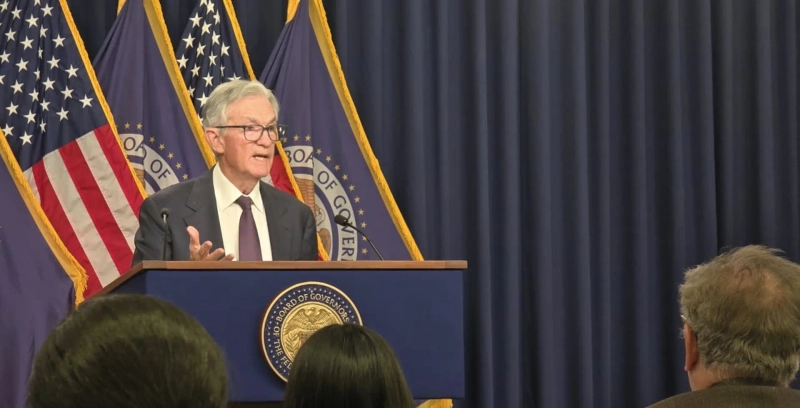

In this context, President Trump once again posted on social media, pressuring Chairman Powell to cut rates. He blamed Powell for not lowering rates after the weak private sector jobs data, noting that Europe has already cut rates nine times. In fact, markets also increasingly expect rate cuts if signs of economic weakness continue. However, since Chairman Powell and the Fed prioritize the independence of the central bank, such pressure may actually have the opposite effect.

Washington = Sang-Eun Lee, Correspondent selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.