"About ₩4.3 trillion worth of Bitcoin options expire today… short-term volatility under scrutiny"

Summary

- It was reported that about ₩4.32 trillion worth of Bitcoin options and about ₩800 billion worth of Ethereum options are set to expire today.

- Ahead of the options expiry, there are concerns about a possible increase in the short-term volatility of the digital asset market.

- The max pain price for Bitcoin and Ethereum options was calculated at $105,000 and $2,575, respectively.

Today, approximately ₩5.2 trillion worth of Bitcoin (BTC) and Ethereum (ETH) option contracts are set to expire, raising expectations that short-term market volatility may increase.

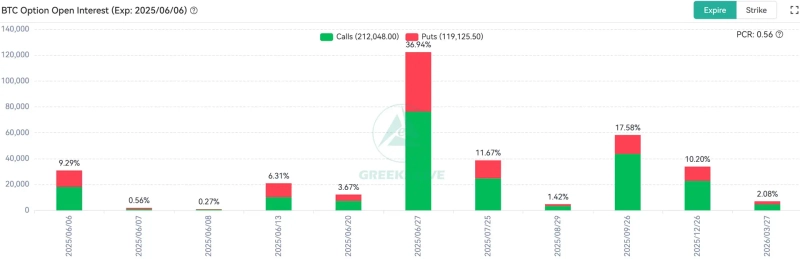

On the 6th, Adam, a researcher at Greeks.live, a digital asset (cryptocurrency) options analytics firm, announced via X (formerly Twitter) that "around 31,000 Bitcoin option contracts and 241,000 Ethereum option contracts are expiring today." The nominal value of these contracts is reported to be about $3.18 billion (approximately ₩4.32 trillion) and $590 million (approximately ₩800 billion), respectively.

He explained, "This week, the digital asset market was mostly range-bound. However, public conflict between President Trump and Elon Musk, CEO of Tesla, triggered a sharp drop in Tesla’s share price, leading both the US stock market and the cryptocurrency market to experience a simultaneous correction, increasing volatility."

Meanwhile, according to Greeks.live data, the max pain price for the expiring Bitcoin options is $105,000, and for Ethereum, it is $2,575.

Typically, coin prices tend to move toward the max pain price—the price at which the largest number of option contracts are settled.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)