Chinese stock market hinges on the 'voice of the US'... Investors on edge despite 'gloomy' CPI

Summary

- This week, the Chinese stock market is expected to show high volatility depending on the results of the resumed US-China trade negotiations.

- The release of China's May Consumer Price Index (CPI) and trade balance is being highlighted as important variables influencing stock prices.

- Investors are remaining vigilant amid both domestic and external uncertainties, such as China's deflationary pressure and warnings from the US on currency policy.

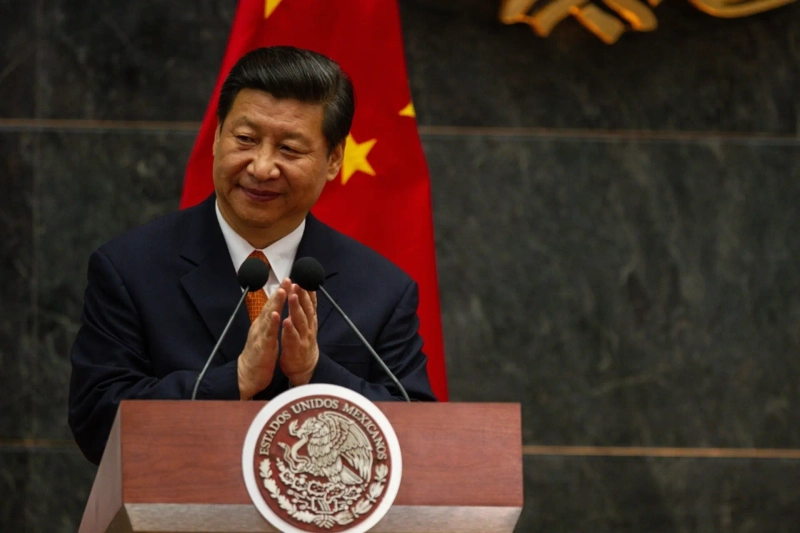

This week, the Chinese stock market is expected to be shaken by the second round of the US-China trade negotiations, which have entered a new phase. As high-level trade talks between the United States and China resume in London, United Kingdom early this week, the volatility of the Chinese stock market is expected to depend on the outcome of these negotiations.

If the talks result in only vague, declarative agreements, a significant deterioration in investor sentiment is anticipated in the short term.

China's Consumer Price Index (CPI) for May, which will be released on the 9th, is also likely to heavily influence the direction of the Chinese stock market this week. Although new discussions with the United States have started, China has been facing rapidly increasing deflationary pressure since the outbreak of the trade war.

China's CPI for April of this year decreased by 0.1% compared to a year ago. This marks three consecutive months of decline. As the housing market, the root of consumer sentiment, has failed to recover for a long period, spending remains restricted. Even the employment market is unstable, and with the outlook for exports becoming more uncertain due to the trade war, China has not managed to escape the shadow of deflation.

Even if the second round of US-China trade negotiations proceeds positively, it is unlikely that tariff rates will return to pre-Trump administration levels. For this reason, there are growing calls both inside and outside China for more aggressive domestic demand expansion and assertive fiscal policies.

On the same day, China’s export and import figures for May, as well as its trade balance in US dollars, will be announced. As the US Treasury Department has been strongly warning China about the lack of transparency in its currency policy and practices, the trade balance results are drawing the attention of investors.

Even in April, when the US-China trade war escalated, China’s exports significantly exceeded expectations, increasing by 8.1% in US dollar terms compared to the same month last year. Although exports to the United States plummeted by more than 20% after the imposition of US 'tariff bombs', exports to Southeast Asia and the European Union (EU) increased sharply. However, there is a strong possibility that clearer negative effects from the United States will emerge in last month’s data.

Beijing = Kim Eun-jung, Correspondent kej@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.