Asia Must Approach Stablecoins More Boldly [ASA Opinion #1]

Summary

- With the expansion of platform-based digital economies in Asian countries, stablecoins are emerging as a vital core of financial infrastructure.

- Securing clear legal status for capital market-based stablecoins and constructing consortia led by IT and financial institutions are important strategies for investors.

- Platform-driven stablecoin strategies will, in the long term, drive innovation in financial infrastructure, including asset management and reward systems.

The question of why stablecoins are needed in each Asian country is comparable to asking why the Korean won is necessary when the US dollar exists. As our societies become increasingly digital, stablecoins become the most ideal form among existing types of money, extending the functional limits of traditional currencies.

If various Asian countries—already among the world’s most digitized—adopt their own stablecoins, there will be a wealth of application fields. Points issued by platforms like Naver and Danggeun Market could exist not only as stablecoins but also enable scenarios such as inter-company trade settlements, automatic tax deductions during donations, and automatic discounts across affiliated platforms—use cases that once seemed like a rosy blockchain future, all made possible by stablecoins.

Stablecoins will shift public perception of “coins” whose value origins are unclear. To introduce them effectively, “capital market-based stablecoins” are needed. Capital market-based stablecoins aren’t limited to banks tokenizing deposits; they allow various entities, including non-bank financial companies and fintech firms, to issue stablecoins backed by cash-equivalent, highly liquid assets exceeding 100% in value.

Since Asian countries largely depend on a few IT platforms or so-called super apps, connecting these services into a single financial platform powered by stablecoins could offer an experience befitting the digital era.

Ultimately, the use case and success of each stablecoin will depend on the issuer’s and operator’s strategies. If issuance and management remain solely the responsibility of banks, the strategic options for stablecoins become limited. This doesn’t mean banks are redundant; rather, in terms of collateral management, issuance, and operation, banks can support stablecoin stability as key institutions. For banks to expand their market share, it’s crucial to form partnerships—with platforms and corporations like Grab, Naver, and SKT—under an operator model. This article explores why the spread of stablecoins is inevitable and particularly why Asia needs capital-market-based stablecoins.

Stablecoins Are the Most Ideal Asset Form

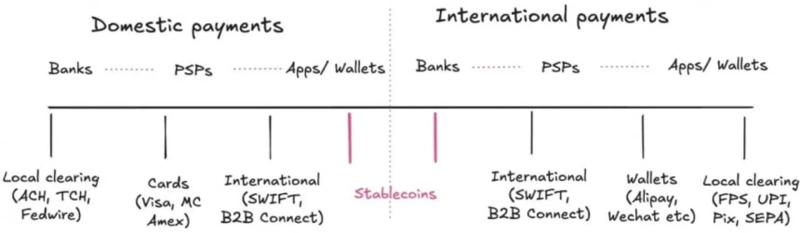

Stablecoins, built on blockchain, are assets accessible to anyone worldwide 24/7 without time or geographic constraints. Crucially, stablecoins offer two programmable features: programmability of functions and of collateral.

Programming functions means you can design smart contract-based features such as granting incentives or rewards for specific user actions that satisfy certain conditions. Programming collateral means stablecoins can be issued not only against off-chain assets (such as bank deposits or government bonds) but also against on-chain assets (like USDC and ETH), with these collaterals transparently managed and verified on the blockchain. Thus, stablecoins bridge the gap between traditional and digital assets and offer the most ideal form for automating and enhancing the transparency of financial systems.

Because of this flexibility, stablecoins provide the foundation for fast, low-cost remittance, programmable payments, DeFi lending and deposits, and cross-border settlements. Anyone can access financial services without a traditional bank account, and developers can use stablecoins to create new financial products and applications. Thus, stablecoins go beyond simple payment tools—they become the core infrastructure, or platform, of the digital economic ecosystem.

By definition, a “platform” is an environment or structure enabling diverse participants to gather and exchange value. Similarly, a stablecoin is not merely currency issued and forgotten; its greatest value is as a platform: a base upon which a range of financial services and applications can be built, not just as a means of stable payment.

For a practical example, consider PayPal’s PYUSD. PYUSD is a USD-pegged stablecoin usable on Ethereum, Solana, Stellar, and other blockchains, serving as the basis for fast, low-cost global payments, real-time remittances, B2B payments, and more. Today, PYUSD is integrated with global corporations such as PayPal, SAP, and Coinbase and is widely used for remittance, payment, invoicing, and real-time funding in real business contexts. Developers and businesses can easily build new applications and services on PYUSD, and anyone within its blockchain ecosystem can utilize this infrastructure to create financial products. In short, a stablecoin like PYUSD acts as a platform connecting various services and users, offering new values that legacy payment systems cannot, and linking diverse services and businesses.

Ultimately, stablecoins are not simple currency; they represent a digital economic financial platform expanding and connecting a wide array of financial and non-financial services.

Asian Super Apps and Stablecoins

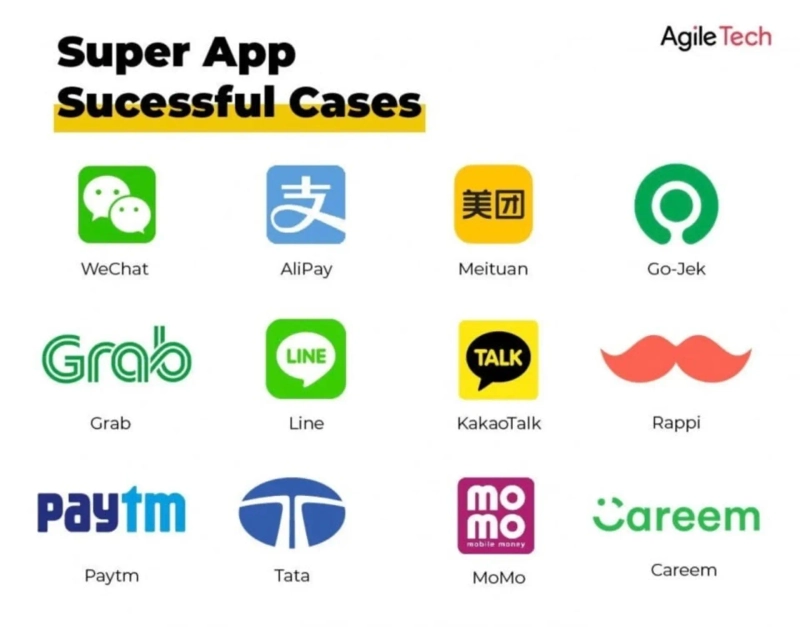

Asia’s leading IT platform market has seen remarkable growth. Beyond large global IT corporations, each region’s flagship platforms are building dominant positions through intense competition. Unlike in the West, Asian platforms go well beyond providing simple services. They integrate news, shopping, payments, social media, mobility, and other functions into a “super app,” allowing users to fulfill nearly every daily need within one platform.

These platforms are not only economic engines but also facilitate social communication, information flow, and even wield political influence. For example, Korean platforms such as Naver and Kakao succeeded by reflecting cultural traits and have expanded to offer almost every online service—messaging, shopping, search, donation, and more.

In Asia, platforms are also seen as tools for national competitiveness and digital sovereignty. Unlike the US or Europe, Asian countries work to foster domestic platforms as a counterweight to dominance from foreign providers.

Especially in Korea, China, and Japan, self-developed platforms aim to protect culture, language, and the local economy while securing initiative in competition with global enterprises. Through this, platforms become the core drivers of innovative startup ecosystems and new industrial clusters. Asian platforms are not merely technology or services—they are the backbone of society, the economy, and, arguably, the state.

Consequently, each country and each leading platform have built their own digital economic ecosystems. Stablecoins can be key to further vitalizing these ecosystems.

Stablecoins Can Become the Financial Platforms of Asia's IT Platforms

Asian IT platforms have already established themselves as super apps offering a range of services within one application. Apps like KakaoTalk, Naver, and WeChat provide tightly integrated ecosystems spanning messaging, payment, shopping, investment, insurance, donations, and more—both financial and non-financial.

While these services are interconnected within each platform, introducing stablecoins could further enhance these connections and create a cross-service incentive system. For example, making a donation within the platform could earn a user discounted shopping or investment benefits, linking economic incentives across services more effectively. This would both increase user traffic and boost platform loyalty.

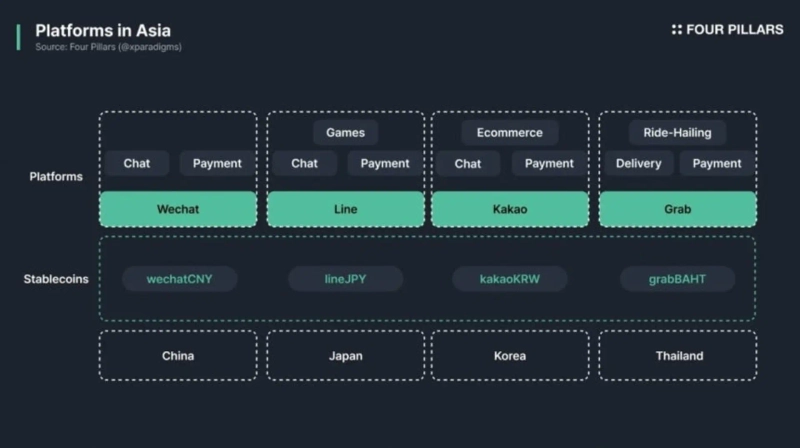

Moreover, these advantages are not limited to a single platform. Should stablecoins issued by various platforms—such as kakaoKRW (Kakao), naverKRW (Naver), rakutenYEN (Rakuten), tencentCNY (Tencent)—become interoperable, they could connect Asian IT platforms into a vast, unified financial platform. This would enable free fund transfers across platforms, dissolving national and platform boundaries, and enable users to manage assets digitally with unprecedented convenience.

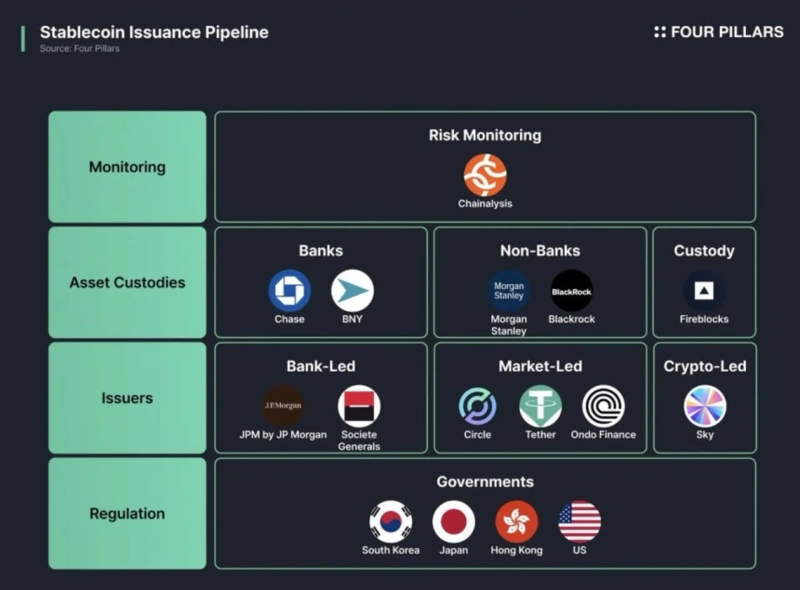

However, realizing this vision requires more than the platforms’ own capabilities. Issuing and operating stablecoins demands partnership with trusted banks and non-bank financial institutions to secure and manage collateral assets. Professional stablecoin operators must take responsibility for issuance and burning as well as transparency and credibility. Monitoring and supervision systems are also essential.

While some of this infrastructure may be provided on a country-specific basis, it’s highly likely that international cooperation and assistance by global enterprises will maximize efficiency in issuance management and monitoring. This collaborative structure—composed of financial institutions, IT platforms, and regulatory agencies—will lay the essential foundation for making stablecoins a core financial infrastructure for Asian platforms.

Key Takeaways for the Successful Introduction of Asian Stablecoins

Asia’s major powers are increasingly specifying regulations and laws regarding stablecoins. Hong Kong has already passed the Stablecoin Act, Japan has clarified a legal framework through the Payment Services Act (PSA), and Korea is gradually establishing a regulatory regime based on the Digital Asset Basic Act. A few fundamental factors must be considered for successful adoption.

Legal: Clear Legislation for Capital Market-Based Stablecoins Needed

Going forward, capital market-based issuance models will drive stablecoin market growth. Traditional models mainly involve banks issuing stablecoins directly with bank deposits as collateral. In contrast, the capital-market-based model allows non-bank financial institutions and fintech companies to issue stablecoins backed by diverse collateral (such as government bonds, corporate bonds, and deposits).

Bank-centric models are strong in regulatory compliance and stability but have notable limits in scalability and innovation. Banks alone struggle to meet the varied needs of different customer groups and services and eventually must collaborate with a range of corporate partners to grow.

For this reason, not only Korea but also other Asian countries should actively refer to the United States' Genius Act or Hong Kong’s Stablecoin Act and legislate to clearly define the legal status of capital-market-based stablecoins backed by various assets. This gives market participants definitive guidelines and is vital for creating an environment fostering both innovation and stability.

Issuance: Preventing Fragmentation through IT-Platform-Led Consortia

If various companies each issue their own stablecoins, incompatibility among types like kakaoKRW, wechatCNY, jdHKD, and rakutenJPY may proliferate. This fragmentation increases user friction and complexity, hindering the growth of the entire stablecoin ecosystem.

Banking systems already exhibit similar fragmentation, but users do not directly feel this because all banks manage and settle funds based on centralized currencies (like Korean won) and internal interbank settlement systems. A similar approach should be adopted for stablecoins.

As capital market-based stablecoins grow, factors like blockchain types, forms of collateral, and token standards may lower interoperability. To solve this, major corporations—including IT platforms and financial institutions—must form consortia to collaborate on standardization and enhance interoperability, building integrated management and settlement systems to minimize fragmentation.

Such consortia will provide a better user experience and will be the key strategy driving the expansion of platform- and service-based ecosystems built on stablecoins.

Opportunities for Asian Countries and Platforms

Monitoring and management systems for stablecoins in Asia are still developing, but the fact remains: these are the most ideal form of money. Moreover, stablecoins must see wide usage, and platforms that underpin personal and business activity can play a critical role in accelerating this.

Regardless of whether they currently issue stablecoins, platforms must formulate strategies for the future financial system.

Especially platforms that dominate daily life and business activity can serve as strategic hubs amplifying the utility of stablecoins. Asia’s super apps, already trusted by users and supporting high transaction volumes, can maximize economic efficiency in their ecosystems and user engagement by integrating stablecoins.

Issuing their own stablecoins or integrating them through partnerships allows platforms to lay the foundation not only for payment solutions but for asset management, credit assessment, and comprehensive reward and finance systems. The critical point is that, regardless of who actually issues them, all platforms must prepare for the stablecoin era and devise appropriate strategies.

In Asia, where dependence on large platforms is high, this approach is even more important. In centralized platform environments like Korea, Japan, and China, companies can use stablecoins to consolidate their internal settlement and payment systems, gaining a competitive edge. Strategic cooperation with government and regulators to bridge with traditional finance could also greatly expand Asia’s stablecoins into the global market.

*The Asia Stablecoin Alliance was initiated by Kang Hee-chang and Bok Jin-sol of Populous, along with Alex Lim (Lim Jong-kyu), Head of LayerZero Korea, to promote stablecoin adoption across Asia as a research and interaction platform for developing clear regulatory environments and robust technical infrastructure.

External contributions do not necessarily reflect the editorial direction of this publication.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)