Fed, Will It Cut Rates Next Month... Even the Hawks Say 'Cut Should Be Considered'

Summary

- Vice Chair Bowman has indicated she may support a rate cut in July if inflation slows, which is expected to influence investor sentiment.

- The yield on the 2-year U.S. Treasury note dropped to an intraday low following Fed officials' remarks about the possibility of a rate cut.

- The Fed's discussion on easing leverage ratio requirements for major banks is drawing attention from capital markets, signaling possible changes in banking regulation.

Vice Chair Bowman: "Economic risks have diminished"

"I support rate cuts if inflation slows down"

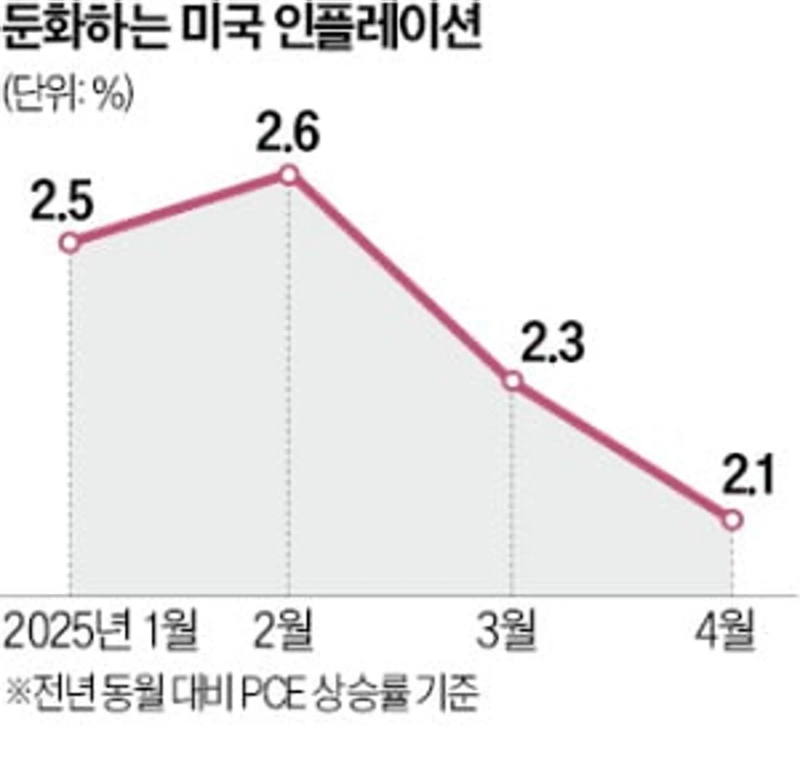

Michelle Bowman, Vice Chair of the U.S. Federal Reserve (Fed), indicated on the 23rd (local time) that she would support a rate cut in July if the trend of slowing inflation continues. With this, following Board member Christopher Waller, even Vice Chair Bowman, known for her hawkish (preference for tighter monetary policy) stance, has publicly supported a July rate cut within the Fed.

Fed, Will It Cut Rates Next Month... Even the Hawks Say 'Cut Should Be Considered' Vice Chair Bowman stated at an event in Prague, saying, "It may take longer than initially expected for the effects of tariffs on inflation to materialize, and those effects may ultimately be smaller." She suggested she would support a rate cut as early as next month.

She mentioned, "Recent economic data shows that the tangible impact of tariffs and other policies has not been clear, and the effect of the trade war on inflation may be more delayed or less impactful than expected." She added, "Overall, the risks in the economic environment have noticeably decreased thanks to progress in trade and tariff negotiations," and said, "Now is the time to consider adjusting the policy rate." Immediately following these remarks by Bowman, the yield on the 2-year U.S. Treasury note—which is sensitive to monetary policy—fell to an intraday low of 3.82%.

Michelle Bowman, who was appointed Vice Chair of the Fed earlier this month by U.S. President Donald Trump, followed up with comments that echoed President Trump's recent calls for a rate cut. She added, "There are signs of vulnerability in the labor market," and, "Going forward, we need to place greater emphasis on downside risks to our employment mandate."

Bowman also stated in her speech that the Fed would begin in earnest to pursue regulatory reform for U.S. banks. Specifically, she mentioned supplemental leverage ratio (SLR) reform, which sets standards on how much high-quality capital banks must hold relative to total assets. U.S. banks have argued that these rules disadvantage low-risk assets such as U.S. Treasury bonds and have continued to call for easing. While Treasuries are considered low-risk assets, they do not count as capital, so the more Treasuries banks hold, the more capital they must set aside, or else risk a lower SLR. Bowman said, "Now is the time to re-examine the impact of leverage ratios on the Treasury market." The Fed is scheduled to discuss amendments to these rules on the 25th. It is expected to agree on lowering the minimum leverage ratio for major banks from the current 5% to a range of 3.5–4.5%.

New York = Shin-Young Park, Correspondent nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.