Patience of Powell vs. Dovish Pressure: The Federal Reserve's Summer Showdown, Who Will Win? [Investing.com]

Summary

- Currently, the Fed funds futures market sees a low probability of a rate cut at the July FOMC, while pricing in about an 80% likelihood of a cut in September.

- Recently, the Treasury market has priced in economic slowdown, with the 10-year yield dropping to 4.35%, and some Fed officials have mentioned the possibility of a July rate cut.

- Chair Powell continues to hold a steady stance on rates, though weakening labor indicators and economic uncertainty are raising pressure for a possible rate cut in September.

By James Picerno

Federal Reserve Chair Jerome Powell is still taking a wait-and-see approach in determining whether tariffs have created inflation significant enough to delay a rate cut. However, the monetary policy outlook on financial markets is shifting so swiftly that even last week's assumptions now seem outdated.

Powell is scheduled to testify before Congress today and tomorrow, where he may adjust his stance. But expectations are low. Like most analysts, it is anticipated that Powell will reiterate what he said at last week's press conference: the Fed will hold rates steady until the impact of tariffs on inflation becomes clearer.

Fed funds futures are still reflecting expectations that there will be no rate cut at the July 30 FOMC meeting. The market currently prices in a roughly 77% probability of rates holding steady and about an 80% chance of a rate cut in September.

The crucial question is whether changing statements from senior Federal Reserve officials could shift this outlook. Recently, two Fed governors have expressed openness to considering a rate cut in July. Michelle Bowman, a Federal Reserve Board Governor, stated on Monday, "The inflationary effects of tariffs may appear more slowly and less significantly than expected," adding, "If price pressures remain subdued, I would support lowering rates at the July meeting."

On Friday, Christopher Waller, another Federal Reserve Board Governor, mentioned in a CNBC interview, "A rate cut could also be implemented in July," adding, "I don't know if the Committee will support this, but personally, I see a possibility."

In contrast, Powell remains of the view that even if tariff-related inflation concerns persist, the US economy remains robust—particularly the labor market—so there is no need to rush to cut rates. Still, the latest labor data show slight signs of weakening economic resilience. The Federal Reserve Bank of Atlanta's GDPNow model projects solid GDP growth in the second quarter following a slight contraction in Q1.

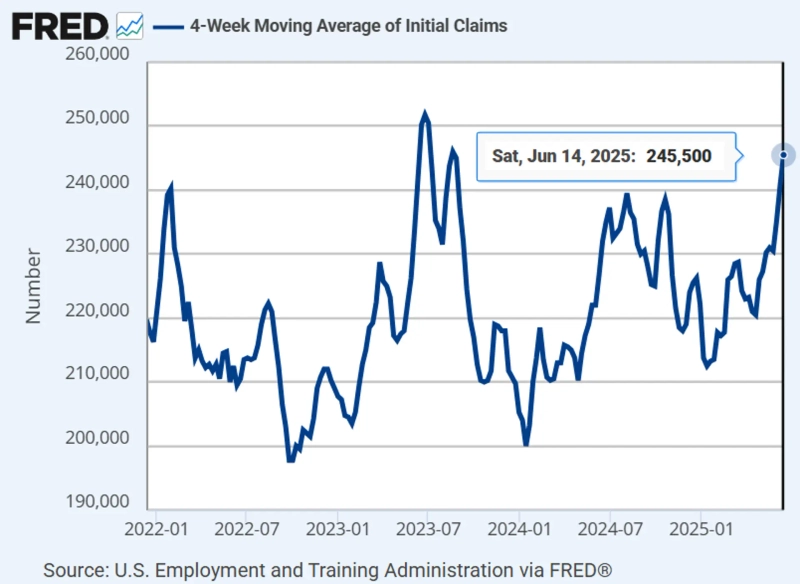

However, forward-looking indicators suggest a less optimistic outlook. Dovish policymakers are pointing to the four-week moving average of weekly jobless claims, which has risen to the highest level since 2023. Some analysts interpret this as a sign of slowing job growth, highlighting that labor market weakness could threaten the economic outlook and strengthen the case for a rate cut.

The Treasury market is reflecting the possibility of economic weakness in its pricing. Despite concerns over tariff-driven inflation, the 10-year yield fell to 4.35% yesterday (June 23), marking its lowest close in almost two months. Safe-haven demand linked to Israel-Iran tensions also appears to have played a role.

“We are not on the side of supporting a [rate cut] in July, but if summer data show signs of economic weakness, we expect this could lead to a rate cut in September,” Mohit Kumar, Chief European Strategist at Jefferies, stated in a client memo.

Meanwhile, President Trump is pushing the Federal Reserve to cut rates. In a social media post this morning, he wrote, “I hope Congress really pressures this foolish and stubborn man. We will pay the price for his incompetence for many years.”

The key question is how Powell will reconcile his position in today's testimony, less than a week since his previous remarks.

At least one senior Federal Reserve official is supporting Powell. Raphael Bostic, President of the Federal Reserve Bank of Atlanta, said in a Monday interview:

“We have the leeway and time to observe how tariffs and other policy issues evolve. Our greater concern is what might happen if we fail to achieve the 2% [inflation] target. For this reason, I agree with maintaining a restrictive stance at the current Federal Reserve target rate of 4.25–4.5% for an extended period. By the last quarter of the year, we should have enough information to make a decision on rate adjustments.”

Although pressure for rate cuts may be rising, Tim Duy, Chief Economist at SGH Macro Advisors, advises that a July cut remains unlikely. In a client memo on Monday, he remarked:

“The MAGA contingent at the Fed is laying the groundwork for a rate cut in September. Even if the impact of tariffs pushes inflation higher in the coming months, it will be interesting to see if Waller and Bowman maintain their support for a rate cut. However, forging consensus for a July cut would be extremely difficult—six weeks of additional data simply isn’t enough.”

This article is provided by Investing.com and the copyright belongs to the source. For inquiries regarding the article content, please contact the media outlet.

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.