Summary

- It was reported that the stablecoin theme stocks that had surged over the past 3 weeks plummeted amid concerns of short-term stock price overheating.

- Stocks that had risen solely on policy benefit expectations, without actual technological capacity or concrete business plans, underwent sharp corrections as investor sentiment collapsed.

- The Bank of Korea and the Bank for International Settlements (BIS) warned that the spread of stablecoins could become a risk factor for financial markets.

Massive Drop in Stablecoin Theme Stocks That Soared for 3 Weeks

Warning Issued Over 'Stock Price Overheating'

Aton -14.4% · LG CNS -11.8%

Multiple Stocks Plunge Over 10%

Fierce Competition Over Trademark Applications Amidst This

Bank of Korea · BIS Warn: 'Stablecoin Expansion Poses a Financial Market Risk'

After the launch of the Lee Jae-myung administration, stocks related to Korean won-based stablecoins, which had been climbing rapidly, plummeted in a single day. As concerns over investment overheating due to a short-term surge arose, sell orders poured in. Analysts point out that this is a typical example of 'theme stocks' that soar on mere expectations and then crash precipitously. While a roller-coaster market unfolded, competition among banks and companies to apply for trademarks related to Korean won stablecoins has intensified.

◇ Stock Price Crash in 'KRW Coin Stocks'

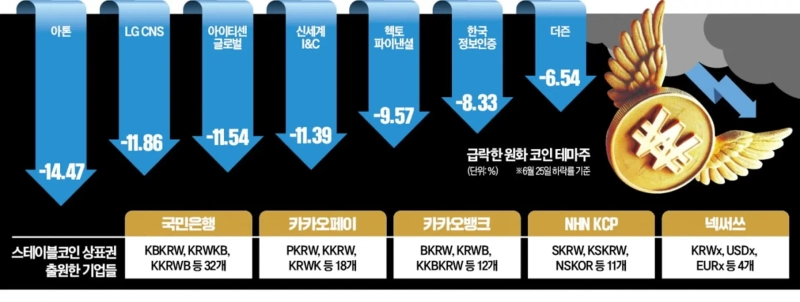

According to the Korea Exchange on the 25th, 11 of the 50 lowest-performing stocks by daily price change were classified as Korean won-based stablecoin theme stocks. On the KOSDAQ market, Aton closed at ₩10,880, down 14.47% from the previous day. LG CNS (₩85,500) also plunged 11.86% on the KRX. Both companies had surged recently as they were grouped as KRW stablecoin theme stocks due to their participation in the central bank digital currency (CBDC) project led by the Bank of Korea.

ITCEN Global, which had announced plans to issue a KRW stablecoin, also dropped 11.54% that day. Additionally, Shinsegae I&C (-11.39%), Hecto Financial (-9.57%), Korea Information Certificate Authority (-8.33%), Thezen (-6.54%), Danal (-6.41%), and Nexth (-6.22%)—all classified as stablecoin theme stocks that had soared earlier this month—fell in succession.

Kakao Pay, which was suspended the previous day due to a sharp rally, surged more than 13% as soon as trading resumed, even breaking ₩100,000 intraday. However, it ultimately eased its gain, closing at ₩93,800, up 1.96%.

The collapse in prices of these listed companies is attributed to sharp rises driven solely by policy benefit expectations, without actual technical capacity or concrete business plans. As warnings of short-term overheating surfaced, a rapid correction followed. A securities industry source said, "Investor sentiment cooled rapidly and sell-offs poured in," adding, "This episode once again exposed the emptiness of theme stocks that are inflated without substance."

◇ Intense Battle for Trademarks

Amid turbulent investor sentiment, the industry saw a pick-up in competition for trademarks related to KRW stablecoins. Kookmin Bank recently applied for 32 trademarks including KBKRW with the Korean Intellectual Property Office. KakaoBank also announced it applied for 12 trademarks such as BKRW on the same day. Previously, Kakao Pay (another Kakao affiliate) had filed 18 trademark applications, and NHN KCP (11 applications) and Nexth (4 applications) had also filed related trademarks.

These companies stated it was a preemptive measure to respond to developments in the stablecoin market. Applying for trademarks is a procedure open to anyone and is only the first step, so it is uncertain whether the patent office will grant official registration. Since trademark applications themselves do not prove the technology or business substance of KRW stablecoins, experts advise investors to exercise caution. A financial sector source pointed out, "The trademark race is being carried out as a form of first-mover marketing," and criticized, "Even commercial banks are jumping competitively despite unclear policy direction."

◇ Bank of Korea and BIS Issue Warnings

The Bank of Korea warned in its 'Financial Stability Report for the First Half of 2025' that "if trust in the value stability and reserves of stablecoins is undermined, a deviation can occur between the value of stablecoins and their underlying assets," and that "this could lead to a 'coin run', where investors massively demand redemptions, thereby spreading risk to the entire financial system."

The Bank for International Settlements (BIS) also said in a draft of its annual report to be published on the 29th that "stablecoins fail to fulfill the role of stable currency, and, lacking regulation, could threaten financial stability and monetary sovereignty."

Jinseong Kim/Joh Mihyun, reporters jskim1028@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.