Fed signals possibility of two rate cuts in 2025… Investment opportunities noted amid tariff variables [Investing.com]

Summary

- Jerome Powell, Chair of the Federal Reserve, indicated the possibility of two rate cuts this year despite an economic slowdown and tariff impositions.

- The U.S. stock market is experiencing a breakout above a bullish wedge pattern and, with the onset of the earnings season after the July holiday, presents further upside and opportunities to expand positions.

- Corteva, Inc. (CTVA) has had a notable rally this year but investors should be cautious about overbought conditions and its valuation well above fair value.

By Lance Roberts

Jerome Powell, Chair of the Federal Reserve (Jerome Powell), delivered his quarterly testimony before the House yesterday and is set to testify before the Senate today. The market reaction was muted, as most of the speech simply reiterated points he had already made during last week’s FOMC meeting and press conference.

Such quarterly testimonies customarily present the same content to both the Senate and House, so it’s unlikely there will be anything new from Powell in today’s Senate testimony.

The key takeaways are as follows:

Economic Slowdown: Chair Powell noted the economy is slowing, but has not yet entered a recession. Regarding the labor market, he stated, "The labor market remains robust, but some signs of cooling are appearing alongside slower economic growth, and while unemployment is still low, it is gradually rising."

Inflation and Tariffs: Powell expressed optimism that the Fed’s 2% inflation target could be achieved without a recession, even as inflation currently remains above target. However, he cautioned that imposing tariffs could create temporary inflationary pressure, potentially adding policy burdens in the coming months.

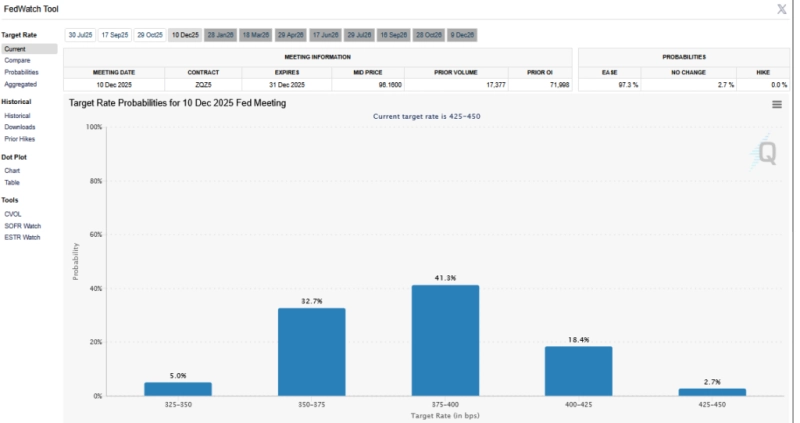

Fed Funds Rate: Powell reiterated the latest FOMC projections, stating he expects two 0.25% rate cuts this year. Markets are also aligning with the Fed’s outlook.

Geopolitical Factors: He mentioned that growing expectations of a ceasefire between Israel and Iran are pushing oil prices lower, a positive factor that helps ease inflation risks.

What to Watch Today

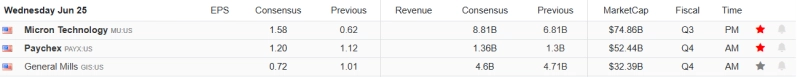

Corporate Earnings

Economy

Market Trading Update

Yesterday, we noted that the market rally was driven by Iran’s muted response to the U.S. attack on their nuclear facilities. In particular, yesterday’s rally broke upward out of a forming bullish wedge pattern, providing further momentum and the potential to push stocks higher.

At the open, stocks gapped up and continued to rally toward initial resistance near the December highs. With plenty of momentum and short covering heading into quarter-end, the market may well challenge all-time highs. The important point is that, with support successfully confirmed and a breakout above the recent consolidation range, there are now few remaining obstacles to further market gains.

Even if there is a market pullback by the end of the month, it should be treated as a buying opportunity. July is typically one of the strongest months of the year, so expanding positions over the next 30 days could be advantageous. With earnings season in full swing after the July 4th holiday, there is little reason to be overly cautious about asset allocation or expanding positions at this time.

Materials Sector Stock Picks (CTVA)

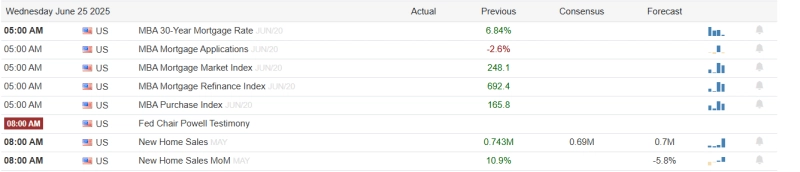

The SimpleVisor chart below shows the absolute and relative scores of the top 10 holdings in the materials sector ETF (XLB). This highlights that Corteva, Inc. (NYSE:CTVA) and Newmont Corporation (NYSE:NEM) are relatively overbought compared to the rest of the market, while most other materials holdings are underperforming.

Gold miner Newmont (NEM) is benefiting from the rise in gold prices. Meanwhile, Corteva, Inc. (CTVA) is a relatively lesser-known agriculture company. Let’s take a closer look at this firm using SimpleVisor.

According to SimpleVisor, CTVA’s main business activities are as follows:

Corteva, Inc. operates in the agricultural sector with two main divisions: Seed and Crop Protection. The Seed segment develops and supplies advanced genetics and varieties to maximize yields. It provides trait technologies offering resilience to weather, disease, pests, and weeds, and supports farmers with digital solutions to optimize crops and maximize profits.

The Crop Protection segment offers products against weeds, pests, and diseases, enhancing soil and crop health with nitrogen management and seed treatment technologies. Key products include herbicides, insecticides, nitrogen stabilizers, and herbicides for pasture management. Corteva operates across North America, South America, Europe, Asia-Pacific, the Middle East, and Africa, was founded in 2018, and is headquartered in Indianapolis, Indiana.

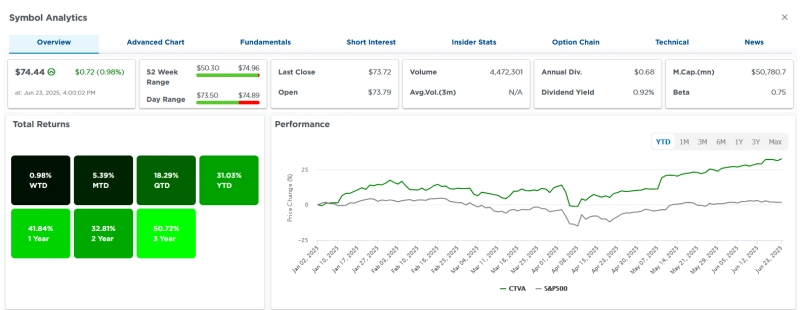

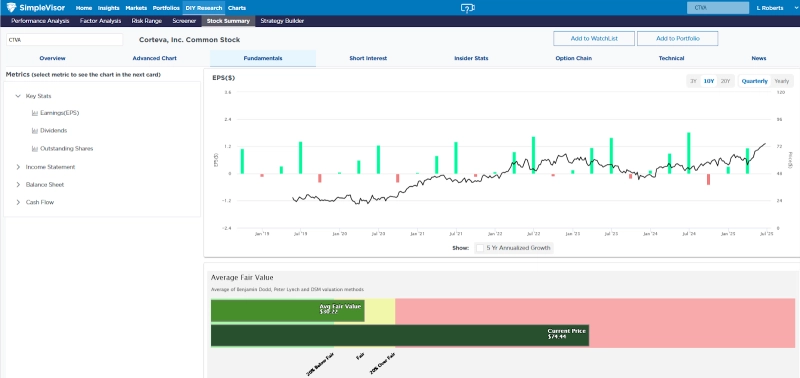

The following screenshot shows that CTVA has risen 31% year-to-date, significantly outperforming the projected 2025 S&P 500 return. The third chart signals a potential warning: EPS growth has stagnated over the past decade, and the current share price of $74.44 is more than twice its fair value of $30.22.

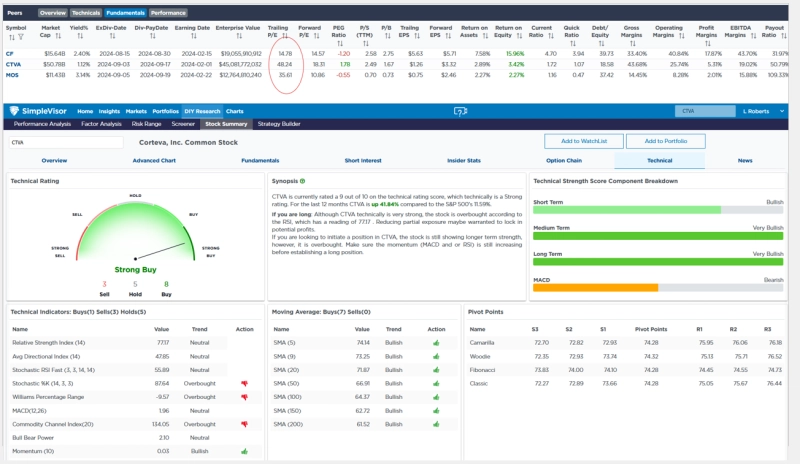

Additionally, revenue growth remains tepid. The last chart combines two SimpleVisor pages, with the upper section comparing CTVA’s valuation to major competitors, and the lower section summarizing technical indicators. As expected, the technical rating is "Strong Buy;" however, as noted in the relative score, the stock is currently overbought in the short term. With CTVA’s share price above major moving averages, traders can refer to these numbers and pivot points to identify future levels of support.

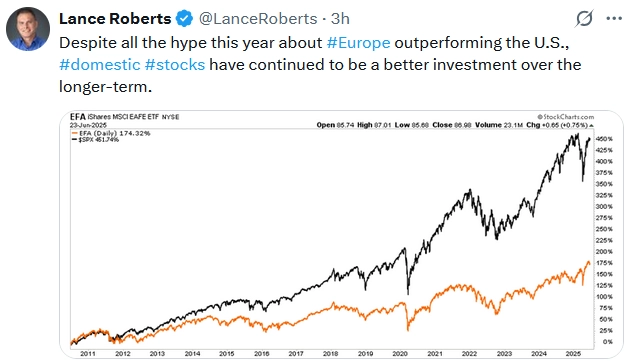

Today’s Tweet

This article is provided by Investing.com and the copyright rests with the original publisher. For inquiries about the content, please contact the media outlet.

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.