Summary

- A net outflow of about ₩4 trillion occurred just in June from US long-term Treasury Bond ETFs (ETF).

- Despite capital outflows driven by heightened volatility and profit-taking sentiment, analysis on Wall Street suggests this is a buying opportunity.

- Prevailing forecasts say the US central bank (Fed) will likely start an interest rate cut by September at the latest.

'Buying Opportunity' Despite ₩4 Trillion Net Outflow in June

Wall Street: "Interest Rate Cuts by September at the Latest"

There has been a significant outflow of global funds from US long-term Treasury Bond ETFs. Although investment sentiment has declined due to high volatility, some analysts argue this presents a timely opportunity for bargain buying.

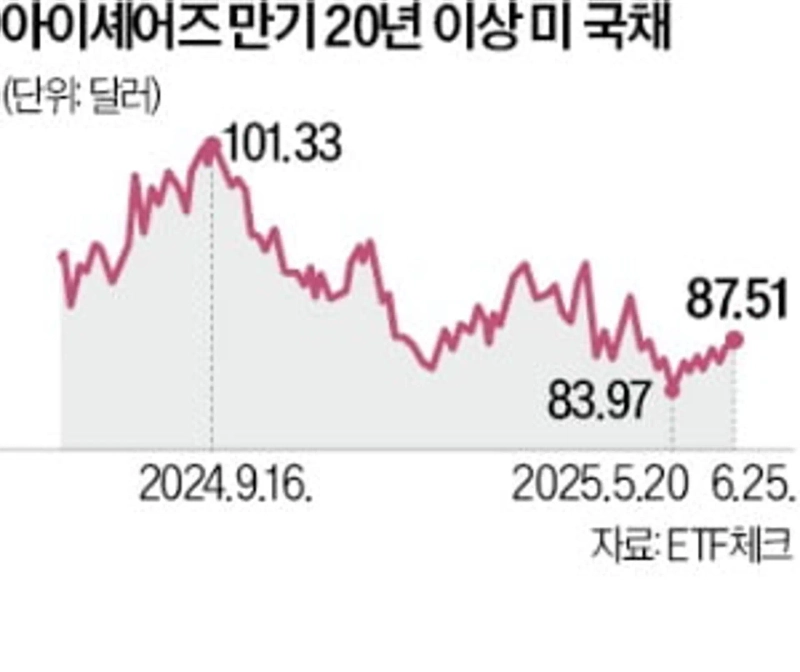

On the 26th, ETF.com reported that the 'iShares 20+ Year Treasury Bond ETF' (TLT), listed on the US stock market, saw a net outflow of $2.88 billion (about ₩3.9075 trillion) so far this month. Last month, there was a record-high monthly net inflow of $4.37 billion for the year, but the trend has reversed to outflows. This product is the largest in terms of assets under management among US long-term Treasury ETFs.

Analysts point to increased volatility caused by the Federal Reserve's uncertainty over rate cuts, coupled with a 'Sell America' (selling US assets) sentiment, prompting investors to realize profits. Over the past three months, TLT has fallen by 1.43%, remaining range-bound.

On Wall Street, there is growing analysis that US long-term bond prices are bottoming out. As the majority view is that the Fed will begin cutting rates by September at the latest, the likelihood of a rise in US Treasury prices is considered high. Calls from within the Fed for an earlier rate cut are also seen as a positive factor.

Jin Kyu Maeng maeng@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.