Summary

- Recently, KOSDAQ-listed companies have been actively raising funds—such as by issuing convertible bonds (CB)—to invest in virtual assets like Bitcoin.

- As financial authorities are set to allow virtual asset trading for investment and financial purposes from the second half of the year, such investments are expected to spread further.

- There are concerns that some are inflating share prices through insubstantial virtual asset investments.

KOSDAQ companies rush to claim ‘Korean version of MicroStrategy’ status

Issuing CBs to buy coins ... Craze for virtual asset-themed stocks

BitMax up 276% in two months

Bridge Biotherapeutics hits upper limit for four days

Initech and others enter virtual asset business

Authorities pilot allowing virtual asset transactions

More companies likely to invest in coins

Warnings of ‘stock price boosting without fundamentals’

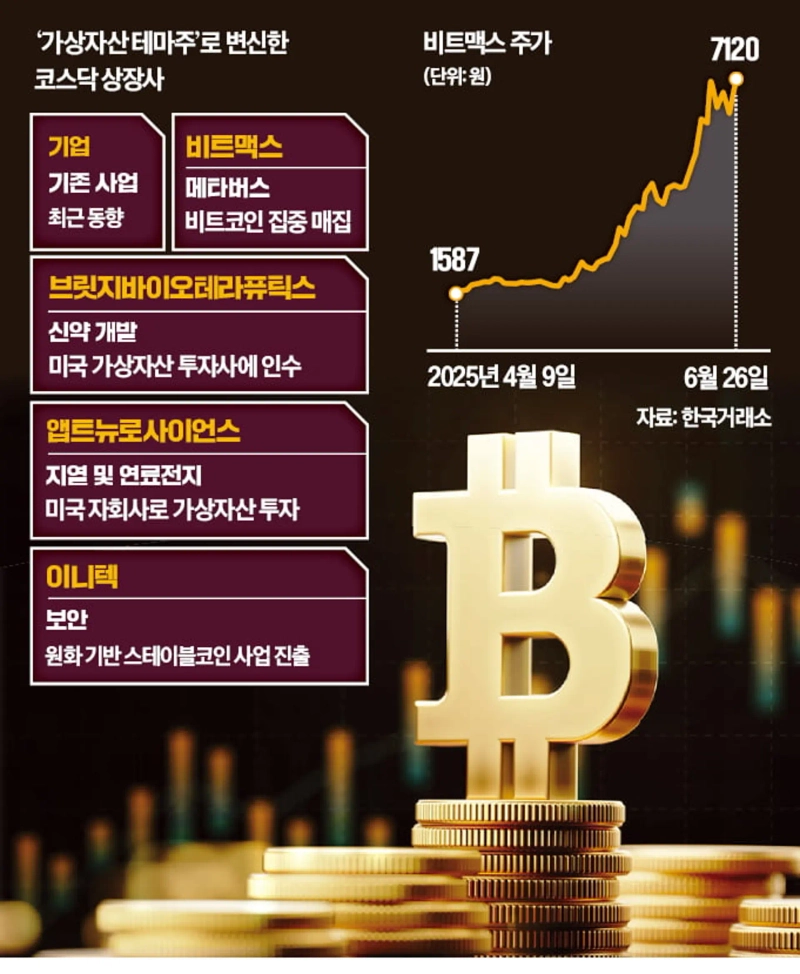

KOSDAQ-listed companies are rushing to bill themselves as the ‘Korean version of MicroStrategy.’ BitMax and Bridge Biotherapeutics, listed on the KOSDAQ, are prime examples. These firms are even issuing convertible bonds (CB) to purchase Bitcoin. Stock prices are soaring with reckless momentum. As financial authorities are expected to allow listed companies to trade virtual assets for investment and financial purposes in the latter half of the year, such attempts are expected to increase further.

The shadow of KOSDAQ ‘whales’

On the 26th, BitMax closed at ₩7,120, up 11.60%. Its stock price, which had been in the low ₩1,000s early last month, has risen sharply day after day. During this period, the share price has surged by 276%. BitMax’s rally was triggered by its Bitcoin holdings exceeding 300 coins and news of plans to issue CBs to accumulate more Bitcoin.

BitMax, which changed its name from MAXST, was once considered a leading metaverse stock. After its KOSDAQ listing in 2021, its market cap soared to nearly ₩800 billion, but shrank to around ₩50 billion as the metaverse business dwindled. In February, after being sold to Kim Byung-jin, chairman of Flake—a ‘whale’ in M&A deals—BitMax abruptly transformed into a virtual asset company. Chairman Kim has generated profits through multiple acquisitions and sales of companies such as Kyungnam Pharmaceutical and Liveplex.

Since March, BitMax has continued to purchase Bitcoin from Chairman Kim. Recently, it announced it would issue CBs worth a total of ₩100 billion, deploying about ₩90 billion of that for Bitcoin purchases. The entire CB funding came from Won Young-sik, chairman of Ocean in W, a famed big player in the KOSDAQ M&A market.

Former KT-affiliate security firm Initech also declared an entry into the stablecoin business. Its largest shareholder likewise secured funds from Chairman Won. During the acquisition process, SJ First Holdings borrowed money from entities such as Ocean in W. An industry insider commented, “Chairman Won is acting as a financial backer for KOSDAQ-listed companies building a virtual asset identity.”

Bridge Biotherapeutics, a biotech company, is also joining the virtual asset bandwagon, hitting the price ceiling for several days. On this day, its share price surged to the limit of ₩2,680. It has now hit the upper limit for four straight days. The stock price has skyrocketed from the ₩700s in just five days. Bridge Biotherapeutics, listed in 2019 via a technology exception for new drug development, faced delisting due to cumulative losses following clinical failures. In this situation, it participated in the crypto theme by raising large-scale funding from a U.S.-based virtual asset investment firm. On the 30th, Bridge Biotherapeutics plans to carry out a ₩20 billion third-party paid-in capital increase targeting Parataxis, and also issue CBs worth ₩5 billion. The largest shareholder will change from founder Lee Jung-kyu to Parataxis Korea.

Apt Neurosciences, a KOSDAQ-listed company formerly focused on geothermal energy, also declared its intention to become a Korean MicroStrategy by pivoting to virtual assets. It plans to hold an extraordinary shareholders’ meeting and add the virtual asset business to its articles of incorporation. Apt Neurosciences is also a borderline company, recording operating losses for three consecutive years.

Corporate virtual asset investment to be allowed

Attempts to boost corporate value by touting themselves as the ‘Korean version of MicroStrategy’ are expected to become more frequent. From the second half of the year, financial authorities will trial allowing about 2,500 listed companies, excluding financial firms, to trade virtual assets for investment and financial management purposes.

Some raise concerns that, with regulatory easing, the fever for virtual asset investments may prompt more companies to make reckless Bitcoin purchases. An investment banking (IB) industry insider remarked, “There are mounting worries that companies will continue trying to inflate their share prices through virtual asset businesses with no underlying substance, regardless of their real value.”

Choi Han-jong, Reporter onebell@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.