"When the U.S. reciprocal tariff suspension ends... Fierce competition for Korea with Mexico and India"

Summary

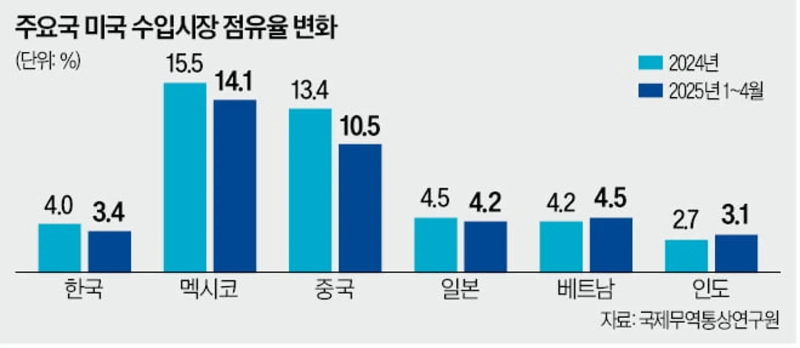

- It was reported that if the reciprocal tariff suspension by the United States ends, Korean companies will face intense competition with Mexico, India, and Taiwan in the U.S. market.

- Korea's market share has markedly declined in the automobiles, parts, and machinery sectors, with Vietnam and Mexico replacing Korean products.

- It was stated that if high tariffs are imposed on competitors such as China, Vietnam, Taiwan, and India, Korea may gain a competitive edge in machinery and electric/electronic products.

KITA, Export Structure Change Report

Automobile, Parts, and Machinery Sectors

Vietnam and Mexico Replacing Korean Products

If Different Reciprocal Tariffs are Implemented

Competitive Advantage Possible in Electric & Electronic Products

If the United States implements the reciprocal tariffs currently suspended until the 8th, Korean companies are expected to face intense competition with firms from Mexico, India, and Taiwan in the U.S. market. Analysts say that with China’s foothold shrinking due to tariff barriers, companies from Mexico and India are likely to raise their market shares.

The Korea International Trade Association (KITA) Institute for International Trade published a report titled 'Export Competition Structure Change and Implications in the U.S. Import Market after Trump’s First Term' on the 2nd. The report mainly examined how the competitive landscape among Korea and key import countries changes under the tariff policy of Donald Trump’s second administration.

According to the report, the total U.S. imports from January to April after President Trump’s inauguration reached $1.2242 trillion, up 19.2% from the same period a year earlier, setting a historical high for January-April cumulative imports. However, U.S. imports of Korean products during the same period amounted to $41.7 billion, down 5.0% year-on-year. As a result, Korea’s ranking by market share in the U.S. import market fell from 7th last year to 10th this year. Out of the top 10 U.S. import countries, only Korea and China (-0.9%) saw a decrease in import value.

By category, imports of Korean products declined in 7 out of 15 items, with notable decreases in semiconductors (-36.2%), chemical industry goods (-23.5%), automobiles and parts (-15.7%), and machinery (-7.4%). The report attributed this decline in market share to the 25% item-specific tariffs imposed on automobiles and auto parts, Korea’s main export items.

Kim Kyu-won, Senior Researcher at KITA, explained, "In the machinery and electric/electronic products sectors, Taiwan and Vietnam, whose market shares are growing in the U.S., have emerged as Korea’s competitors," adding, "Vietnam and Mexico are replacing Korean products in automobiles, parts, and machinery sectors."

However, if different reciprocal tariffs are implemented by country, Korea is also projected to have an upper hand in major imported items. China (54%), Vietnam (46%), Taiwan (32%), and India (26%)—all facing higher forecasted reciprocal tariffs than Korea (25%)—are likely to set higher prices due to these tariffs, which could revive Korea’s competitiveness in machinery and electric/electronic products.

Senior Researcher Kim advised, "To prepare for reciprocal tariffs, companies should diversify production bases and reduce production costs," adding, "In particular, companies should increase exports of products that are hard to replace or difficult to manufacture in the U.S."

Reporter Yang Gil-seong vertigo@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)