Tesla Falters as Performance Slumps Amid Ongoing Verbal Sparring With Trump

Summary

- The heated dispute between President Trump and CEO Musk caused Tesla's share price to drop by more than 5%.

- Wall Street firms such as JPMorgan have successively lowered Tesla's price target.

- Bloomberg L.P. analysts forecast a 12% year-on-year drop in second-quarter vehicle deliveries.

Musk Once Again Criticizes U.S. Tax Cut Bill

JPMorgan and Other Wall Street Firms Lower Their Price Targets Again

As Elon Musk, CEO of Tesla, Inc., openly criticized a key legislative agenda — the 'one big, beautiful bill' — championed by Donald Trump, the 45th President of the United States, the conflict between President Trump and CEO Musk has reignited. When Musk, who opposed Trump's agenda, voiced his dissent, President Trump retaliated with antagonistic statements such as 'deportation' and 'cutting subsidies.' As a result, Tesla's stock price plummeted by more than 5% in a single day.

On the 30th of last month, CEO Musk posted on X, "Looking at a bill that raises the debt ceiling by a record $5 trillion, it's clear we live in a one-party dictatorship." He further stated, "If the insane spending bill passes, the 'America Party' will be founded the very next day," raising the prospect of forming a new party. In response, President Trump fired back in a post on Truth Social on the 1st (local time), saying that federal budget cuts should be made by reducing the government subsidies received by Musk's businesses.

Subsequently, in a press interview, President Trump remarked, "We may have to let the Office of Government Efficiency handle Musk," and emphasized that "the Office of Government Efficiency may be a monster that needs to devour Musk." Asked whether he would consider deporting Musk, who was born in the Republic of South Africa and later acquired U.S. citizenship, Trump answered, "I don't know," but added, "It's something we'll have to look into." After these comments, Musk wrote on X, "I'm tempted to escalate, but for now, I'll restrain myself."

The two sides had previously clashed in early last month over issues such as the elimination of electric vehicle subsidies and tax cuts, but the situation was temporarily resolved following Musk's apology. However, at the end of last month, as Musk renewed his attack on the 'one big, beautiful bill,' tensions flared up again.

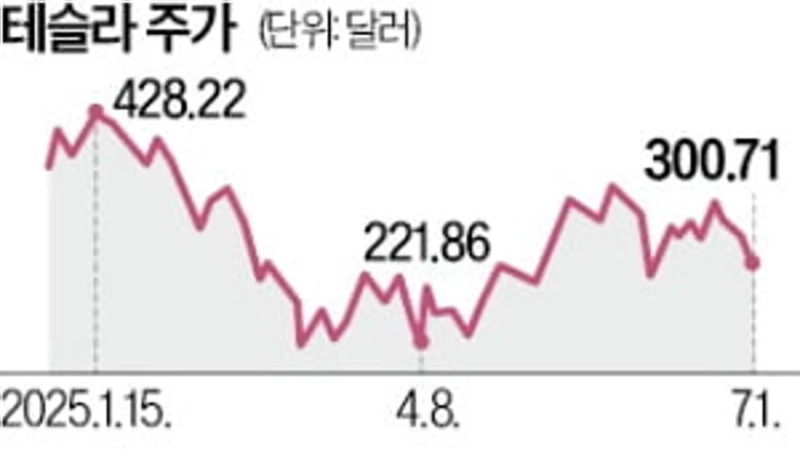

The heated debate between Trump and Musk caused Tesla's share price to drop sharply. On the 1st, Tesla's shares closed at $300.71, down 5.34%. This marked a decline for six consecutive trading days. Compared to the closing price on the day after the launch of the robotaxi trial run (June 23), the price tumbled by 13.7%, causing its market capitalization to fall below the $1 trillion mark.

Negative forecasts for Tesla's earnings also weighed on the company's stock. JPMorgan set Tesla's price target at $115, down from April's target of $120. According to Bloomberg L.P., analysts expect Tesla's second-quarter vehicle deliveries to total 389,400 units, a 12% decrease from the previous year.

Han Kyungjae reporter hankyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)