US Treasury yields more 'volatile' than last year… Safe haven status in question

Summary

- It was reported that the volatility of the 10-year US Treasury yield has expanded this year compared to last year, raising concerns about its status as a safe asset.

- The rise in 10-year US Treasury yields is highlighted as an important indicator affecting global asset allocation, commodity prices, and capital outflows from emerging markets.

- Investors' trust in US Treasuries is weakening due to US tariff policies and the possibility of increased Treasury supply.

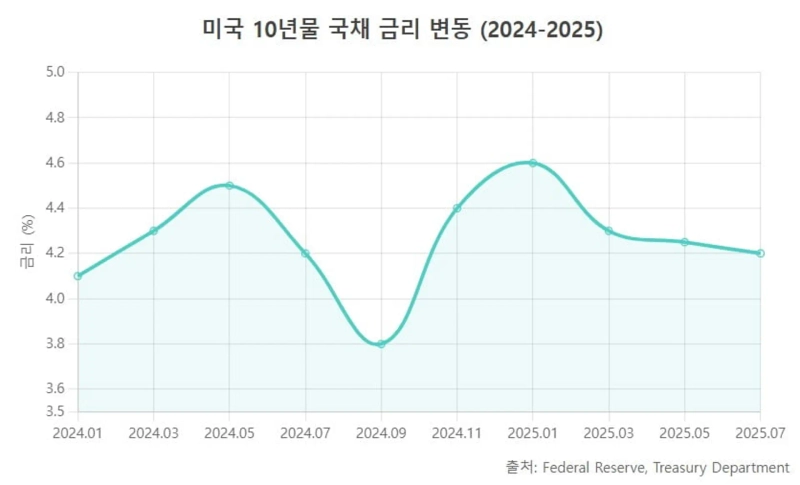

This year, the yield on the 10-year US Treasury bond has been swinging. The 10-year US Treasury is considered the benchmark safe asset in the global financial market. Some analysts say that the volatility in US Treasury yields has increased the overall volatility of the global financial market.

Widening volatility in US Treasury yields

According to Reuters and others on the 3rd, the average 'ICE BofA MOVE Index' from January to June this year recorded 98. The MOVE Index is a volatility index for US Treasury prices based on options pricing, developed by the global investment bank Merrill Lynch. A rise in this index signals greater expected volatility in the US Treasury market.

Last year, the average of this index was around 90. This means that the volatility in US Treasury yields is greater this year than last year. However, for the first half of this year, the index is lower than the 2023 average (about 120). At that time, greater volatility in Treasury yields was attributed to the Federal Reserve (Fed) rapidly raising benchmark rates. During the COVID-19 crisis in 2020, the index soared above 200.

The yield (return) on the 10-year US Treasury bond is regarded as the de facto benchmark rate and a safe haven indicator in global financial markets. Central banks and institutional investors around the world have typically invested their dollar-denominated assets, acquired through foreign currency earnings, in US Treasuries. The Bank of Korea and People's Bank of China, for example, prefer to keep their dollar holdings in interest-bearing US Treasuries rather than as cash.

The US has collected dollars that have flowed overseas due to trade deficits by selling Treasuries, sustaining a cycle where the world invests in US assets to secure dollars. In this system, the 10-year Treasury yield serves as the benchmark for global asset allocation. Various bonds, stock valuations, and loan interest rates are all determined with reference to the 10-year Treasury yield.

During global crises or economic downturn fears, investors typically buy US Treasuries to seek refuge, which causes yields to drop (and Treasury prices to rise). In international financial markets, both the US dollar and gold are regarded as representative safe assets, with US Treasuries being the primary stable investment vehicle for dollars.

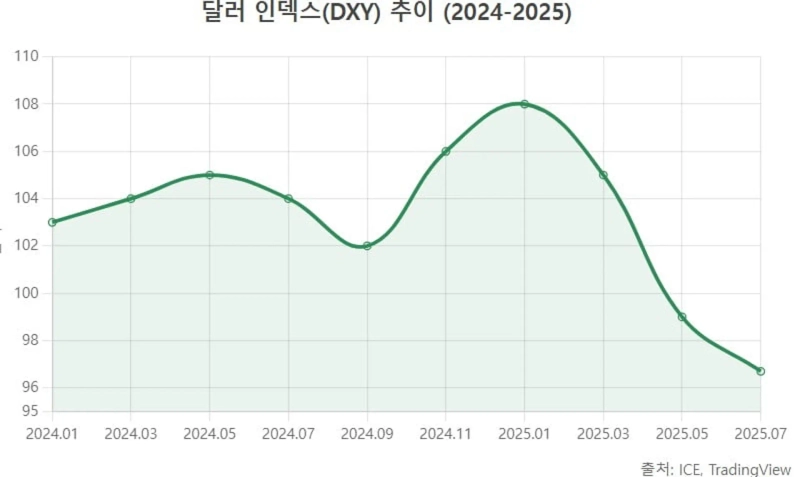

When the 10-year Treasury yield moves, ripple effects are observed across various asset classes and markets. Typically, rising US bond yields strengthen the dollar. As US assets (bonds) offer higher yields, global capital flows into dollars, boosting its value. On the other hand, if Treasury yields fall or expectations for Federal Reserve rate cuts arise, the dollar's strength can weaken.

Changes in US Treasury yields also impact commodity prices such as oil and gold. Rising yields tend to strengthen the dollar and increase funding costs, putting downward pressure on commodity prices. Because commodities are traded in dollars, a stronger dollar tends to suppress their prices. Higher Treasury yields also increase the cost of holding commodities, damping speculative demand.

A rise in US Treasury yields generally weighs on global stock markets, particularly growth sectors such as the Nasdaq. Higher yields reduce the present value of future cash flows. This leads to lower valuations for tech and growth stocks with high P/E ratios. During periods of rising rates, safe assets like bonds become more attractive, potentially causing some funds to leave riskier assets like stocks.

Rising US Treasury yields are typically a point of concern for emerging markets. As US yields go up, returns on dollar assets grow more attractive, potentially pulling capital out of emerging markets and causing their currencies to depreciate (higher exchange rates). Bond markets in emerging countries may also experience capital outflows.

Sharp swings due to Trump’s trade policy

This year, however, cracks have appeared in these patterns. Some argue that the 'absolute safe haven' status of US Treasuries is wavering as global trade frictions escalate due to President Donald Trump’s use of tariffs as leverage. Changes in the 10-year US Treasury yield this year illustrate this.

According to Reuters and other media, there have been five occasions in the first half of the year when the 10-year US Treasury yield moved more than 0–20bp (0.10–0.20 percentage points) in a day or more than 30bp (0.30 percentage points) in a week.

Between February 18 and 25 (Eastern time), Treasury yields fell from about 4.8% to about 4.3%, dropping by 0.50 percentage points. The main reason was rapidly deteriorating US economic data, heightening fears of a slowdown. Prospects for a Federal Reserve rate cut resurfaced. The US Treasury also announced it would not increase long-term bond issuance for the time being, raising expectations of reduced supply pressure.

On April 3–4, yields plummeted by 0.15 percentage points in a single day to nearly 4% following the Trump administration's abrupt announcement of major tariffs. This shock rippled through financial markets, heightening global recession fears and causing a stock plunge, while the flight to Treasuries pushed yields sharply lower.

Between April 7 and 11, yields then surged. From a low of 3.860% on the 7th to a high of 4.592% on the 11th, moving as much as 0.732 percentage points. This was the largest weekly swing in 20 years. At the time, there were concerns that the traditional status of 'US bonds = safe haven' was being shaken.

During this period, China responded to the Trump-led tariff attack with 125% retaliatory tariffs, intensifying the trade war. Foreign investors shunned US assets, and the typical safe haven drop in Treasury yields was limited. Instead, there was a sell-off of US bonds. Rumors spread that China might be selling US Treasuries on a large scale, amplifying the rise in yields.

On April 15, yields fell about 0.18 percentage points to around 4.30% as signs of easing global trade tensions and bargain-hunting emerged. The Trump administration’s partial delay of tariff impositions contributed to this move. The share of indirect bidding, including foreign investors, rose in US Treasury auctions, partially dispelling rumors that China was selling US Treasuries.

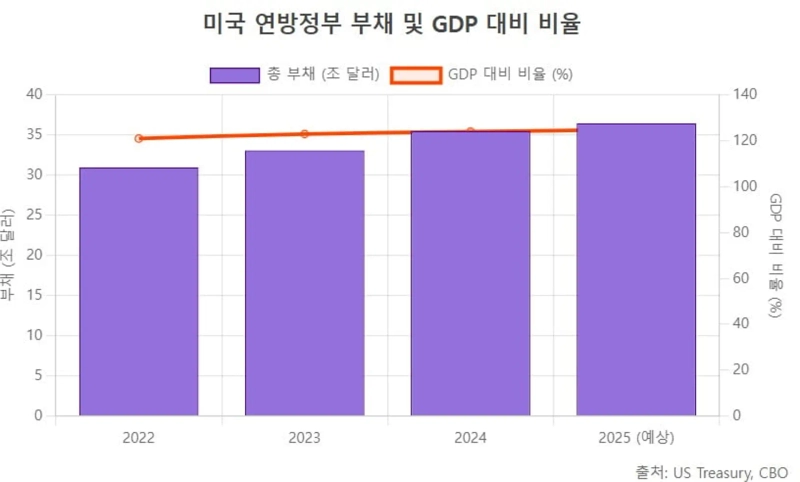

From May 16 to 22, yields rebounded, rising 0.30 percentage points to hit about 4.6%. The major driver was Moody's downgrade of the US government’s credit rating from AAA to Aa1. Moody’s cited the US Treasury’s ballooning debt and mounting interest costs. Large-scale tax cut and spending bills, discussed in Congress, also raised concerns about further fiscal deterioration.

Jay Pelosky, founder of independent investment advisory firm TPW Advisory, commented, “Recent real-time signals from the US dollar and Treasury markets suggest a growing consensus that the US may no longer be the world’s safeguard or firefighter.” He added, “In fact, in some cases, the US may even be the cause of the fire (negative impacts on the global economy).”

Jabaz Mathai, Head of G10 Rates and Foreign Exchange Strategy at Citibank, said, “We think Treasuries have become less attractive as a safe haven,” adding, “The main reasons are the potential for a significant increase in supply and the administration's tariff policies.”

Reporter Joo-Wan Kim kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)