Summary

- OpenAI has agreed to lease an additional 4.5 gigawatts (GW) of Oracle's data center capacity, sending Oracle stock to an all-time intraday high.

- Oracle revealed that based on substantial contracts in its cloud infrastructure business, it has secured an amount nearly three times the revenue accumulated over the last four quarters and is actively pursuing expansion of AI infrastructure investment.

- S&P reported that although Oracle's cloud infrastructure spending could put pressure on cash flow, it offered a positive assessment for the company's long-term business strategy.

OpenAI to Lease Additional Data Centers

Oracle Shares Soar 38% Year-to-Date

As demand for artificial intelligence (AI) surges, OpenAI, the developer of ChatGPT, has decided to lease additional data center capacity from the American software company Oracle, sending Oracle stock to an intraday record high. According to Bloomberg News on the 2nd (local time), OpenAI agreed to lease an additional 4.5 gigawatts (GW) of Oracle data center capacity as an extension of the 'Stargate' project. 1 GW is enough electricity to power about 750,000 households. Bloomberg also reported, "This additional lease by OpenAI is unprecedented in scale." At the end of last month, Oracle announced a cloud deal worth $30 billion annually, with this new agreement constituting a significant portion of that. This amount is nearly three times that of Oracle's current cloud infrastructure business revenue (a cumulative $10.3 billion over the past four quarters).

Oracle provides large-scale cloud services to companies such as Amazon and Microsoft (MS). It has also actively pursued strategic partnerships to increase AI infrastructure investment. After announcing the Stargate project this January, in collaboration with OpenAI and SoftBank, to invest $500 billion over the next four years building large-scale data centers across the U.S., Oracle is constructing its first data center for OpenAI in Abilene, Texas. In May, the company also officially announced new AI projects in the United Arab Emirates (UAE) and a new cloud collaboration with IBM.

To accommodate OpenAI’s additional demand, Oracle plans to build multiple data centers across the U.S. Sites in Texas, Wisconsin, Michigan, and Wyoming are under consideration. There is also discussion about expanding the existing Abilene site’s planned capacity from 1.2 GW to about 2 GW.

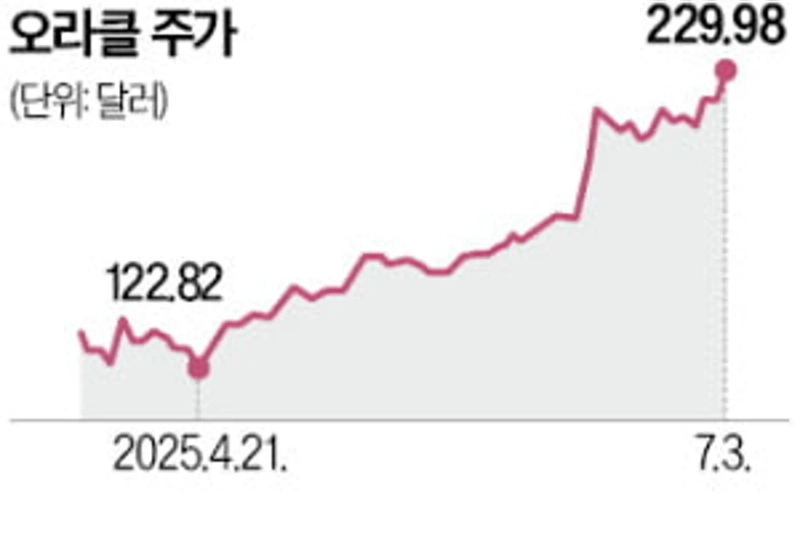

Following the contract news, Oracle closed at $229.98 on the New York Stock Exchange, up 5.03% from the previous day, and hit an intraday 52-week record high of $231.90. Since the beginning of this year, Oracle shares have risen more than 38%. Credit rating agency S&P stated in a report that "Oracle's cloud infrastructure spending is putting pressure on the company's cash flow," but also assessed that "Oracle's cloud business strategy is positive in the long term."

Han Kyung-jae, hankyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)