Editor's PiCK

[Exclusive] Stock surged 320%... “₩90 billion in coins” shocks KOSDAQ market

Summary

- It was reported that cases are appearing on the KOSDAQ market where listed companies are carrying out large-scale Bitcoin purchases by issuing convertible bonds (CBs).

- With the ongoing virtual asset-themed stock frenzy, including a 323% stock price surge, the Financial Services Commission has announced a review of leverage investment restrictions.

- Some argue that listed firms are essentially using fund-like structures to evade regulations.

₩100 billion in CBs issued to buy Bitcoin

Government concerned as ‘coin leveraging’ spreads

KOSDAQ companies become 'CB factories'

FSC reviewing leverage investment restrictions

Buzz around the emergence of the 'Korean Strategy'

BitMax chairman transfers coins to company

Regulatory loophole: transactions bypassing exchanges

Theme stock frenzy causes 323% surge in stock price

Divided opinions on 'leveraged investment regulation'

“Blocking from the outset infringes on market autonomy”

Others: “It’s essentially a fund... Regulatory evasion”

Authorities agonize over allowing corporate investment

“Is this the Korean Strategy, or just money games on the KOSDAQ?”

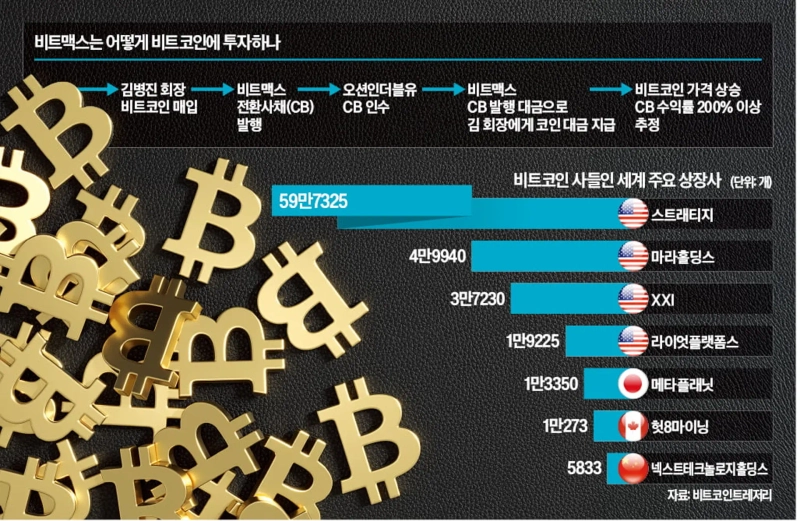

As a series of KOSDAQ-listed firms issue convertible bonds (CBs) to purchase large amounts of Bitcoin, financial authorities are growing increasingly concerned. The rise in ‘coin leveraging’ (investment with borrowed money) among listed companies shows signs of spreading. There are also concerns that the speculative fever of the virtual asset market could spill into the stock market. Proposals to block corporate ‘coin leveraging’ at the source are being discussed, but many push back, saying it would infringe on corporate autonomy.

◇Virtual asset-themed stock frenzy

According to financial authorities on the 7th, the Financial Services Commission is reviewing options for adding leverage investment restriction clauses to the “Guidelines for Listed Companies and Professional Corporate Investors Selling Virtual Assets,” scheduled for release in the second half of this year. The core issue is whether listed companies should be allowed to invest in virtual assets with funds borrowed by issuing CBs or similar means.

What triggered these discussions was criticism that some KOSDAQ-listed firms’ Bitcoin purchases have gone too far. BitMax, listed on the KOSDAQ, announced last month that it issued a total of ₩100 billion in CBs and would use about ₩90 billion of that to buy Bitcoin. In February, Kim Byung-jin, chairman of Flake, acquired the company, changed its name, and jumped into purchasing virtual assets, riding the coin-themed stock craze. BitMax’s share price has surged 323.05% since the start of the year.

When it became apparent that investing in cryptocurrency through verified corporate accounts was impossible, chairman Kim, BitMax’s largest shareholder, transferred Bitcoin and Ethereum to the company eight times in total. Direct transactions between individuals or companies, bypassing exchanges, remain unregulated. The necessary funds were raised through CBs. Funds for acquiring the CBs came from Won Young-sik's Ocean In W, whose chairman was arrested for alleged stock manipulation involving a Bithumb affiliate.

Some predict another “second BitMax” could emerge. An industry official said, “Foreign capital is seeking to acquire shell companies listed on KOSDAQ in order to emulate BitMax-like business models.”

◇Financial authorities troubled

Initially, the authorities planned to allow some 3,500 listed companies and professional corporate investors—excluding financial companies—to open KRW-denominated bank accounts with real-name verification in the second half of this year. However, with the rash of reckless investment before even allowing corporate investment, they have been put on high alert. They are holding off on an immediate decision out of adherence to the principle of letting the market self-regulate. Even if Bitcoin crashes and stock prices plummet, authorities say it is not an issue for government intervention.

Some allege that BitMax is essentially operating collective investment vehicles like funds and trusts without registering as a collective investment business, thus evading regulations. A capital markets law expert pointed out, “In principle, BitMax’s business structure can be seen as that of a collective investment company.”

In the U.S., Strategy—the world’s largest listed holder of Bitcoin—also issues CBs to buy Bitcoin, but some argue conditions in Korea are different. One expert, speaking on condition of anonymity, said, “Unlike the U.S., where institutional investors dominate, Korea is heavily reliant on retail investors. The Korea Exchange should revise listing rules to suppress speculative practices as a form of self-regulation.”

By Hyung-gyo Seo and Mi-hyun Cho, seogyo@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)