Editor's PiCK

Korea Focuses on the Future of Stablecoins: Korean Crypto Weekly [INFCL Research]

Summary

- News of Upbit and Naver Pay collaborating to issue a KRW-backed stablecoin is drawing attention as a potential turning point for the digital asset market.

- Upbit and Bithumb have launched virtual asset lending and short-selling services, which could influence a wide array of investor strategies.

- While key high-volatility tokens and meme coins posted strong gains, shifting capital toward equities and declining trading volumes signal changing market flows.

1. Market Overview

This week, the Korean cryptocurrency market saw heightened interest in both major tokens and speculative mid-cap coins. On Upbit, XRP, BTC, and CBK led trading volumes, while meme coins like MOODENG and BONK also displayed notable movements. Bithumb mirrored this trend, with growing personal investor interest in niche assets like PENGU and MEV. Major gainers such as CBK, BONK, and STRIKE all recorded weekly increases of over 50%, reflecting sustained interest in high-risk, high-return investments across Korean exchanges.

Meanwhile, news of Upbit and Naver Pay collaborating on KRW stablecoin development went viral on social media, igniting discussions about the future of digital payments. The launch of short-selling services by Upbit and Bithumb also fueled heated debates among investors. In addition, as the Korean stock market hit record highs, questions emerged regarding a potential shift of funds back from crypto to equities as individual investor optimism surged.

2. Exchanges

2-1. New Listings

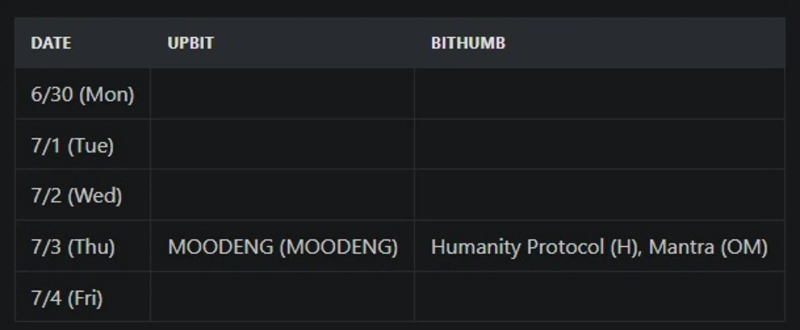

Last week, several new tokens were listed on Korea’s major exchanges.

MOODENG was listed on Upbit.

Humanity Protocol and MANTRA were listed on Bithumb.

Humanity Protocol (H)

Humanity Protocol is a strong example of a project that carried out short but intense marketing in the Korean market over 2-3 months.

Backed by renowned VCs like Pantera Capital and Jump Crypto, Humanity approached the Korean community with a unique palm-based identity verification method, compelling valuation, and an easily accessible testnet. Rather than relying solely on KOL marketing, the team adopted a more diverse strategy.

Beyond KOL collaborations, one of their standout tactics was community outreach. They regularly held AMAs (Ask Me Anything) with rewards, co-hosted a hackathon with Korea University's blockchain society, and organized multiple offline meetups to sustain public attention.

KOL marketing efforts were also prominent. Instead of one-off promotions, Humanity built close partnerships with influencers and held various events across multiple channels, attracting users from different segments of the community.

Finally, Terrence Kwak, founder of Humanity, demonstrated a deep commitment to Korea. Not only did he visit Korea to attend meetups, but he also actively engaged with the local community—going so far as to set his X profile photo to one featuring a famous Korean celebrity whom he resembles.

2-2. Trading Volume

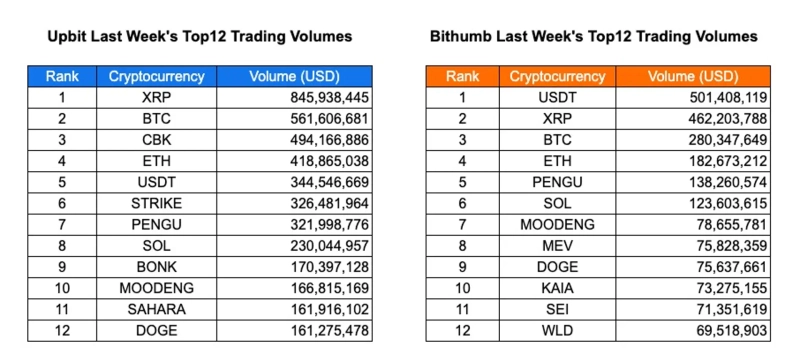

Upbit’s weekly trading volumes were concentrated in high-liquidity tokens—XRP led at $845.9M, followed by BTC at $561.6M, and CBK at $494.2M, with a particularly notable surge in CBK activity. ETH and USDT posted steady volumes of $418.9M and $344.5M respectively, while STRIKE and PENGU both hovered around $320M, indicating growing interest in emerging or trend-driven assets. The inclusion of MOODENG, SAHARA, and BONK among the top 12 tokens further exemplifies a shift toward speculative and community-driven coins, with each surpassing $160M in weekly trading volume. Despite the presence of leading tokens, the overall distribution reflects the diverse appetites of Korean retail investors.

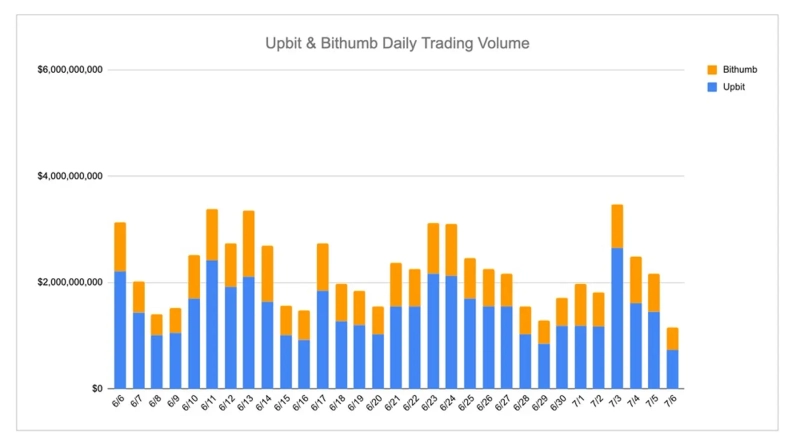

Bithumb’s rankings also showed strong activity: XRP ($462.2M), USDT ($501.4M), and BTC ($280.3M) led the pack, while mid-tier listings like PENGU ($138.3M), MOODENG ($78.7M), and MEV ($75.8M) drew significant attention. The reappearance of DOGE, SOL, and SEI in both exchanges’ top 12 signals ongoing interest in mainstream altcoins, while KAIA and WLD completed Bithumb’s rankings at $73.3M and $69.5M, respectively. Weekly volumes were generally lower compared to Q2 highs, and CoinGecko’s 1-month volume chart suggests a slight downturn, possibly signaling short-term weakness in domestic trading momentum.

2-3. Top 10 Weekly Gainers

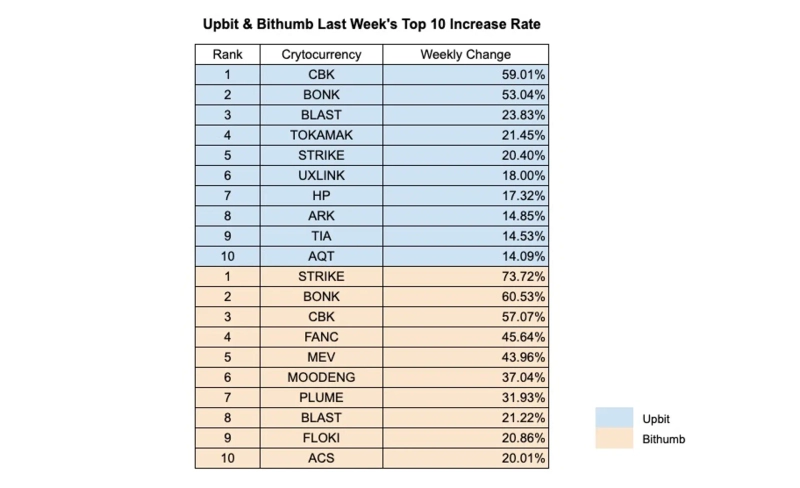

On Upbit, the biggest gainers this week were highly volatile tokens: CBK surged 59.01%, the highest return, closely followed by BONK at 53.04%. BLAST (+23.83%), TOKAMAK (+21.45%), and STRIKE (+20.40%) all experienced double-digit gains, illustrating momentum both for meme coins and lesser-known infrastructure projects. UXLINK, HP, and ARK also saw gains between 14% and 18%, showing renewed interest in mid-cap tokens. The inclusion of TIA and AQT in the top 10 indicates investor attention is widening beyond short-term plays.

On Bithumb, STRIKE stood out with a 73.72% surge, followed by BONK at 60.53% and CBK at 57.07%, reflecting bullish sentiment similar to Upbit. FANC (+45.64%), MEV (+43.96%), and MOODENG (+37.04%) also rallied, suggesting increased demand for speculative, retail-focused tokens. PLUME, FLOKI, and ACS each posted over 20% gains, supporting the view that retail trading momentum quickly circulates among trending assets. The overlap of tokens like BONK, CBK, STRIKE, and BLAST across exchanges highlights their current dominance among Korean traders.

3. Korean Community Buzz

3-1. Upbit & Naver Pay to Collaborate on KRW Stablecoin Issuance

Upbit and Naver Pay are set to collaborate on issuing a KRW-backed stablecoin—a move seen as a major turning point for Korea’s digital asset market. According to Dunamu, Naver Pay will take the lead with support from Upbit, and details will be finalized once a regulatory framework is established. This announcement follows Naver Pay’s unveiling of a stablecoin consortium at its 10th-anniversary event in May.

Industry members shared reactions like, “The fact that these two companies are joining forces… this is huge.”

3-2. Upbit & Bithumb Launch Virtual Asset Lending & Short-Selling Services

On July 4, Upbit and Bithumb became the first in Korea to launch a service allowing users to borrow cryptocurrencies such as Bitcoin for short selling. Users can deposit collateral to borrow assets and bet on price declines. Upbit currently supports only Bitcoin (BTC) but plans to expand supported assets. Bithumb offers a wider range including BTC, ETH, XRP, SOL, DOGE, and USDT.

Within the community, there are conflicting views: “Isn’t this just short selling under a flashy name?” and “Is Korea preparing to legalize crypto derivatives to attract capital inflows?”

3-3. Korean Retail Investors Flock to Stocks

Last week, Korea’s stock market reached an all-time high, with the KOSPI closing at 3116.27—its highest point in nearly four years. Customer deposit balances surpassed ₩70 trillion, while crypto trading volumes declined sharply.

Community opinions included comments like: “Time to cash out before equities drop and move back to crypto!” and “As long as stock returns remain strong, it’s hard to argue for moving funds back to crypto.”

*All content is for informational purposes only and does not constitute the basis for investment decisions, recommendations, or advice. The information provided disclaims liability for investment, legal, tax matters, etc.

INF Crypto Lab (INFCL) is a consulting firm specializing in blockchain and Web3, providing one-stop services for Web3 entry strategy, tokenomics design, and global market expansion. INFCL offers strategic planning and execution for leading domestic and international securities, gaming, platform, and global Web3 companies, leveraging accumulated knowledge and references to drive the sustainable growth of the digital asset ecosystem.

This report is independent of media editorial policy, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)