Jo Jin-seok, CEO of KODA: "Trust is essential for virtual asset custody... It must function like a bank"

Summary

- Jo Jin-seok, CEO of KODA, stated that a virtual asset custody company must possess bank-level transparency and regulatory compliance as a trust infrastructure.

- KODA holds approximately 90% market share in the domestic virtual asset custody market and serves many institutional clients, including KOSDAQ-listed firms.

- CEO Jo announced plans to strengthen global expansion into the RWA market and strategic collaboration with public chains like Solana in line with domestic regulatory developments.

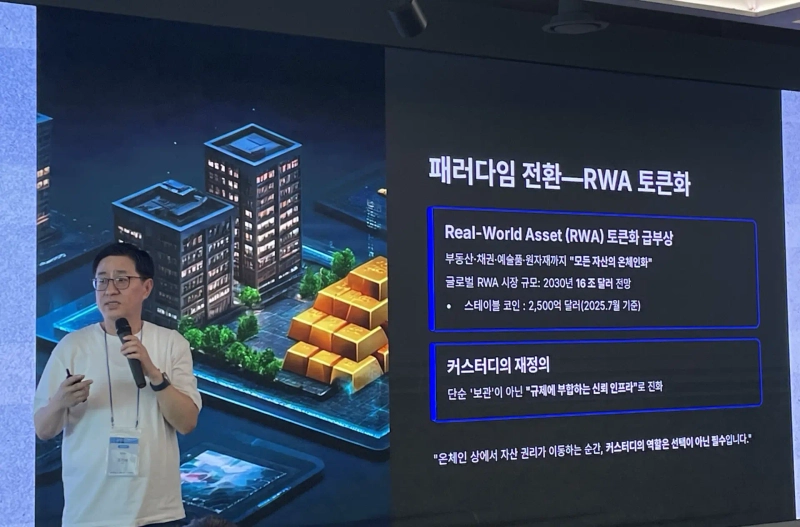

Jo Jin-seok, CEO of virtual asset custody (custody) firm KODA, emphasized that in the era of tokenization of real-world assets (RWA), the role of custody is turning into a 'trust infrastructure.'

At the institution and media event 'Internet Capital Markets' hosted by Solana (SOL) at Gangnam Hashed Lounge on the 21st, CEO Jo stated, "Custody providers must now function like banks," and added, "It is necessary to go beyond simply storing digital assets to possess transparency and regulatory compliance that meet institutional standards."

He highlighted three core elements for custody firms: ▲ asset stability ▲ accounting transparency ▲ regulatory compliance. He commented, "In the past, it sufficed to store assets like a warehouse, but now all accounting data and controls required for external audits must be provided," adding, "Especially when listed companies hold virtual assets, custody must play a major role in the audit process or an appropriate opinion cannot be obtained."

Currently, KODA holds approximately 90% market share in the domestic virtual asset custody market. CEO Jo emphasized, "Institutional clients have entrusted 32 types of assets, totaling about 70 billion tokens," and "many domestic listed companies use KODA based on its in-house developed infrastructure and audit response system." He continued, "The number of KOSDAQ-listed companies buying Bitcoin in bulk is increasing, and more than 90% of them are our clients," adding, "Even today, 40 Bitcoins have been newly deposited."

From the second half of the year, there are also plans to expand globally. Jo said, "Alongside the improvement of domestic regulation, the global RWA market entry will be accelerated," and, "We are discussing strategic collaboration with Solana, the most scalable among public blockchains."

He explained, "If a stablecoin is issued in Korea, it is preferable to select a public chain rather than a private chain, and KODA could potentially be responsible for the custody and management of Solana-based stablecoins." He further emphasized, "The RWA market has already begun, and without custody, tokenized assets cannot function in the institutional sphere," adding, "A custody provider that fulfills technology, trust, and regulatory requirements will become the core infrastructure of the digital asset ecosystem."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)