Tax hike amid trade war... Large corporations to pay an additional ₩16.8 trillion

Summary

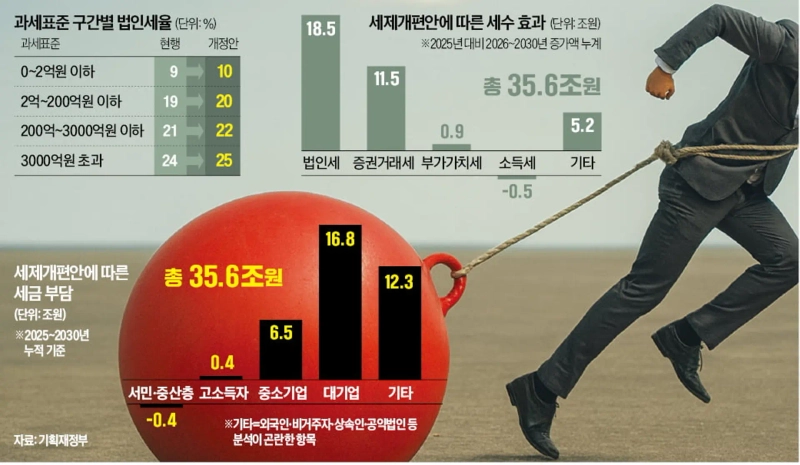

- The government announced plans to secure an additional ₩35.6 trillion in tax revenue over 5 years by raising the corporate tax rate by 1%% point, among other measures.

- Large corporations are set to bear half of the increased tax burden, amounting to ₩16.8 trillion, and companies as a whole will shoulder 65%% of the total tax hike.

- The business community expressed concerns that increased corporate tax burdens may weaken global competitiveness and discourage investment.

First tax proposal of the Lee administration is a tax hike... Half of the burden falls on large corporations

Corporate tax rate raised by 1%p for all companies

Increased securities transaction and major shareholder capital gains taxes

Tax revenue expected to rise by ₩35.6 trillion over 5 years

The government will raise the corporate tax rate by 1% point in all 4 brackets, increasing the top rate to 25%. The securities transaction tax will rise from 0.15% to 0.20%, and the threshold for capital gains tax on major shareholders will be lowered from ₩5 billion per stock to ₩1 billion, broadening the tax base. This shift from tax cuts to tax hikes aims to collect an additional ₩36 trillion in taxes over 5 years, with half of this amount shouldered by large corporations.

On the 31st, the Ministry of Economy and Finance held a plenary session of the Tax System Development Deliberation Committee and finalized the '2025 tax reform plan.' The focus is on completely reversing the tax cut policies implemented by the Yoon Suk-yeol administration since 2022 after three years.

Lee Hyung-il, the First Vice Minister of the Ministry of Economy and Finance, said, "We aimed to restore the tax base that was undermined during the previous administration's tax cuts," and added, "We plan to concentrate the funds secured by raising corporate taxes on strengthening the fundamental competitiveness of our industries."

The Ministry of Economy and Finance estimated that tax revenue will increase by ₩35.6 trillion over 5 years with the tax reform. This is primarily due to significant increases in corporate tax (₩18.5 trillion) and securities transaction tax (₩11.5 trillion) revenues. About half, or ₩16.8 trillion, of the increased tax burden will be borne by large corporations. Considering that the tax burden on small and medium-sized companies will also increase by ₩6.5 trillion, companies will take on two-thirds of the overall tax increase. Representatives of the business community commented, "The increase in corporate tax burden runs counter to the Lee Jae-myung administration's policy vision of boosting potential growth and invigorating the stock market."

The ₩400 billion decrease in tax revenue from low- and middle-income earners (those with total annual salaries of ₩87 million or less) will be offset by high-income earners.

For shareholders of listed companies who are active in shareholder returns, their dividend income will be separated from the comprehensive financial income tax, which tops out at 45%, and instead be taxed at a lower rate of 14~35%. While this is intended to activate the stock market, the complex requirements and relatively small benefits are criticized as being ineffective.

Corporate tax rate up by 1%p... Overhaul of education tax and non-taxation for mutual finance

Companies facing 'domestic and external crises'... Reforming the education tax rate for finance and insurance sectors

The first tax reform proposal of the Lee Jae-myung administration, announced on the 31st, is summarized as a 'tax hike' to support expansionary fiscal policy. The additional tax revenue over the next 5 years is expected to reach ₩35.6 trillion, with about half borne by large corporations. There are concerns that, if combined with added regulatory burdens from commercial law and labor law reforms, rising corporate tax burdens could rapidly undermine the competitiveness of global companies.

Corporate tax rate up by 1% point

According to the '2025 tax reform plan' announced by the Ministry of Economy and Finance on the 31st, next year's corporate tax rates for the four taxable income brackets will each rise by 1% point. The top corporate tax rate for taxable income above ₩300 billion will rise from 24% to 25%. The rates for taxable income up to ₩2 billion, over ₩2 billion to ₩20 billion, and over ₩20 billion to ₩300 billion will increase to 10%, 20%, and 22%, respectively.

The top corporate tax rate was reduced from 25% to 22% during the Lee Myung-bak administration, restored to 25% during the Moon Jae-in administration, and then cut by 1% point by the Yoon Suk-yeol administration in the 2022 tax reform, before being restored to the previous level after 3 years.

Lee Hyung-il, the First Vice Minister of the Ministry of Economy and Finance, explained, "To reinforce the corporate tax base, we are restoring the corporate tax rate to 2022 levels and will channel the raised funds back to companies through support for development of ultra-innovative products."

Education tax for major financial companies increased by ₩1.3 trillion

The government will also gradually reduce the special tax exemption long applied to mutual financial cooperatives such as agricultural and fisheries cooperatives, credit unions, and Saemaul Geumgo since 1976. Currently, all members of such cooperatives are exempt from the 14% tax on interest and dividend income for deposits up to ₩30 million and contribution capital up to ₩20 million, and only pay a 1.4% special agricultural and fishing village tax. This has led to criticism that the tax exemption has become a tax shelter contrary to its original intent. From next year, quasi-members with a total annual salary exceeding ₩50 million will be subjected to a 5% tax, increasing to 9% from 2027. The tax exemption will remain for farmers, fishers, and (quasi-)members with an annual salary of ₩50 million or less.

The education tax on financial and insurance companies will also be revised. Under the current Education Tax Act, financial and insurance companies pay 0.5% of their income as education tax. Starting next year, companies earning over ₩1 trillion will pay 1.0%, while those earning ₩1 trillion or less will continue to pay 0.5%. According to financial industry sources, "the total impact across the sector will be as much as ₩1.3 trillion," and there is further concern that proposals to exclude the education tax from the base for additional interest could increase the burden even more.

Tax hikes to fund welfare pledges

The return to a tax hike policy, despite anticipated backlash, is interpreted as laying the groundwork to fulfill campaign pledges by President Lee Jae-myung that require trillion-won-level annual expenditures, such as expanding child allowances, applying health insurance to care costs, and reducing basic pension cuts for couples. Even just implementing these welfare pledges requires an additional annual budget of ₩20 trillion.

However, with prolonged sluggish domestic demand and intensifying global competition in key industries, tax revenue is decreasing. There was a tax revenue shortfall of ₩56 trillion in 2023, and about ₩30.8 trillion last year. This year, an additional budget of ₩31.8 trillion was arranged, with ₩21.1 trillion financed by debt (government bonds).

Experts agree that while it is appropriate to expand budgets for welfare and social safety nets, funding should be secured through spending restructuring and expanding the revenue base. Business leaders criticize the move, pointing to increased corporate burdens amid difficult external conditions caused by the tariff war initiated by the Donald Trump administration in the United States. According to the latest tax reform, 65% (₩23.3 trillion) of the expected five-year tax revenue increase (₩35.6 trillion) will come from companies. A senior official from a major domestic business group said, "If the corporate tax hike coincides with commercial law reforms and amendments to the Yellow Envelope Law (amendments to the Trade Union and Labor Relations Adjustment Act), it will inevitably dampen management and investment activities."

Jeong Young-hyo / Lee Kwang-sik / Nam Jeong-min / Kim Ik-hwan / Jeong Ui-jin, reporters hugh@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.