Editor's PiCK

U.S. Spot Bitcoin ETFs See $100 Million Net Outflow on the Last Day of July

Summary

- There was a net outflow of $114.69 million from U.S. spot Bitcoin (BTC) ETFs on the last day of July.

- In particular, major outflows were seen from ARK Invest’s 'ARKB' and Fidelity’s 'FBTC,' while some ETFs like BlackRock’s 'IBIT' recorded net inflows.

- The change in fund flows in the ETF market led to a 2.5% decline in Bitcoin’s price, and the partial withdrawal of institutional funds contributed to the short-term bearish pressure.

On the last day of July, spot Bitcoin (BTC) ETFs in the United States experienced a net outflow of over $100 million.

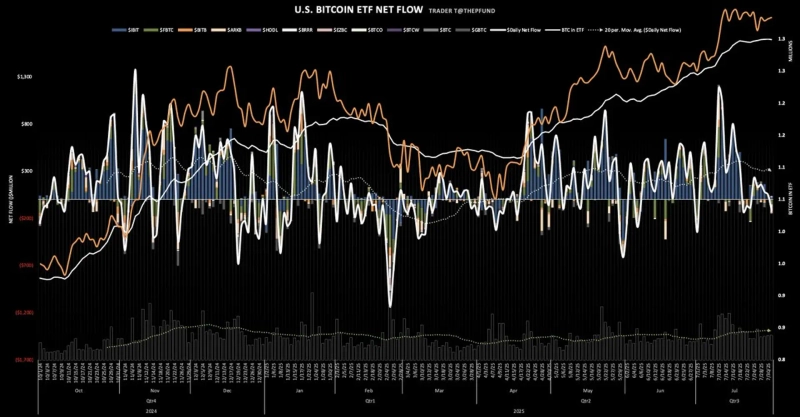

According to data from TraderT on the 31st (local time), a total of $114.69 million was withdrawn from U.S.-listed spot Bitcoin ETFs that day.

The largest net outflow occurred from ARK Invest's 'ARKB,' which saw $89.92 million leave. Fidelity’s 'FBTC' also reported a net outflow of $53.63 million. Grayscale’s 'GBTC' recorded $9.18 million in outflows as well.

On the other hand, BlackRock’s 'IBIT' recorded a net inflow of $18.77 million. Invesco’s 'BTCO,' Franklin Templeton’s 'EZBC,' and VanEck’s 'HODL' saw slight inflows of $3.49 million, $6.78 million, and $3.31 million respectively. Bitwise’s 'BITB,' Valkyrie’s 'BRRR,' and WisdomTree’s 'BTCW' had no net inflows or outflows.

These fund flow changes in the ETF market affected Bitcoin’s price as well. As of Binance’s Tether (USDT) market, Bitcoin was trading at around $115,500, down 2.5% from the previous day. The market attributes the increased short-term downward pressure to profit-taking amid the price rally and partial withdrawal of institutional funds.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)