Double Blow of Tariffs and Tax Hikes... Except for Shipbuilding Stocks, Everything Plummets

Summary

- Due to the government's tax reform plan and tariff negotiations, the domestic stock market plunged, with the KOSPI and KOSDAQ falling by 3.88% and 4.03%, respectively.

- Leading stocks, especially high-dividend ones, suffered significant declines, and the drop in KOSDAQ—where many individual investors trade—was attributed to stricter criteria for large shareholders.

- As expectations for government support of the stock market collapsed, investors rushed to take profits, triggering panic selling. There is a mix of opinions about the potential for further declines and the prospect of a long-term rebound.

Panic Over Tax Hikes... KOSPI's 'Black Friday'

Plunges 3.9%... KOSDAQ Down 4%

Tax Reform Disappoints, Triggering Sell-Off

The KOSPI Index plunged nearly 4%, marking a 'Black Friday.' As hopes for government support to boost the stock market cooled rapidly, a flood of 'panic sell' orders overwhelmed the market.

On the 1st, the KOSPI Index closed at 3119.41, down 3.88%. This is the largest drop this year since April 7 (-5.57%), when Donald Trump, President of the United States, announced a reciprocal tariff executive order. The KOSDAQ Index also finished down 4.03% at 772.79.

Analysts say the trigger was the tax reform proposal, which includes plans to increase taxes imposed on the securities market. A full 90.9% (2,420 companies) of all listed firms recorded losses. High dividend stocks, which had attracted investment in anticipation of the new government's policy to encourage long-term holding by raising payout ratios, fell particularly hard. The KRX Securities Index and KRX Bank Index dropped by 6.67% and 4.29%, respectively. Shin Jin-ho, CEO of Midas Asset Management, explained, "The domestic stock market had risen sharply in the first half of the year, so with the government announcing a tax policy that ran counter to market support, a flood of sell orders came in as investors sought to realize profits."

With the strong dollar and foreign investors also selling off stocks, the KRW-USD exchange rate closed up ₩14.40 at ₩1,401.40. It was the first time in two and a half months since May 14 (₩1,420.20) that the rate had risen above ₩1,400.

As expectations for government policy had been high, there is considerable concern that the market downturn may continue. Kang Dae-kwon, CEO of Life Asset Management, commented, "If the tax plans are not quickly revised, the KOSPI Index could drop as low as the previous upper threshold of the box range, 2,700."

The ruling party's National Assembly leadership rushed to respond. Kim Byung-ki, acting chairman and floor leader of the Democratic Party of Korea, posted on social media that "there are many voices expressing concern about the tax reform plan," adding, "the party will examine options such as raising the threshold for large shareholders eligible for the ₩1 billion criterion, focusing on the 'Tax Normalization Special Committee' and the 'KOSPI 5000 Special Committee.'"

After the tax reform plan was announced, a flood of disappointing sell orders drove down domestic stock indices on the 1st. The index and exchange rates are shown on the electronic board in the Seoul Hana Bank headquarters dealing room. Reporter Lim Hyung-taek See enlarged image

After the tax reform plan was announced, a flood of disappointing sell orders drove down domestic stock indices on the 1st. The index and exchange rates are shown on the electronic board in the Seoul Hana Bank headquarters dealing room. Reporter Lim Hyung-taek

KOSPI Plunges 3.9%... Biggest Decline Since Start of This Administration

Leading Stocks, Especially High Dividend Ones, Tumble on Tax Reform Disappointment

Even before the presidential election, the new government promoted 'KOSPI 5000' as a flagship policy pledge. They claimed that redirecting household funds, which had been flowing into real estate, into the stock market would help companies secure investment funds and citizens prepare for retirement. After surging over 20% right after the election, the KOSPI Index cooled sharply as the government abruptly turned toward a tax-increasing policy for the market. Burdened by the twin shocks of 'tax hikes' and 'tariffs,' Korea's domestic stock market is expected to face further adjustment for some time.

◇ High Dividend Stocks Suffered Especially Large Drops

On the 1st, the KOSPI Index plummeted 3.88% to close at 3119.41, falling more than 126 points from the previous session. Leading sectors such as semiconductors, defense, nuclear energy, and cosmetics all slumped in unison. SK Hynix and Samsung Electronics each tumbled by 5.67% and 3.50%, respectively. Hanwha Aerospace, which hit ₩1,000,000 during the previous session and earned the title of 'Emperor Stock,' also dropped 5.72%. Doosan Enerbility (-6.40%), which had risen steeply, was no exception.

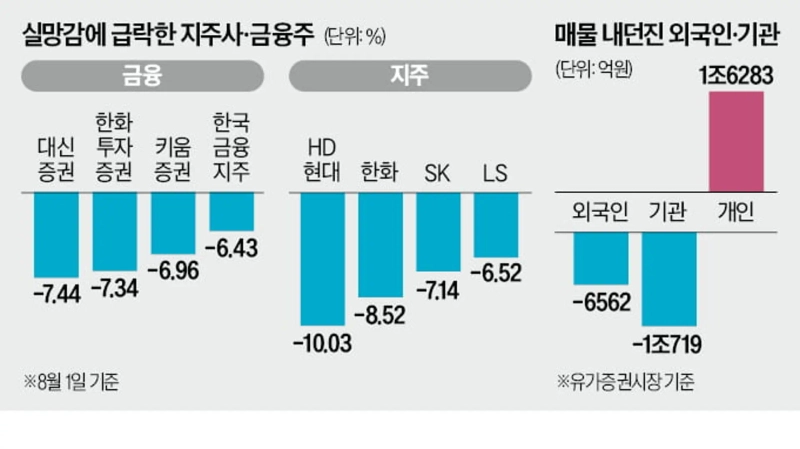

Financial holding companies and other high-dividend financial stocks, which had attracted much investment, were hit hard. Daishin Securities, Hanwha Investment & Securities, and Kiwoom Securities plunged by 7.44%, 7.34%, and 6.96%, respectively. HD Hyundai (-10.03%), Hanwha (-8.52%), and SK (-7.14%) also posted sharp losses.

Japan's Nikkei 225 Index, in a country that completed tariff negotiations similar to Korea, fell only 0.66%. Experts explain that the unusually steep decline in the Korean stock market, compared to overseas, is due to the tax reform plan.

The local rally since June has been driven more by improvements in PER (price-earnings ratio) than company earnings (EPS). The government's support for stock prices helped raise the KOSPI's PER. As the tax plan was unveiled, expectations for government support evaporated and triggered a rapid sell-off.

The government had announced the previous day that it would significantly tighten the large shareholder criteria for stock capital gains tax, lowering the threshold from the current ₩5 billion to ₩1 billion. The heavier loss for the KOSDAQ Index, with a higher proportion of individual investors, was also attributed to the stricter large shareholder criteria.

◇ Further Declines Possible... But Long-Term Rebound Expected

The separate taxation plan for dividend income, announced the previous day, was also a disappointment for investors. High taxation of dividends reduces the incentive for major shareholders to increase payouts and discourages investment in domestic companies, yet the government decided to apply a 35% tax rate to dividend income exceeding ₩300 million. The market had been expecting a 25% rate (as proposed by Rep. Lee So-young).

Only 13.3% of all listed firms (about 350) would benefit from separate dividend taxation. Even Samsung Electronics, SK Hynix, and Hanwha Aerospace—top holdings among retail investors—are not eligible for the benefit. Shin Jin-ho, CEO of Midas Asset Management, said, "Due to the tariff agreement with the United States, there is now a pressing need to secure more tax revenue as more funds will need to be invested in the U.S.," adding, "When expectations for government support in the stock market collapsed all at once, investors rushed to realize gains."

The 15% reciprocal tariff agreement with the U.S., now finalized, is also seen as a burden on listed companies' performance. Hyundai Motor Company and other auto and auto parts companies are said to be particularly affected. An asset management company official commented, "With the KORUS FTA essentially rendered ineffective, Korean manufacturing companies must now compete on equal footing with rivals from other countries."

Some analysts predict that the end of U.S.-Korea reciprocal tariff negotiations will fuel U.S. inflation, dragging down global stock markets. Until the second quarter, manufacturers had delayed price hikes due to tariff uncertainty, but starting this month, they are likely to begin raising prices.

There are mixed opinions about the outlook for Korea's stock market going forward. Kim Dae-jun, a researcher at Korea Investment & Securities, said, "Based on the KOSPI Index, the first support line is the 10-year average 12-month forward PER (price-earnings ratio) of 10.3 times, or 3063."

Some point out that the day's sharp decline was due to 'overshooting' (excessive selling). Shin also said, "While the details of the separate dividend taxation were below expectations, it's true that the tax rate is decreasing," adding, "Ultimately, stocks with high dividend yields will be revalued, leading to a rebound in the stock market."

Reporters: Shim Sung-mi, Kang Hyun-woo, Jeon Beom-jin smshim@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.