Editor's PiCK

U.S. July 'Employment Shock'... Probability of September Rate Cut Rises

Summary

- The growth in U.S. nonfarm payrolls for July fell well short of expectations, signaling a slowdown in the job market.

- After disappointing employment figures, U.S. Treasury yields plunged, and speculation about a September rate cut by the Federal Reserve intensified.

- After the jobs report, the probability of a September rate cut at the Chicago Mercantile Exchange jumped from 40% to 69%.

Nonfarm payrolls increased by 73,000, falling short of expectations

Substantial downward revision of May and June employment figures

Treasury yields plunge on rate cut outlook

The increase in U.S. July employment fell sharply below market expectations, signaling a slowdown in the job market. After the employment data was released on the 1st, U.S. Treasury yields plunged, sparking assessments that the chances of a rate cut by the Federal Reserve in September have increased.

On this day, the U.S. Department of Labor announced that in July, nonfarm payrolls rose by 73,000 compared to the previous month. This is well below the Dow Jones consensus forecast of 100,000. Previous employment figures were also substantially revised downward. June’s job growth was revised from 147,000 to 14,000, and May’s from 144,000 to 19,000. Job recovery announced so far has been overestimated compared to reality.

Looking closer, Federal Government employment decreased by 12,000, continuing its downward trend. CNBC analyzed, "Compared to January when the Department of Government Efficiency (DOGE) led by Elon Musk began reducing government jobs, federal government employment has declined by 84,000." However, healthcare payrolls increased by 55,000. The unemployment rate rose by 0.1 percentage points from the previous month to 4.2%. The number of unemployed stood at 7.2 million.

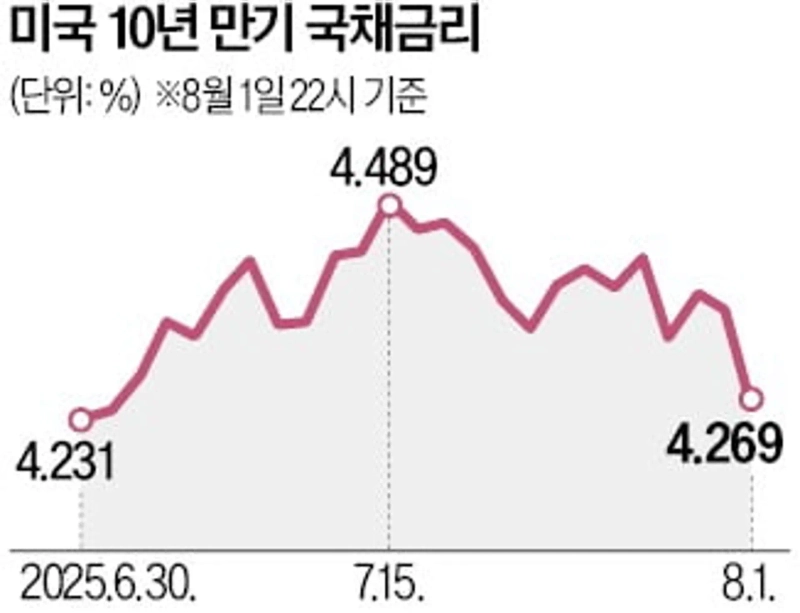

U.S. July 'Employment Shock'... Probability of September Rate Cut Rises As the jobs report fell short of expectations, Treasury yields in New York plummeted. The yield on 10-year U.S. Treasury Bonds fell by around 0.08 percentage points from the previous trading session to 4.269% (as of 10 p.m. Korea time). The assessment is that the probability of a September rate cut increased due to signs of a weaker-than-expected labor market. ManpowerGroup's North America President Doyle, from the global HR company, said, "The labor market is not in a crisis, but hiring momentum continues to weaken and pressures are starting to build."

With this jobs report exposing warning signals, the Federal Reserve’s dilemma is predicted to deepen. According to the Chicago Mercantile Exchange (CME), the probability of a Fed rate cut in September jumped from 40% to 69% after the employment data release. On July 30, the Federal Open Market Committee (FOMC) held its regular meeting and kept the benchmark rate steady at 4.25–4.50%.

U.S. President Donald Trump again attacked Fed Chair Jerome Powell on his Truth Social account. Trump wrote, “Stubborn fool, ‘Too Late’ Powell must drastically lower rates immediately,” adding, “If he continues to resist, the (Fed) board should take control and do what everyone knows needs to be done.”

Reporter: Donghyun Kim 3code@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.