From South Korea to China, Surging Dollar Deposits... Could They Become a 'Bomb' for Global Financial Markets? [Global Money X-File]

Summary

- It was reported that dollar deposits in major Asian countries have surged to record highs.

- It was stated that changes in the U.S. central bank (Fed)'s interest rate policy could increase dollar conversion pressure in Asia.

- Expectations of a weaker dollar, stronger local currencies, and increased market volatility are projected to play an important role in global financial markets.

Recently, dollar deposits in major Asian countries have surged to record highs. There are concerns that, depending on the speed of interest rate cuts by the United States Federal Reserve (Fed), dollar deposits could act as a powder keg for global financial markets.

China's Foreign Currency Deposits Surpass $1 Trillion

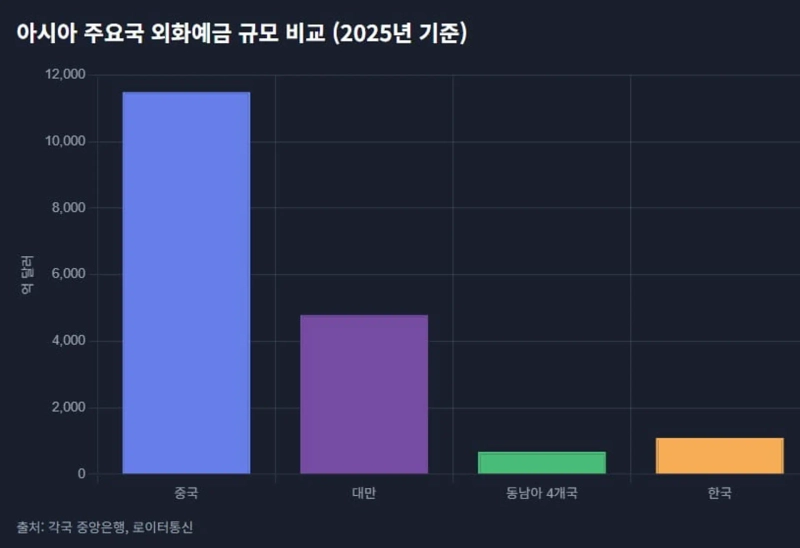

According to Reuters and others on the 5th, dollar deposits held by companies and households in Asian countries have recently reached historically high levels. In China's case, as of the end of June, foreign currency deposits (including dollars) at banks stood at about $1.02 trillion—the highest since March 2022. In just the first half of this year, deposits increased by $165.5 billion, marking the largest semi-annual increase since related statistics have been compiled.

This is a jump of approximately 20% year-on-year. The People's Bank of China (PBOC) directed commercial banks to lower interest rates on dollar deposits to curb these deposits and to incentivize yuan conversions.

In Taiwan, as of the end of May this year, corporate and household foreign currency deposits stood at $471.2 billion. This figure is down 3.5% from the same month last year, yet it remains near an all-time high. Due to a nearly 7% sharp appreciation of the New Taiwan Dollar in May, the converted deposit amount decreased, but measured in dollars, deposits still rose by $9.8 billion from the previous month.

A cap imposed by Taiwan's central bank on the amount that can be sold each day has led companies to keep their dollar earnings in deposits rather than selling them freely. Currency regulators are believed to have guided the accumulation of dollar deposits by limiting daily dollar sales to curb excessive exchange rate fluctuations.

A similar trend has continued in Malaysia, Thailand, Indonesia, and the Philippines, where exporters continue to accumulate dollar assets. As of the end of March, total foreign currency deposits in these four countries reached $62.2 billion—close to a record high. In Malaysia, foreign currency deposits accounted for 10.6% of all deposits, far exceeding the five-year average.

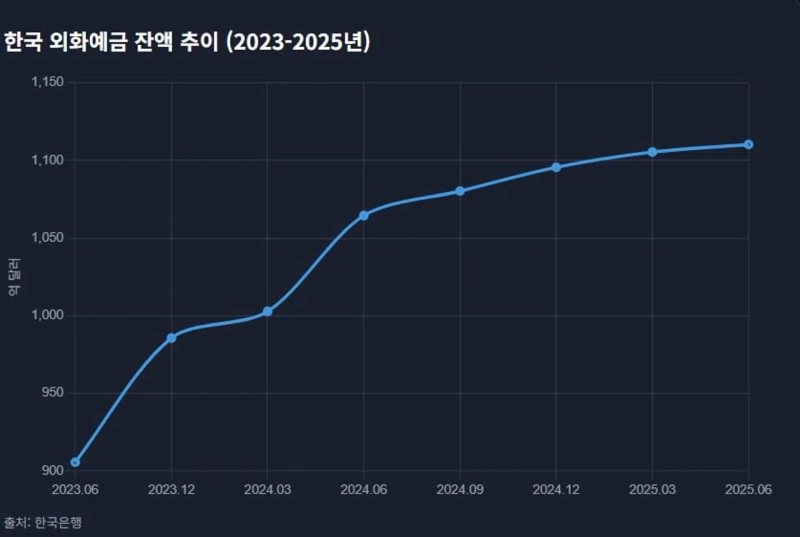

Dollar deposits are also on the rise in South Korea. According to the Bank of Korea, as of the end of June, foreign currency deposits held by domestic residents totaled $106.44 billion, up $5.08 billion from the previous month, marking two consecutive months of increases. Compared to a year ago ($90.57 billion), this is a rise of about 17.5%.

By currency, dollar deposits rose by $3.6 billion from the previous month. Renminbi (yuan) deposits (+$1.1 billion) and yen deposits (+$260 million) also increased—partially due to temporary deposits of dividends received from overseas subsidiaries. By depositor type, corporate deposits climbed by $4.66 billion, while individual deposits grew by $420 million, together driving the overall rise in foreign currency deposits.

Potential Impact on the Global Economy

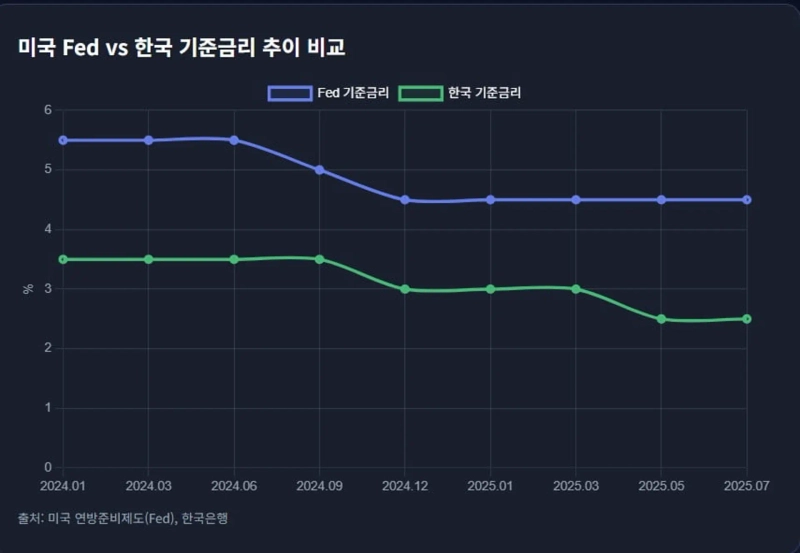

There is analysis suggesting that the recent surge in dollar deposits in Asia could affect the global economy, depending on the Fed’s interest rate policy. As U.S. employment data suddenly worsened recently, expectations that the Fed will lower its key rate in September surged to 84%. The outlook that rates will be cut at least twice this year has also gained momentum.

If the Fed lowers its policy rate, the interest rate gap between the U.S. and Asia will shrink. This would likely weaken the dollar and exert upward pressure on Asian currencies. Lower Fed rates make dollar asset returns less attractive, increasing incentives for companies and households to exchange their dollars for local currency. This means selling pressure on dollar deposits could intensify.

In early May, when Fed rate cut expectations rose, some analyses said Taiwanese and Korean firms sold off dollars, causing local currencies to spike. If expectations of a Fed pivot strengthen, dollar-selling sentiment among Asian exporters may also spread. If the pattern of "weak dollar and strong local currencies" becomes clear, speculative capital may also join in.

Gary Ng, Chief Economist at France's investment bank Natixis, pointed out, "Trump’s tariff policies also weakened market confidence in U.S. dollar assets."

The problem is increased market volatility. If companies and financial institutions holding large dollar assets attempt to convert them to local currency all at once, daily swings in certain currencies could grow larger. In fact, in May, the New Taiwan Dollar surged almost 10% in two days—the biggest jump since 1988.

Christopher Wong, Senior Foreign Exchange Strategist at Oversea-Chinese Banking Corporation (OCBC), warned that "if the weak dollar trend accelerates, exporters may rush to sell off their dollar holdings, leading to excessive local currency appreciation."

The Pace of Fed Rate Cuts Is Key

If dollar deposits are converted en masse in Asia, their ripple effect on global financial markets could unfold under various scenarios. If the Fed lowers rates slowly, exporters in Asia are more likely to exchange dollars gradually. In this case, the dollar index (dollar value) will decline slowly. Asian currencies would see gradual further appreciation (value increase).

If the scale of dollar sales remains within what the market can absorb, U.S. Treasury and other dollar asset prices should avoid a major shock, and the interest rate spread (U.S.-Asia rate differential) can narrow smoothly. Central banks are also likely to allow a natural readjustment of foreign exchange market equilibrium without drastic interventions.

If rapid Fed rate cuts speed up the pace of dollar conversion in Asia, exporters and institutional investors may rush to sell dollars and buy local currencies, causing the dollar index to plunge rapidly. As safe-haven demand wanes, U.S. Treasury yields could spike (prices plunge). But strong easing signals from the Fed could also cause short-term rates (under two years) to drop sharply, greatly amplifying volatility in rate spreads (the difference between the two rates).

[Global Money X-File highlights important, but lesser-known, trends in worldwide money flows. For convenient access to the global economic news you need, please subscribe to the reporter’s page.]

Reporter Joo-Wan Kim kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.