Editor's PiCK

Traders Focusing on Mid-cap Tokens: Korean Crypto Weekly [INFCL Research]

Summary

- Both Upbit and Bithumb saw an increase in trading volume for small and mid-cap tokens, with Upbit firmly maintaining its top market share.

- Investor speculation is rising around newly listed tokens such as Chainbase (C) and Optimism (OP).

- With the KRW-USD exchange rate climbing, Tether (USDT)’s Kimchi Premium has resurfaced, creating new arbitrage opportunities.

1. Market Overview

Last week, Korean exchanges showcased some relatively small but notable new listings: Upbit added Optimism (OP) and Omni Network (OMNI), while Bithumb listed Chainbase (C).

Upbit continued to dominate in trading volume, consistently accounting for the vast majority of daily transactions, with peaks approaching $10 billion across multiple days from July 23 to July 25. In contrast, Bithumb’s volume remained much lower, seeing only slight upticks even amidst a general market uptrend. XRP once again topped the charts at both exchanges. On Upbit, XRP traded $2.83 billion, and on Bithumb, $1.21 billion, reflecting XRP’s sustained popularity among Korean retail investors.

On Upbit, ETH ($1.46 billion) and BTC ($1.1 billion) followed, while new names like STRIKE ($646 million), ENA ($598 million), and OMNI ($563 million) signaled strong speculative interest. Bithumb’s rankings reflected some of these trends as ETH, BTC, and ENA all placed in the top five. The meme token PENGU achieved $329 million in trading volume on Bithumb and $360 million on Upbit, highlighting cross-platform growth. Overall, while both platforms are aligned on top liquidity leaders, the breadth of mid-cap assets trending on Upbit continues to set it apart as the dominant force in Korea’s crypto trading landscape.

2. Exchanges

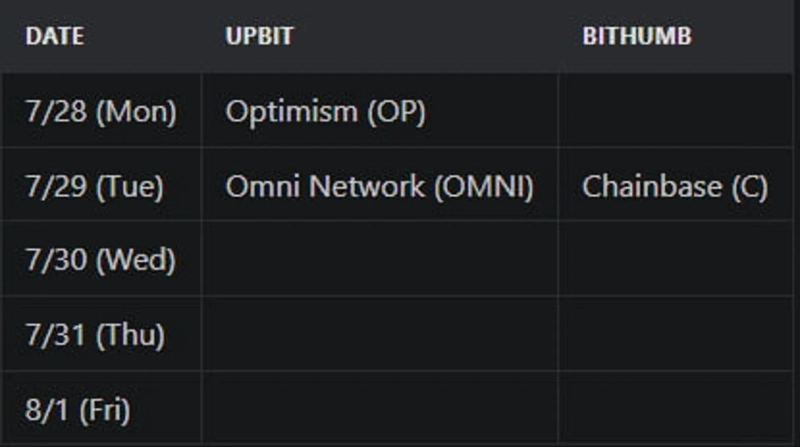

2-1. Newly Listed Coins

Last week saw a flurry of new listings on major Korean exchanges.

Optimism and Omni Network were listed on Upbit.

Chainbase was listed on Bithumb.

Key Marketing Strategies & Main Points

Chainbase (C)

Chainbase’s Korean KOL marketing focused strictly on essential activities. Beginning with the airdrop guide launched in late 2024, they drew on Tencent’s investment to capture community user interest.

Reviewing Chainbase’s post history, only critical and necessary updates were shared via KOL channels. Rather than aggressive promotion, the strategy appears centered on keeping diverse users engaged through multiple channels and preventing loss of interest. At the same time, frequent mentions of the upcoming token sale (TGE) helped generate significant anticipation.

After the airdrop period ended, efforts focused on visibility through partnership announcements, product updates, and sharing campaign info. Post-TGE at overseas exchanges, updates continued on price movements, additional listings, and events—culminating in a successful listing on Bithumb.

Optimism (OP)

Optimism saw a sharp rise in Korean holders during the superchain boom. When OP KRW was recently listed on Upbit, jokes circulated in the Korean community that “OP holders have finally seen the light.”

Meanwhile, the timing of OP’s listing on Upbit sparked speculation within the community that exchange listing policies had changed following management reshuffles. When Upbit listed OMNI the next day, these suspicions solidified, and Korean users are now actively trying to identify coins remaining on Upbit’s watchlist.

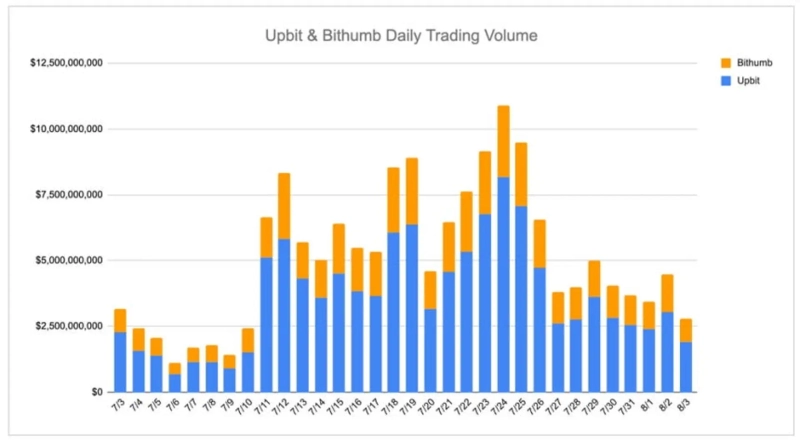

2-2. Trading Volume

Last week, Upbit continued to outstrip Bithumb in trading volume, cementing its status as the dominant exchange in Korea. Daily volume charts showed a clear gap between Upbit and Bithumb. Upbit repeatedly claimed over $10 billion in market share, especially from July 23 to July 25. Meanwhile, Bithumb’s volumes remained notably lower, with only slight upswings during short-term price peaks.

XRP posted about $2.83 billion on Upbit and about $1.21 billion on Bithumb, once again topping volume on both platforms and highlighting robust Korean retail appetite. ETH and BTC on Upbit followed with $1.46 billion and $1.1 billion respectively. Newer tokens like STRIKE ($646 million), ENA ($598 million), and OMNI ($563 million) also placed highly, indicating increased speculative activity.

Bithumb reflected similar trends in asset popularity, with ETH, BTC, and ENA all reaching the top five. The meme-inspired token PENGU ranked sixth on Bithumb at $329 million, and made the top ten on Upbit at $360 million, firmly establishing its growth across both platforms.

In summary, both exchanges exhibited similar activity at the top of the token volume charts, but Upbit remains the clear leader not only in total volume but also in breadth of trending assets.

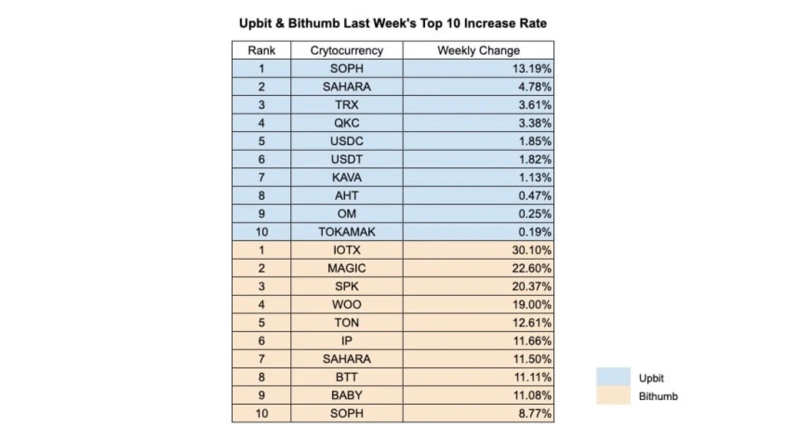

2-3. Top 10 Gainers

Market sentiment remained relatively neutral last week, with only a few tokens seeing double-digit gains. On Upbit, SOPH posted the steepest rise at +13.19%, followed by SAHARA (+4.78%) and TRX (+3.61%). Notably, the major stablecoins USDC and USDT both edged modestly higher, perhaps reflecting cautious capital inflows or arbitrage in uncertain markets.

On the other hand, Bithumb stood out for active trading in small-cap altcoins. IOTX surged 30.10% to lead the charts, followed by MAGIC (+22.60%) and SPK (+20.37%). WOO, TON, and SAHARA were among other tokens posting gains above 10%. Interestingly, SOPH, which topped Upbit’s gainers, also rose 8.77% for the week on Bithumb, showing persistent demand across platforms.

Overall, this week’s gainers list points to increased attention on small and mid-cap tokens, especially on Bithumb, where speculative activity continues to drive short-term price momentum.

3-1. Regulators Push Back on Korean Exchange Leverage Products

On August 4, Bithumb launched a service allowing users to borrow coins at up to 4x collateral value, and Upbit introduced a “coin loan” program for USDT, BTC, and XRP, offering loans up to 80% of deposited KRW or crypto. The Financial Services Commission immediately raised warnings to both exchanges over concerns about investor protection and legal risks. Consequently, Upbit announced on July 28 that it would end the USDT loan program by August 27, offering users early repayment options.

Community reaction was divided. Some argued that Korea must fully open domestic leverage trading to retain local activity (and tax revenue), while others insisted on sticking with overseas platforms such as Binance. (Source)

3-2. Tether Returns to Kimchi Premium Territory

Last week, the KRW-USD exchange rate broke the 1,400 won threshold, hitting its highest since May 19. With this, Tether (USDT), which had long traded at a discount, began selling at a premium versus the won. On August 3, the Kimchi Premium reached 1.52%, with USD at 1,389 KRW and USDT at 1,403 KRW.

Community traders joked about earning “easy pocket money” through arbitrage, while others admitted being “stuck buying at ₩1,500” and wishing for a return to those levels.

3-3. Bithumb B-Salon: KOLs Forecast Bitcoin Strength

Bithumb released the sixth episode of its KOL-driven YouTube series ‘B-Salon’, this time featuring four renowned traders with distinctive styles. The episode, recorded just weeks before Bitcoin hit its all-time high, saw all four guests express strong bullish views on the cryptocurrency. Viewers watched the traders’ confidence with a mix of awe and envy, with many wishing they had taken the same stance.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)