Global IBs Raising Korea's Growth Rate, Goldman Sachs and J.P. Morgan: "2% Growth Next Year"

Summary

- Global IBs have recently reported that, reflecting the settlement of Korea-US tariff negotiations and a recovery in consumer demand, they have revised Korea’s economic growth forecasts upwards.

- Goldman Sachs, J.P. Morgan, and Citi have raised their growth forecasts for this year, and projected that next year’s rate could rise to the 2% range.

- The growth forecasts of global IBs have been presented higher than those of major institutions such as the Bank of Korea.

Reflecting Tariff Negotiation Settlement and Consumer Recovery

Annual Average Growth Rate Revised Up to 1%

"Recovery Trend Will Be Even Clearer Next Year"

Bank of Korea Also Expected to Raise Forecast Soon

Global investment banks (IBs) are successively raising their forecasts for Korea's economic growth rate, reflecting the conclusion of the Korea-US tariff negotiations and signs of consumer recovery. Some IBs, such as Goldman Sachs and J.P. Morgan, have projected next year's growth rate to be in the 2% range.

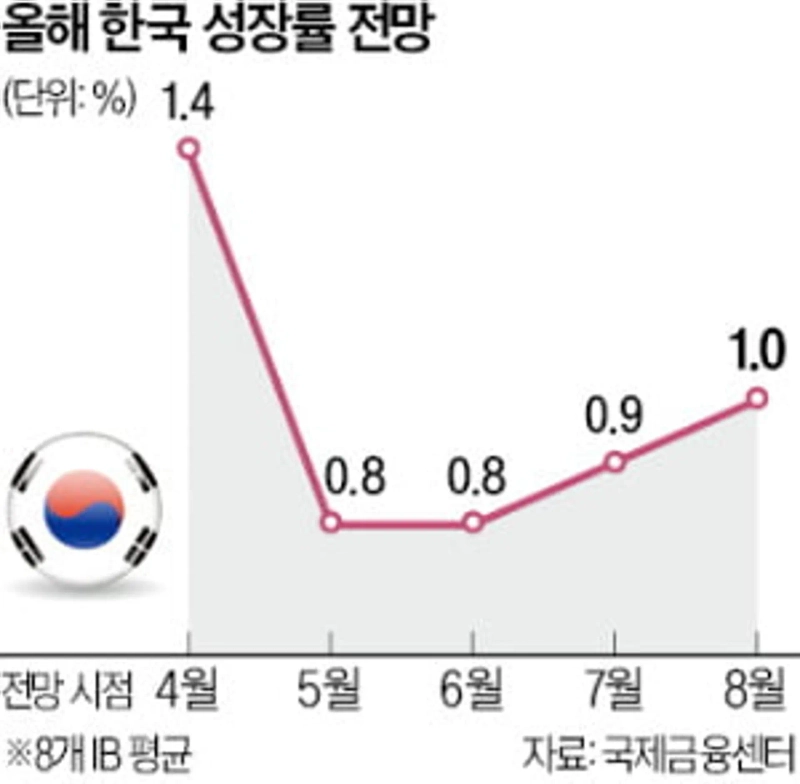

According to the International Finance Center on the 6th, the average growth rate forecast for Korea presented by eight global IBs for this year was 1.0%. After dropping from 1.4% in April to 0.8% in May, staying in the 0% range, the forecast has finally climbed back to 1% after four months.

Among the eight IBs, Goldman Sachs, J.P. Morgan, and Citi have recently raised their forecasts in the past month. Goldman Sachs now expects Korea's growth rate to reach 1.2% this year, raising the forecast by 0.1 percentage points. In its report, Goldman Sachs noted, "With this trade deal announcement, uncertainties related to tariffs on items such as semiconductors have decreased," adding, "Korea is not at a disadvantage compared to other countries."

J.P. Morgan, which had the most negative outlook on the Korean economy, also increased its forecast for this year from 0.6% to 0.7%. Citi raised its forecast from 0.6% to 0.9%. J.P. Morgan explained in its report, "Favorable exports and manufacturing growth meant Q2 GDP growth (0.6%) slightly exceeded market expectations," and added, "Although there may be some reaction in Q3, fiscal stimulus will help cushion the effects."

UBS (1.2%), Barclays (1.1%), Bank of America Merrill Lynch (1.0%), Nomura (1.0%), and HSBC (0.7%) all maintained their previous forecasts.

Goldman Sachs, J.P. Morgan, and Citi each raised their forecasts for next year’s growth rate by 0.1 percentage points. The recovery trend that began in the second half of this year is expected to become even more pronounced next year. The forecasts for Korea’s growth rate next year by Citi and J.P. Morgan increased to 1.6% and 2.0%, respectively. Goldman Sachs projected 2.2% for next year, the highest among the eight IBs.

These global IB forecasts are higher than those of major domestic and international institutions. The Bank of Korea forecast 0.8% growth for this year and 1.6% for next year in its economic outlook last May. The projections by the Korea Development Institute (KDI) and the Asian Development Bank (ADB) are the same as those of the Bank of Korea. The Bank of Korea is expected to raise its growth forecast in its revised economic outlook on the 28th.

Jin-gyu Kang, Reporter josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.