Editor's PiCK

With the SEC's policy shift... US asset manager says '3 areas present investment opportunities'

Summary

- Matt Hougan, CIO of Bitwise, highlighted Ethereum and layer 1 blockchains as important investment opportunities.

- Hougan stated that there are investment opportunities in the growth of crypto superapps such as Coinbase and Robinhood.

- He emphasized that the technological innovation of DeFi apps and the convergence of traditional and crypto markets will offer investment opportunities.

U.S. asset manager Bitwise has cited Ethereum (ETH), DeFi (DeFi), and others as new investment opportunities.

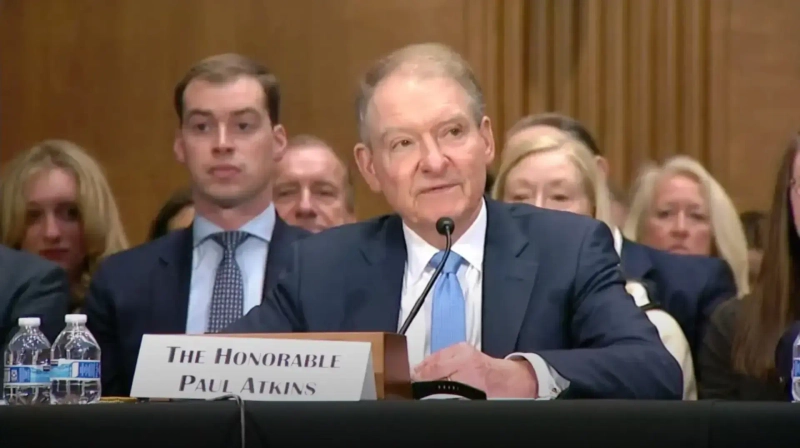

Matt Hougan, Chief Investment Officer (CIO) of Bitwise, stated on the 5th (local time) in a 'CIO Memo' that "Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), delivered a speech last week on 'American Leadership in the Digital Financial Revolution,'" and added that "(the speech) is a roadmap for how to invest over the next five years." Earlier, Chairman Atkins had stated in his speech on the 31st of last month, "I hope that by working with various officials in the administration, we can make the U.S. the world's cryptocurrency hub," and that "this is an opportunity that spans generations."

CIO Hougan identified three things, including Ethereum, as new investment opportunities in the cryptocurrency sector. Hougan said, "First, the most obvious opportunity is to invest in Ethereum and other layer 1 blockchains that support stablecoins and tokenization," noting, "If most assets move to public blockchains, investors should have exposure to those blockchains."

Superapps in the crypto space like Coinbase and Robinhood were also mentioned as investment opportunities. Hougan explained, "One of the key themes of (Chairman Atkins') speech is the section called 'superapp activation,'" adding, "In that section, Atkins describes a future in which a single app can provide customers with a variety of financial services." He added, "Coinbase started with cryptocurrency and is moving towards traditional assets, whereas Robinhood started with traditional assets and is rapidly moving into cryptocurrency," further stating, "One of these companies could become the world's largest financial services company."

The final investment opportunity mentioned was DeFi apps. Hougan emphasized, "DeFi is not merely a technological revolution but a conceptual one," and said, "Chairman Atkins is also well aware of this." He continued, "While regulatory clarity has been lacking, DeFi apps have shown significant usage," noting, "As traditional and crypto markets merge, tremendous opportunities await."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)