Trump: "100% Tariff on Semiconductors…Exemption if Manufacturing Promised in the U.S."

Summary

- Donald Trump mentioned the possibility of a 100% tariff on semiconductors, but analyses indicate that Korean companies such as Samsung Electronics are unlikely to face significant impact thanks to large-scale domestic investments in the U.S. and a promise of most-favored-nation status.

- Since the Korea-U.S. tariff negotiations established most-favored-nation status for semiconductors, it is widely expected that the tariff rate for Korea will be capped at the same level as the EU, with a maximum of 15%.

- However, the timing and details of the tariffs remain undisclosed, and there is ongoing uncertainty since higher tariffs could lead to increased IT product prices and a slowdown in semiconductor demand.

Korea Secures Most-Favored-Nation Status

Limited Impact Expected for Samsung and Others

Donald Trump, former President of the United States, stated on the 6th (local time), "I will impose a 100% tariff on semiconductors entering the U.S.," but added, "However, companies that have established a production base in the U.S. or have made a firm commitment to produce domestically will be exempt." Since the U.S. government has promised to grant Korea most-favored-nation treatment regarding semiconductor tariffs, and with Samsung Electronics and others currently building factories in the States, there is analysis that the impact will not be substantial.

President Trump made this announcement at an event held at the White House, where Apple revealed its additional investment plans in the U.S. However, he did not specify when the tariffs would take effect or provide other details. Apple announced it would invest a total of $600 billion in the U.S. over four years and procure U.S.-made components for the iPhone from companies like TSMC, Samsung Electronics, and Corning.

Even if the Trump administration imposes high tariffs on semiconductors, many predict the rate applied to Korean companies won't be very significant. This is because during the Korea-U.S. tariff negotiations on the 30th of last month, Korea secured a most-favored-nation pledge regarding semiconductor tariffs. As the U.S. and the European Union (EU) agreed to a maximum 15% tariff on semiconductors, it is expected that Korea will receive the same treatment. However, there is caution against making premature assessments of the impact, as the U.S. government has not disclosed specific details, and President Trump is known for potentially reversing decisions at any time.

'Most-Favored-Nation for Semiconductors' Secured...But Uncertainty Remains for Samsung & SK

Low Likelihood of 100% Tariff...Deal with EU Sets 15% Cap

The risk of semiconductor tariffs, which had been receding, resurfaced following Trump's "100% tariff" remarks. While Korea obtained most-favored-nation status for semiconductors and Samsung Electronics is making large-scale U.S. investments, leading the majority to expect that "no tariff shock is forthcoming," Trump's unpredictable statements present a new variable.

Some are concerned that, given the lack of memory semiconductor production facilities in the U.S. by Samsung Electronics and SK Hynix, the Trump administration could impose high tariffs on DRAM and NAND flash. There is also speculation that if high tariffs on critical IT components like semiconductors are enacted, it could trigger a vicious cycle of increased finished product prices, reduced consumer demand, and slower semiconductor sales.

Reliance on Most-Favored-Nation Pledge

On the 7th, the government and the semiconductor industry commented on President Trump's statement, "Will impose around 100% tariffs on all semiconductors entering the U.S.," noting that "uncertainty will continue until concrete policies are released next week." However, most analysts believe that "it is unlikely Korea companies like Samsung Electronics and SK Hynix will face a 100% tariff rate."

This is because the bilateral tariff negotiations between Korea and the U.S. at the end of last month delivered an agreement to grant most-favored-nation status for semiconductors. Such status promises not to impose tariffs or other trade disadvantages under conditions less favorable than those given to any other country. Given that on the 27th of last month, the U.S. and EU mutually agreed to cap tariffs on semiconductors and pharmaceuticals at 15%, it is said that the same maximum rate will apply to Korea's semiconductors.

Apple and TSMC Receive 'Tariff Exemption'

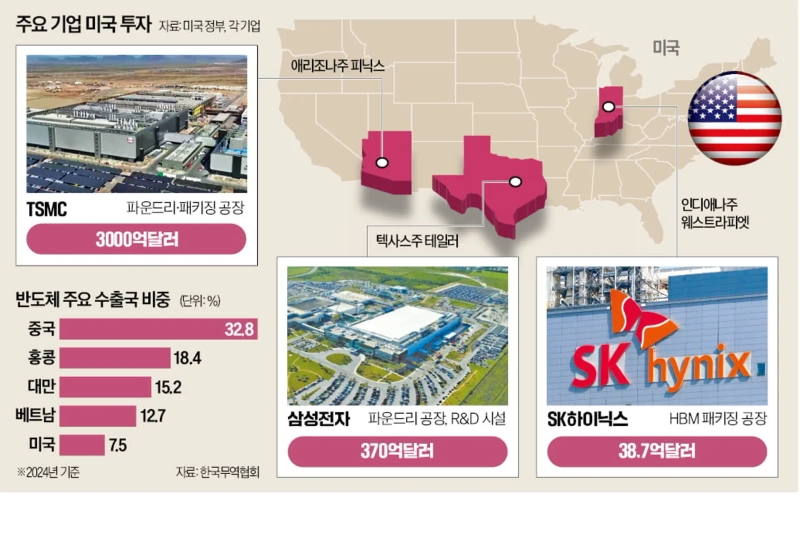

President Trump’s pledge that "building production facilities in the U.S. will result in exemption from tariffs" further encourages positive outlooks. Samsung Electronics plans to invest $37 billion (about ₩51 trillion) into its foundry plant in Taylor, Texas, while SK Hynix also committed $3.87 billion to build a high-bandwidth memory (HBM) packaging plant in Indiana. Bloomberg News reported that Samsung Electronics is "well-positioned to avoid tariffs." Apple and TSMC, both of whom announced large-scale investments in the U.S., have received tariff exemption pledges from the Trump administration. The expectation that semiconductor tariffs would hurt the profitability of major U.S. tech companies and lead to higher domestic IT product prices serves as an advantage for Korean companies.

Because the volume of semiconductors Korea exports directly to the U.S. is relatively small, there is analysis suggesting little impact even if tariffs are imposed. According to the Ministry of Trade, Industry and Energy, last year’s semiconductor exports to the U.S. totaled $10.6 billion, accounting for only 7.5% of overall exports. A semiconductor industry source explained that "the U.S.-bound volume mainly consists of replacement parts for smartphones, PCs, servers, or pre-shipment samples." The majority of shipments go to Chinese and Taiwanese firms for packaging before being re-exported to the U.S., meaning the tariff burden for Korean companies remains limited.

Burden of Increasing Costs and Pressure for Additional Investment

There are also cautious voices. The mere imposition of tariffs along the semiconductor supply chain would increase the production costs of finished goods like smartphones, PCs, and servers. If IT consumption contracts, so does demand for semiconductors.

Another burden is the possibility that the U.S. could press for additional investments as a condition for tariff exemptions. There is talk that the U.S. may use the absence of domestic general DRAM and NAND flash plants by Samsung Electronics and SK Hynix as a pretext to demand further memory production facilities in the U.S. An industry representative commented, "It’s difficult to predict what tariff rates Korean companies will face due to lack of details," adding, "We will respond with a concerted effort alongside the government to reduce uncertainty."

New York = Shin-Young Park, Correspondent / Jung-Soo Hwang / Dae-Hoon Kim, Reporters nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.