Patent Fees Shaken by Trump..."Burden on Korean Companies Increases 9.9 Times"

Summary

- "The U.S. Department of Commerce is seeking to impose a patent fee of up to 5%, which is expected to greatly increase the burden on domestic companies such as Samsung Electronics and LG Electronics."

- "The new value-based patent fee system raises concerns about punitive double taxation and could make the cost of maintaining U.S. patents for Korean companies 9.9 times higher."

- "If the system overhaul becomes reality, the structural cost of entering the U.S. market for global companies will rise, making a shift in patent management and filing strategy unavoidable."

U.S. Department of Commerce Pushes for Fees up to 5%

Significant Increase in Burden for Patent Holders

Punitive Double Taxation That Could Hinder Innovation

Samsung Electronics Ranks No.1 in U.S. Patent Registrations

Unavoidable Shift in Patent Management and Filing Strategy

It has been reported that the Trump administration is considering overhauling the patent system to boost government revenue by billions of dollars. If implemented, this plan is expected to impact not only U.S. companies like NVIDIA, Apple, Meta, and SpaceX, but also domestic companies such as Samsung Electronics, LG Electronics, and Hyundai Motor Company.

◇ Discussion of Charging Up to 5% Patent Fee Based on Value

According to foreign media such as The Wall Street Journal (WSJ) on the 11th, the U.S. Department of Commerce is reportedly considering a plan to impose a fee on patent holders equivalent to 1% to up to 5% of the overall patent value. There is speculation that the current system of lump-sum fees, usually in the thousands of dollars range, may be replaced or supplemented with this new structure. Foreign media reported that Howard Lutnick, the U.S. Secretary of Commerce, is leading this project as part of a plan to increase government revenue.

The patent system overhaul is being described as a "paradigm shift" that shakes the foundation of the U.S. patent regime that has been maintained for 235 years. Patents play a crucial role in the U.S. economy by protecting inventions and techniques and providing a basis for subsequent research through disclosure.

Under the current system, patent holders pay fixed periodic fees to the government over several years. These fees typically range from several thousand to as much as $10,000 (about ₩14,000,000). If the Department of Commerce introduces a new fee based on patent value, the burden on patent holders is expected to rise sharply.

Industry sources believe the new fee structure would essentially function as a property tax. Brad Watts, vice president of the U.S. Chamber of Commerce's Global Innovation Policy Center, expressed concern that this “fundamentally changes the mindset around intellectual property protection” and could “be seen as a tax on innovation.” According to the U.S. Patent and Trademark Office (USPTO), the value of patents in the U.S. amounts to several trillion dollars, and global corporations like Samsung Electronics and Apple acquire thousands of patents annually. If this new value-based fee system is fully implemented, it is expected to apply equally to foreign companies, including Korean firms operating in the U.S.

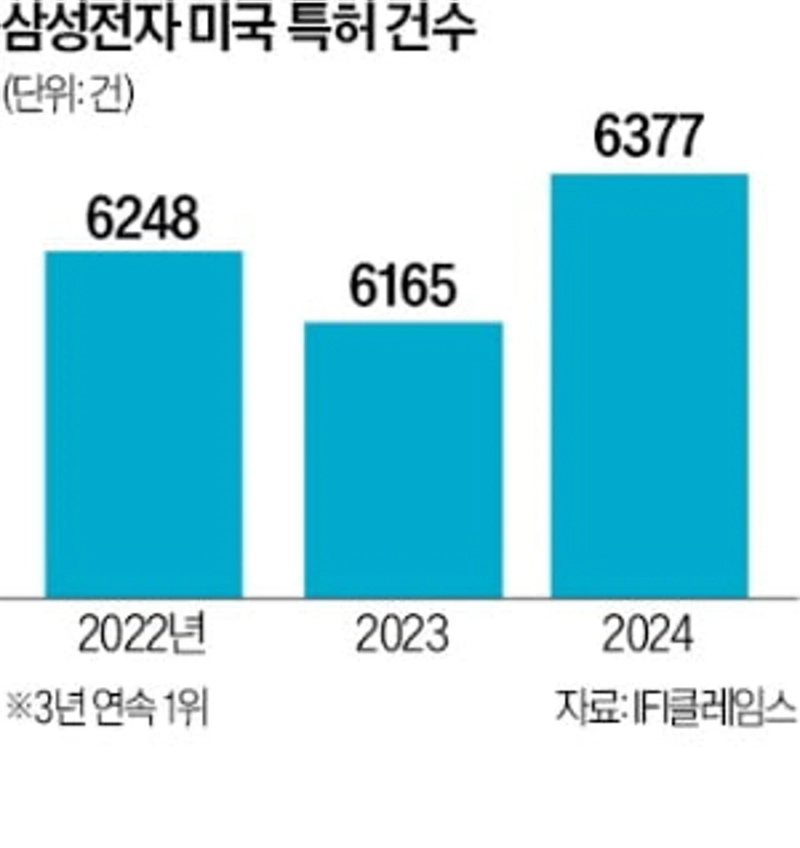

According to U.S. patent analytics firm IFI CLAIMS Patent Services, Samsung Electronics ranked first in the number of U.S. patents granted for three consecutive years: 6,248 in 2022, 6,165 in 2023, and 6,377 last year. Taiwan's TSMC ranked second last year, followed by Qualcomm, Apple, Huawei, LG Electronics, and Samsung Display. More than half (56%) of all U.S. patents granted last year were owned by foreign companies. The breakdown by country was: Japan (43,364), China (28,258), Korea (24,115), and Germany (14,044).

◇ "The Worst Policy for Stifling Innovation"

A major risk is that this measure introduces "systemic uncertainty" in addition to simply increasing fees. The Trump administration has only presented a fee range, while how patent value will be appraised remains unclear. The WSJ noted that companies already pay taxes on revenue generated from patents, and predicted that there will be significant backlash against the new proposal. The U.S. patent industry argues that imposing additional fees based on patent value, even as companies are already taxed on income from patents for artificial intelligence (AI), healthcare, etc., amounts to punitive double taxation.

There are even concerns that this may conflict with several international patent treaties to which the U.S. is a signatory. Stanford University Professor Mark Lemley critiqued, “Most patent applicants don’t know the real value of their patents in advance, so imposing costs based on such ambiguous criteria is the worst policy to suppress innovation.” Hana Securities, in a recent report, also analyzed that “the Trump administration’s overhaul of the patent system could pose a crisis for Korean companies,” adding that “if enacted, the cost of maintaining U.S. patents for Korean firms could surge by a factor of 9.9.”

Experts interpret this reform as not merely a way to boost revenue, but as part of ongoing technological hegemony competition and a national security strategy. In particular, if China restricts the export of strategic resources such as rare earth elements, the U.S. could weaponize both patent fees and tariffs in response. If this trend continues, foreign firms’ cost of entering the U.S. market will inevitably rise structurally. The value-based patent fee system is emerging as a major policy variable with direct implications for the global corporate management environment, beyond just a simple regulatory revision.

An industry source commented, “Korean companies now face a situation where much more sophisticated patent management and filing strategies are unavoidable.” USPTO’s authority to set fees is slated to expire next year, and whether the plan will be realized depends on decisions made by Congress.

By Kang Kyung-joo qurasoha@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)