Following Altman's 'AI Bubble Theory'... Samsung Electronics rises, SK hynix falls

Summary

- Recently, Samsung Electronics surged 18% since last month, driven by expectations for HBM4 market entry and an increased perception of being undervalued.

- SK hynix fell 12% over five days due to intensifying HBM market competition and concerns over falling market share, with its investment rating downgraded as well.

- However, some analysts cite rising HBM demand and anticipated revenue growth next year as reasons for potential share price recovery for SK hynix.

Deepening 'Decoupling' of Semiconductor Top Two

SK hynix declined 12% over 5 days

Concerns over decreased HBM market share

Counterargument: 'Strong results due to rising demand'

Samsung Electronics surged 18% since last month

Strength from expectations for HBM4 market entry

Still undervalued at just 1.2x PBR

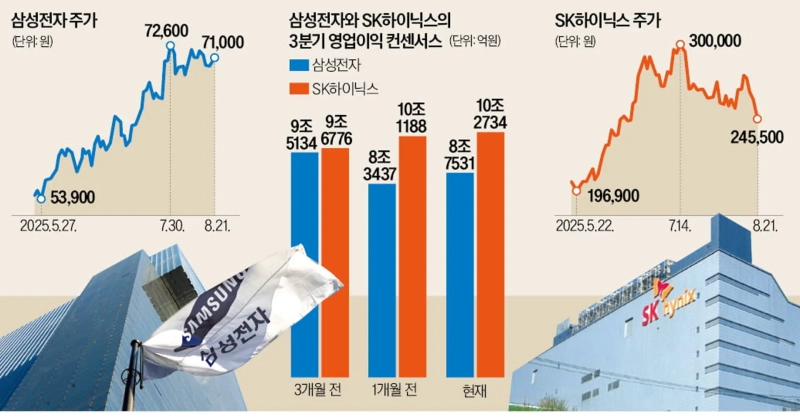

Samsung Electronics and SK hynix are seeing an expanding gap in returns. As competition in the High Bandwidth Memory (HBM) market is expected to intensify, and the 'AI bubble theory' sparked by Sam Altman, CEO of OpenAI, has emerged, these factors have influenced trends. SK hynix shares dropped nearly 12% in the last five trading days, while Samsung Electronics rebounded on growing expectations of full-scale entry into the HBM market in the second half of the year.

Investors Expecting a 'Favorable Breeze' for Samsung Electronics

On the 21st, Samsung Electronics shares closed at 76,000 KRW, up 0.14%. Since last month, Samsung Electronics has risen 18.06%. In contrast, SK hynix closed at 245,000 KRW, down 4.11% on the same day, breaking the 250,000 KRW level. In particular, SK hynix has fallen 16.10% since last month with five consecutive days of declines.

In the securities industry, the prevailing view is that Samsung Electronics' shares will gain more momentum in the second half of the year. KB Securities and Kiwoom Securities have selected Samsung Electronics as their 'top pick' in the semiconductor sector, based on the assumption that entry into the next-generation HBM4 market will proceed smoothly. Park Yoo-ak, an analyst at Kiwoom Securities, commented, "Although there has been no official news about passing quality tests, improvements in first-generation nano-process (1nm) performance and yields are expected to boost Samsung's HBM4 market share," adding, "Investor expectations for Samsung Electronics' HBM4 market entry will rise towards year-end." He continued, "The recent share price is at a PBR (price-to-book ratio) level of 1.2x, below the average of 1.5x," and said, "With news of new foundry clients, the share price is expected to continue rising."

Reports that the US Department of Commerce is considering acquiring a stake in Samsung Electronics are also seen as positive for the share price. Kim Dong-won, Head of Research at KB Securities, analyzed that "as ties with the US government strengthen, this could reduce political risks such as tariffs." KB Securities forecasts Samsung Electronics' operating profit in the second half at 18 trillion KRW, the highest since the second half of 2021 (29.6 trillion KRW) in four years.

SK hynix Weighed Down by Market Competition Concerns

Opinions among analysts are divided on the outlook for SK hynix shares. There is consensus that SK hynix's HBM business will grow next year, as major tech firms retain robust investment appetites. However, investors' focus is on intensifying competition in the HBM market previously dominated by SK hynix, as Samsung Electronics and Micron continue to catch up. This gives rise to concerns that falling market share could also mean lower EPS (earnings per share) growth compared to the past.

Kiwoom Securities downgraded its investment rating on SK hynix from 'Buy' to 'Outperform.' Analyst Park said, "Concerns over HBM market share decline may limit stock price upside for now," but added, "However, because SK hynix will likely maintain its number one position in HBM next year, downside risk remains low."

DB Financial Investment also downgraded SK hynix's rating to 'Hold.' In a recent report expecting memory semiconductor prices to drop in Q4 this year, it pointed out that "it's time to closely monitor the speed at which latecomers catch up."

There are counterarguments as well. Some analysts say rapidly growing HBM demand, despite intensifying competition, will support SK hynix’s earnings. Hanwha Investment & Securities forecasts SK hynix’s HBM revenue next year at $28.2 billion, up about 30% from this year. This figure reflects expectations for lower market share at 55% next year (down from 64% this year) and lower HBM prices.

Kim Kwang-jin, an analyst at Hanwha Investment & Securities, said, "The longer this goes on, the more it will be highlighted that market competition does not impair SK hynix’s HBM business growth potential, leading to share price recovery."

Reporter Seongmi Sim smshim@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Market] Bitcoin falls below $71,000…Lowest level since October 2024](https://media.bloomingbit.io/PROD/news/0e5880b9-61dd-49d4-9d2e-c47a3fb33a93.webp?w=250)