"We've been borrowing well so far"...Will the '$1 Trillion Time Bomb' Explode? [Global Money X-File]

Summary

- It was reported that global investors are facing increasing pressure to unwind 'yen carry trade' funds raised with low-interest yen.

- A narrowing interest rate gap between the US and Japan and recent yen strength have raised the risk that $1 trillion worth of yen carry trades could be unwound abruptly, greatly increasing volatility in global asset markets.

- During the yen carry unwind, assets like US Treasuries, tech stocks, and emerging market assets are directly affected, and the Korean economy is exposed to multiple risks such as softening global demand and foreign capital outflows.

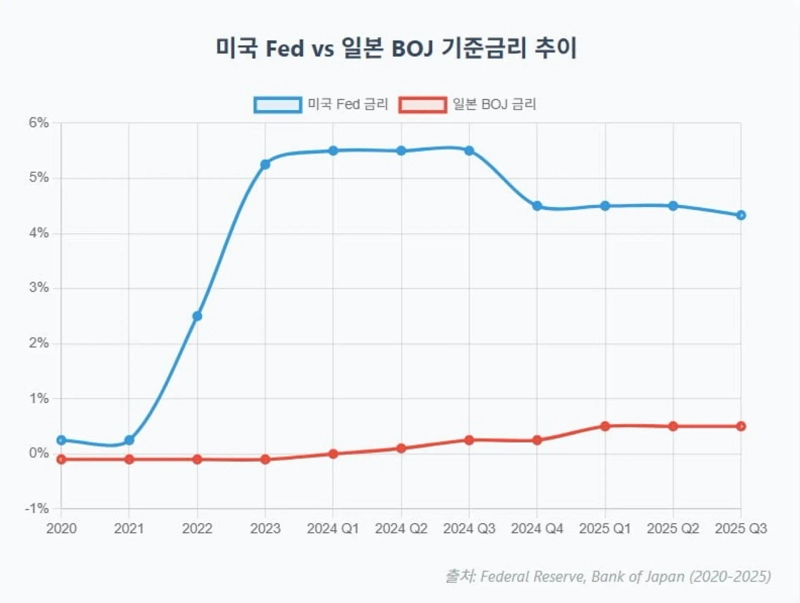

Pressure to unwind 'yen carry trade' funds, which have been a hidden engine of global liquidity for decades, is rising. Recently, the probability of a US Federal Reserve (Fed) rate cut has remained above 70%. Conversely, the Bank of Japan (BOJ) has hinted at the possibility of raising its benchmark rate, signaling even greater movement of 'yen carry trade' funds ahead.

Powell and Ueda Taking Opposite Approaches

According to Reuters on the 25th, the Fed and BOJ sent opposite signals regarding monetary policy at the Jackson Hole Meeting held in Wyoming, USA, on the 22nd. Jerome Powell, the Fed Chair, mentioned economic slowdown and declining employment, saying, "It may be necessary to adjust policy stance," hinting at a rate cut in September.

Powell evaluated that "long-term inflation expectations remain well anchored at around 2%," but pointed out that "the 'curious kind of balance' observed in the labor market is increasing downside risks to employment." This has been interpreted as the Fed leaning toward policy easing due to concerns about economic slowdown.

Following the related remarks by Powell, the market-implied probability of a 0.25% rate cut at the September FOMC climbed to 91.5%. However, as Powell did not send a clear rate cut signal, the probability of a September rate cut by the Fed fell to 75%, close to the pre-speech level, within a day. Still, it's above 70%, a high level.

Matthew Luzzetti, Chief US Economist at Deutsche Bank, commented, "Given the existence of very different views within the FOMC, the easiest path forward is likely to be a gentle pace of rate cuts." Stephen Stanley from Santander Capital Markets also forecast, "The September message is likely to be 'cut once and wait and see.'"

Meanwhile, Kazuo Ueda, Governor of the BOJ, indicated the possibility of a rate hike in Japan. He mentioned that wage growth within Japan is spreading, suggesting that the conditions for a further rate increase are taking shape. Governor Ueda noted that despite a decline in Japan's working-age population, wage stagnation over past decades was due to "entrenched deflationary expectations," which made companies reluctant to raise product prices and wages.

However, he said, the global inflation shock triggered by the COVID-19 pandemic has helped Japan escape the deflationary trap. Recently, he diagnosed that "labor shortages have become one of our most pressing economic issues." He added, "Wage increases are now spreading from large firms to SMEs," and, "Unless there is a significant negative demand shock, the tight labor market is expected to continue exerting upward pressure on wages."

He stressed, "We will closely monitor these trends and continue reflecting supply-side changes in our monetary policy decisions." Previously, the BOJ ended its negative interest rate policy for the first time in 17 years in March last year, raising the benchmark from 0–0.1% to around 0.25% in July. In January this year it was raised again to about 0.5%, and then held steady across four meetings through July.

This time, BOJ Governor Ueda's optimism based on Japan's escape from deflation and wage growth is seen as supporting conditions for another rate hike within the year. Reuters, citing a recent survey of macroeconomists, reported that about two-thirds of respondents expect the BOJ to raise its policy rate by at least 25bp by year-end.

The Start of Historic Decoupling?

This year's Jackson Hole Meeting confirmed that the world's number one and three economies are officially heading down opposite policy paths. The Fed's direction is signaled to be determined primarily by cyclical economic slowdown, while BOJ's policy is rooted in the structural shift of escaping deflation.

Such a divergence in policy motives has led analysts to believe it will be difficult for the US and Japan's monetary policies to realign anytime soon. The Fed's easing could always be reversed depending on incoming data. However, Japan's tightening is tied to a rare improvement in the country's economic fundamentals, making it much harder to reverse.

In this context, a reassessment of all global investment strategies based on the yen is necessary. The "giant dam" of cheap-yen liquidity that has supported the global market for over a decade is showing signs of cracking. $1 trillion worth of "yen carry trade" funds may display extreme volatility.

The 'yen carry trade' refers to a strategy of borrowing in ultra-low-yielding yen and investing in the assets of higher-yielding countries. Since the 1990s, Japan maintained near-zero rates due to prolonged recession and deflation. Rates have lingered at 0% until quite recently.

Global investors have long borrowed yen to invest in higher-yield currencies such as the US dollar, or high-return assets. For instance, they may use low-rate currencies like the yen or Swiss franc to invest in high-yielding assets such as Mexican government bonds or US tech stocks.

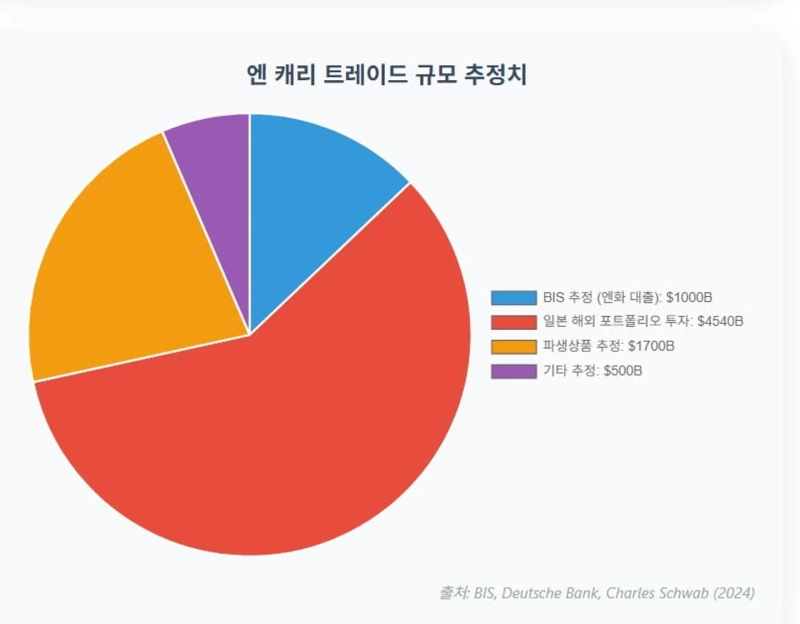

It is difficult to determine the exact size of such transactions. However, according to the Bank for International Settlements (BIS), as of March 2024, the outstanding amount of yen-denominated loans issued by Japanese banks abroad reached about 157 trillion yen—roughly $1 trillion. This covers funds used by asset managers and other long-term investors, and is a conservative estimate that excludes speculative short-term futures and hard-to-measure OTC derivatives. Over $1 trillion has served as a hidden source of liquidity, flowing into global stocks, bonds, commodities, and emerging markets, supporting asset prices worldwide.

However, AMRO (ASEAN+3 Macroeconomic Research Office) finds that Asian emerging-currency assets (KRW, CNY, etc.) were not a main investment target for yen carry trades in the past, due to relatively small interest differences and the tendency for Asian currencies to also weaken alongside the yen. Currencies that move opposite to the yen—like the Mexican peso and Brazilian real—have a strong correlation with yen carry trades.

Will the '$1 Trillion Time Bomb' Defuse?

The core drivers of the yen carry trade are interest rate differentials and exchange rate movements. When investors borrow yen to buy dollar assets, they generally hope for two things: First, interest income from the rate difference between Japan and the target country. Second, yen's value will not surge during the investment period (either yen stays weak or stable). If either expectation fails, carry trade profitability deteriorates and the unwinding pressure intensifies.

Currently, conditions for such an unwind are mounting as the US-Japan policy rate gap is narrowing. The US rate hike cycle seems complete, while Japan last year raised its rate for the first time in 17 years (from 0% to 0.5% in July), and is reportedly considering further hikes within the year.

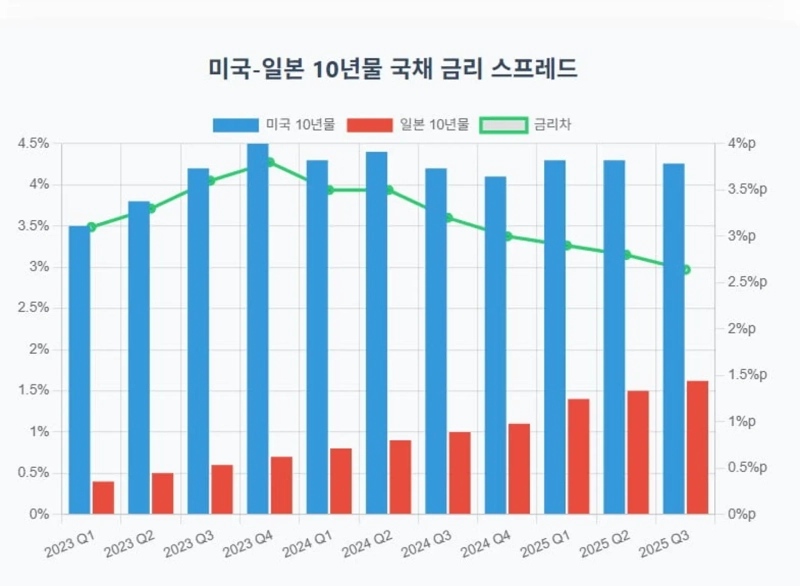

Currently, the 10-year government bond yield stands at about 4.30% for the US and around 1.6% for Japan—a 2.7% point gap, down from over 3 points a year ago. The narrowing spread reduces the appeal of funding in yen. As short-term yen borrowing costs (interest) rise and target asset yields (e.g., USD) dip, carry trade interest revenue declines.

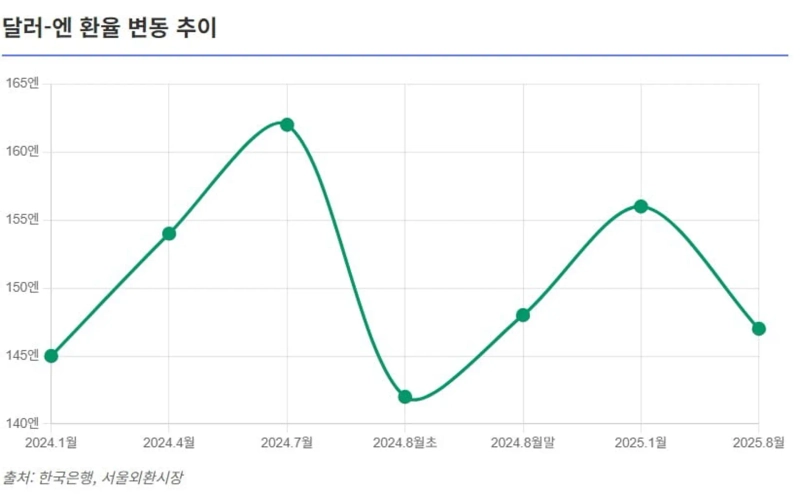

The bigger risk is the reversal in the exchange rate. Investors prefer a stable or weak yen relative to the dollar so that repaying yen loans carries little FX loss. Recently, however, the yen has strengthened sharply. In July 2024, the yen weakened to 162 per dollar, but by early August, amid "yen carry unwind," it had jumped to 153 per dollar in just two weeks—a record annual high.

Even now the yen faces upward pressure. On August 22, right before Powell's Jackson Hole speech, USD/JPY touched 148.0. After Powell's dovish remarks, the dollar fell to the 146 yen range, highlighting increased volatility. A stronger yen inflicts double losses on carry trade investors: they must sell overseas assets, convert dollars back to yen, and repay their debts. When the yen surges, the cost of repaying those debts rises sharply.

For example, if yen was borrowed at $1=160 yen but must be repaid at $1=140 yen, that means a 14% FX loss on top of other costs. Ultimately, as rate benefits shrink and currency losses loom, investors struggle to endure, forcing them to hurriedly unwind yen short positions. Athanasios Vamvakidis, Global Head of G10 FX Strategy at Bank of America, said, "Liquidation of yen short positions is closely linked to unwinding of carry trades and may spill over to other currency carry positions." If positions funded in yen are reduced, chain reactions of yen buying (selling of investment currencies like the dollar) may occur, strengthening the yen further and deepening asset price declines.

A 'Perfect Storm' Over Global Asset Markets

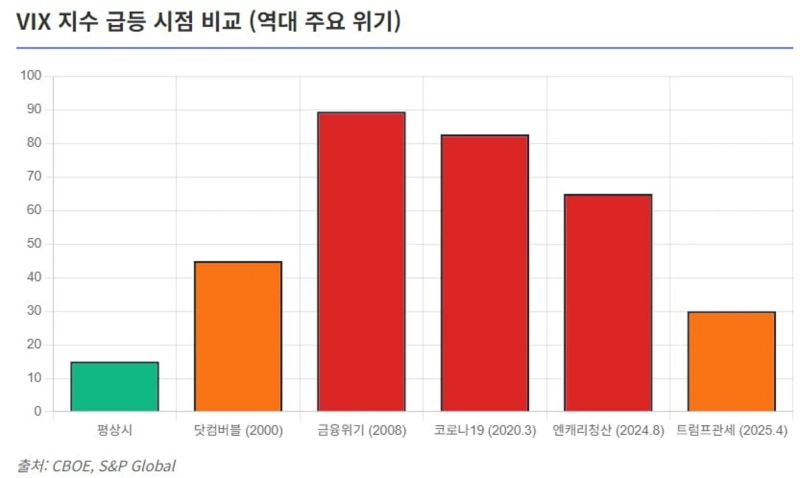

Carry trade unwinds normally trigger and accompany rising market volatility. Last August, an unexpected tightening move from the BOJ coupled with recession signals from the US caused a sharp spike in volatility. According to BIS, on August 5, 2024, Tokyo's Nikkei Index plunged 12.40%, and the TOPIX Index dropped 12.23%. The US VIX Index also soared to a post-pandemic high. The direct catalyst was rapid unwinding of investments funded by yen.

To stem losses, investors hurriedly dumped assets denominated in Mexican peso, Brazilian real, etc., causing those currencies to collapse. This fed a vicious cycle of further yen appreciation. With US and Japan now moving in opposite rate directions, the risk of simultaneous, large-scale yen carry trade unwinds has intensified.

The Bank of Korea estimates that total global yen carry funds outstanding amount to about 506 trillion yen, of which about 6.5%, or 32.7 trillion yen (about ₩300 trillion), is classified as exposed to unwinding risk. Should this sum be recalled abruptly, global FX and bond markets could see severe shocks. The phenomenon of reversed rate and currency differentials between the US and Japan could trigger "margin call"-type unwinding of yen carry funds.

The US Treasury market—a key destination for yen carry inflows—may also be impacted. Japanese investors are some of the largest overseas holders of US Treasuries. When the yen strengthens and domestic Japanese rates rise, they are more likely to repatriate assets. There have been recent reports of such selling: Reuters, citing Japanese Ministry of Finance data, noted that in the last week of the previous month Japanese investors were net sellers of overseas long-term bonds to the tune of 526.3 billion yen, marking two consecutive weeks of selling.

US Treasury yields have come under upward pressure from slowing foreign demand. The 10-year Treasury yield stood at 4.258% as of August 24, up more than 12% from a year earlier; 30-year yields have also climbed into the mid-4% range. Conversely, Japan's 10-year yield is around 1.6%, returning to 2008 levels. With narrowing spreads and less Japanese demand for US Treasuries, US yields may remain high or see sharp swings instead of declining.

The US stock market is also affected. Cheap-yen financing has supported risk assets, especially US tech stocks. The unwinding of yen carry trades raises the risk of additional selling pressure, including for growth stocks. In the stock plunge from late July to early August last year, J.P. Morgan analysts noted, "some selling of stocks was driven by yen carry trade unwinding."

Emerging market bonds and currencies also face heightened volatility. Emerging markets that attract a lot of yen carry funds are vulnerable. Each time the yen flipped to strength during crises or tightening shocks, emerging currencies plummeted and local yields spiked. In August 2024, the Mexican peso and South African rand suffered marked losses against the yen. Matthias Scheiber, Chief Portfolio Manager at Allspring Global Investments, who recently reduced yen long positions, remarked, "Due to the rate spread, we are facing negative carry and need to manage it proactively."

Korea Caught in the Crossfire

The Korean economy is also affected. A stronger yen is typically favorable for Korean exports, since Korea and Japan compete in various manufacturing sectors such as autos, semiconductor equipment, and machinery. When the yen rises, dollar prices of Japanese goods increase, improving Korea's price competitiveness. Historically, a rising USD/JPY (weaker yen) has helped Japanese exports at the expense of Korea, while yen strength gives Korea a relative benefit.

This time, the direction is towards yen strength. Sectors with high competition against Japanese firms, such as autos, shipbuilding, and machinery, could benefit to a certain extent. In finished car markets, where price competitiveness is immediately impacted by exchange rates, yen strength can increase pricing advantages for companies like Hyundai Motor Company over Toyota. If the won remains relatively stable or weak against the dollar due to US rate cut expectations, a rise in the KRW/JPY exchange rate (stronger yen, weaker won) could boost Korean exporters' margins.

However, the major variable is softening global demand. The backdrop to the yen's current strength involves not only Japanese inflation and monetary tightening, but US economic slowdown concerns. Powell has also voiced worries about US growth and employment deceleration—indicating that end demand both in the US and globally may weaken. This would adversely affect Korea, whose economy is heavily driven by exports. Sectors such as semiconductors and petrochemicals are highly sensitive to global business cycles and could be impacted more than they are by yen movements alone.

The won's relative performance must also be considered. If the global dollar weakening becomes prominent after Jackson Hole, the won could also strengthen against the dollar. For instance, if the yen gains 10% and the won 5% against the dollar, the net KRW/JPY change is only 5%—diluting the improvement in export competitiveness.

Capital outflows and tighter financial conditions could also weigh on Korean exporters. Increased global volatility from yen carry liquidation may lead to higher Korean rates and lower local stock prices. Rising domestic rates raise corporate funding costs, falling stocks squeeze investment conditions, and ultimately pose challenges for exporters' investment and hiring. Should foreigners sell off Korean assets and force excessive won weakness, government intervention could be required.

[Global Money X-File highlights the vital but little-known movements of money across the world. Subscribe to the journalist’s page for more essential global economic news.]

Reporter Juwan Kim kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Market] Bitcoin falls below $71,000…Lowest level since October 2024](https://media.bloomingbit.io/PROD/news/0e5880b9-61dd-49d4-9d2e-c47a3fb33a93.webp?w=250)