Nuclear Power Revived by AI: Why Wall Street Is Betting on Kazakh Mines? [Global Money X-File]

Summary

- The proliferation of artificial intelligence (AI) and the explosive increase in power demand from data centers have driven a sharp rise in demand for nuclear fuels such as uranium.

- Global uranium supply is heavily concentrated in certain countries, mainly Kazakhstan. Disruptions in production and geopolitical risks have led to a surge in uranium prices.

- Institutional inflows from financial investors and ETFs have driven strong performance in uranium and associated mining company stocks, but major countries including South Korea have structural vulnerabilities in securing key fuels.

Summary

·Surge in nuclear power and uranium demand due to AI expansion.

·Uranium supply concentrated in certain countries is intensifying.

·Uranium prices surge due to supply shortages and speculation.

·South Korea’s vulnerability due to heavy reliance on imported nuclear fuel

Competition to secure uranium, the fuel for nuclear power, is intensifying. As electricity demand rises sharply, the demand for nuclear power plants is also surging. The supply chain is vulnerable as uranium mining and enrichment are concentrated in specific regions. Recently, analysis suggests that global speculative capital has rushed into this market, pushing up the prices of related mines and financial products.

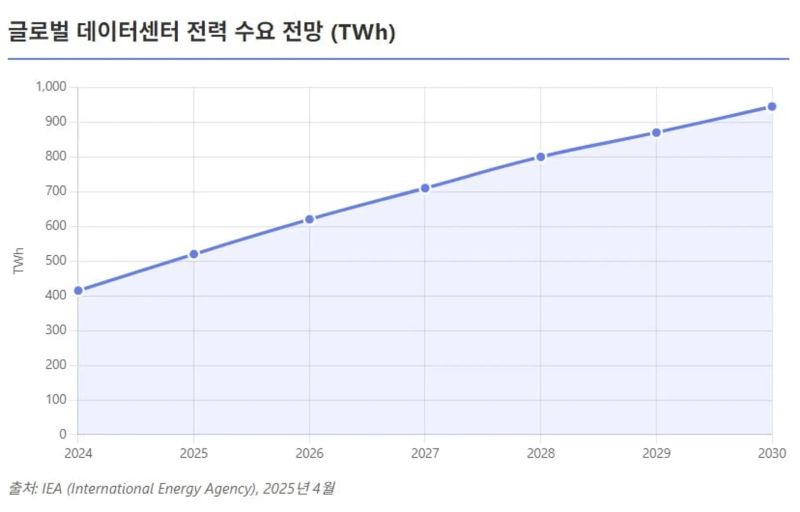

Data Center Power Demand Surpasses Entire Japan

According to Reuters on the 27th, the International Energy Agency (IEA) projected last April, "Over the next five years, data center power consumption will double, reaching about 945TWh by 2030, exceeding all of Japan's consumption." The key driver behind soaring electricity demand is the proliferation of artificial intelligence (AI), which requires massive power for model training and services.

Recently, major US big tech companies have been racing to sign nuclear-based long-term Power Purchase Agreements (PPAs). Last year, Microsoft signed a 20-year PPA with US energy company Constellation. Unit 1 of the Three Mile Island Nuclear Generating Station, which had halted operations in 2019 due to economic woes, will also be restarted. Constellation stated, "To support national competitiveness in core industries like data centers, abundant carbon-free power available every hour is necessary, and only nuclear power can provide this reliably."

Amazon (AWS) agreed this year to purchase 1.92GW of nuclear power over 17 years from the US independent power producer Talen Energy. Google also entered a next-generation SMR (Small Modular Reactor) power PPA with Tennessee Valley Authority (TVA) and Kairos Power. Amanda Corio, Global Energy Lead at Google, stated, "The digital economy requires smart, reliable energy sources. This collaboration will accelerate innovative nuclear technology to support power demand in the AI era." With big tech driving up nuclear demand, the number of new nuclear and SMR projects under construction or planned in the US and other countries is rising.

Shortage of Uranium Fuel

However, there is a challenge in securing SMR fuel. While existing light-water reactors run on low-enriched uranium (LEU, 5% U-235), many next-generation SMRs require 5-20% low-enriched uranium (known as HALEU). Russia effectively holds a monopoly over HALEU production, serving as a bottleneck for SMR plans.

Since 2022, the US Department of Energy has tasked Centrus Energy Corp. with producing demonstration-scale HALEU (900kg annually), but initial facility operation has been delayed. US Secretary of Energy Chris Wright stated, "Advanced reactors are essential to US leadership in AI and energy," and pledged, "We will support the acceleration of America’s next-generation nuclear renaissance."

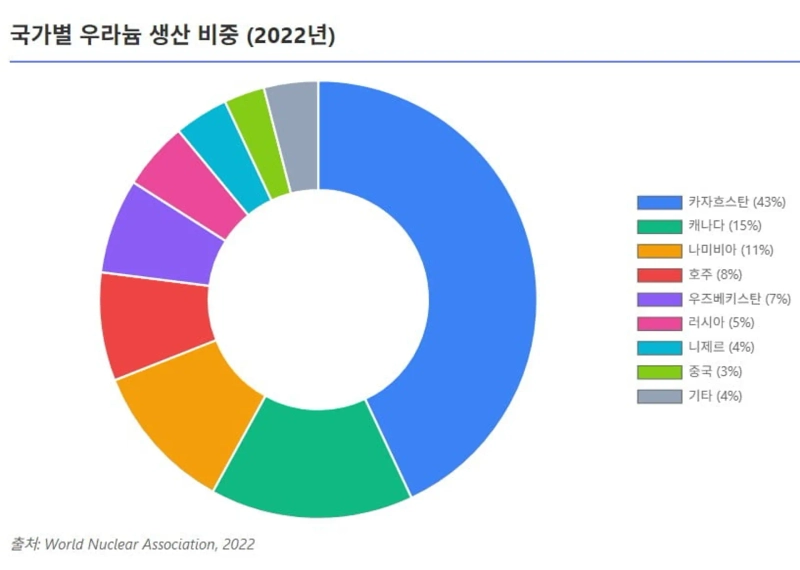

Uranium faces severe regional concentration from the very start of its value chain. As of 2022, Kazakhstan accounted for 43% of global uranium mine production, followed by Canada (15%) and Namibia (11%). Since becoming the world’s top producer in 2009, Kazakhstan has steadily increased its output, retaining its lead with further expansion plans last year. The top three countries account for 70% of global production. This leaves uranium supply highly vulnerable to geopolitical shifts or policy changes.

For example, following a coup in Niger, West Africa, in 2023, the operation and export of uranium mines run by French company Orano became uncertain. Until 2022, Niger produced about 5% of the world’s uranium and supplied 14% of the EU’s uranium imports. The military government nationalized French stakes and Western sanctions were discussed, raising the risk of a “second Libya” scenario. France declared its domestic nuclear fuel supply would not be affected, but the European Union began seeking alternative sources and boosting strategic reserves.

Even Kazakhstan, the world’s largest producer, is not free from geopolitical risks. Kazatomprom, Kazakhstan’s state-owned enterprise, is allied with Russia through the CSTO. When Russia invaded Ukraine in 2022, anti-war protests erupted in Kazakhstan and Russian troops intervened, raising concerns. With Western sanctions focused on Russia, Kazakhstan itself is not under sanctions.

The World’s Most Fragile Supply Chain

Kazatomprom, the largest uranium producer globally, faces multiple additional risks. The company has repeatedly lowered production plans due to sulfuric acid shortages and construction delays—key issues for mining. Recently, it announced a roughly 10% reduction in next year’s output, which would cut global supply by about 8 million pounds.

Related taxes have also increased. Kazakhstan hiked its mineral extraction tax on uranium from 6% to 9% starting this January, and plans to introduce a progressive tax—linked to price and output—of up to 18% from next year. This directly raises the floor for global uranium production costs.

Logistics are another challenge. Traditionally, Kazakh uranium is transported via Russia’s Saint Petersburg port. The war in Ukraine forced the search for alternatives. The “Middle Corridor”—a complex multimodal route traversing the Caspian Sea, Azerbaijan, and Georgia—has been used as an alternative to avoid Russia. However, this route is slower and costlier, creating inevitable transport bottlenecks.

Meirzhan Yusupov, CEO of Kazatomprom, stated in the ‘2025 First Half Consolidated Financial Results Announcement’ on the 22nd, "Despite volatility in the spot uranium and broader capital markets, long-term uranium prices remain stable at $80 per pound, indicating strong fundamentals. The company believes current market conditions are not sufficient to return to 100% of initial production levels." The world’s largest producer signals it will not flood the market despite high prices.

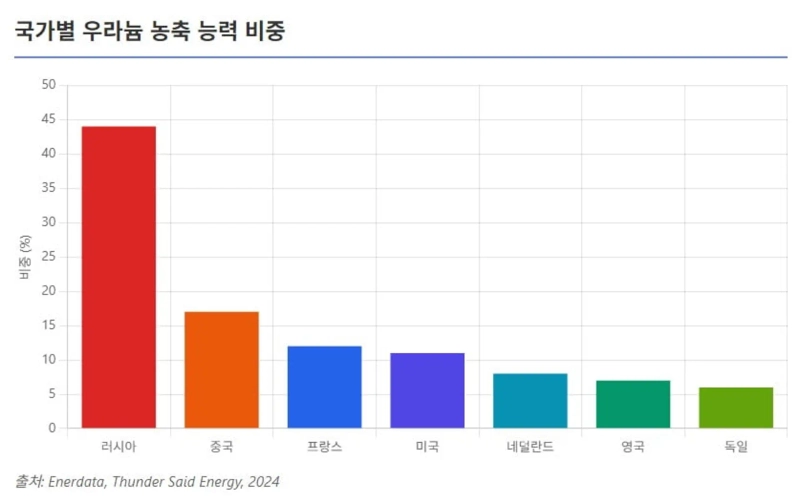

Russia’s influence over uranium supply is also considerable. While Russia accounts for only about 5% of global uranium mining, its market share soars at the processing stages. Russia controls roughly 22% of global uranium conversion capacity and a remarkable 44% of enrichment capacity, effectively making it the largest supplier worldwide.

For example, even if a power utility buys uranium concentrate (U3O8) from Canada or Australia, it may still need to send it to Russia for conversion to reactor-ready fuel. The Center for Strategic and International Studies (CSIS) warned, "Uranium supply is now dangerously concentrated in the hands of Russia and China, which together hold over 50% of the world’s enrichment capacity. This poses unacceptable risks to US energy and national security."

For this reason, uranium-related items have been excluded from Western sanctions against Russia. However, further sanctions or Russian export restrictions remain possibilities. In 2024, the US Congress passed a law banning imports of Russian low-enriched uranium (LEU); Russian fuel purchases will be phased out by 2028. The EU discussed similar sanctions in July 2023 but failed to reach consensus.

Instead, the US and Europe are investing heavily to resolve conversion and enrichment bottlenecks. This year, the Urenco USA plant in New Mexico started operating new gas centrifuge cascades, enabling an additional 700,000 SWU of enrichment capacity. Over the next two years, the plant will further expand, increasing low-enriched uranium output for US commercial nuclear fuel. France’s uranium company Orano also announced a project to expand enrichment capacity at its Georges Besse II (Tricastin) facility by 30%.

Price Surge and Investment Boom

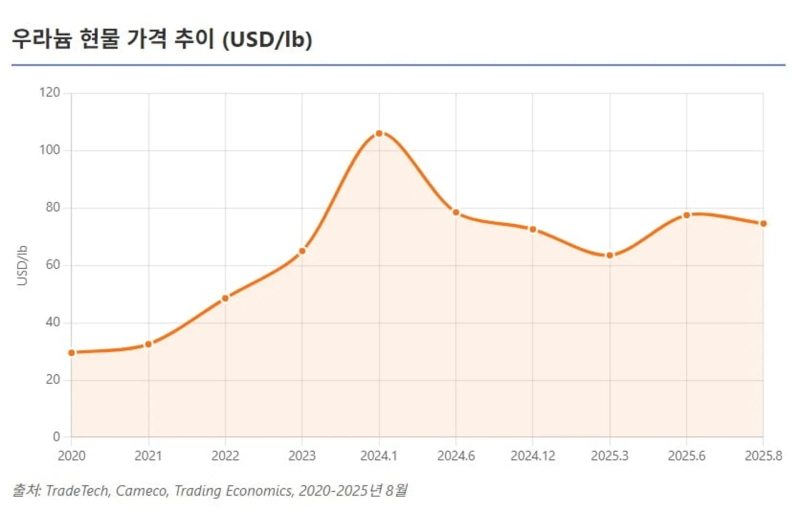

Uranium prices could only head higher. Since 2021, they have surged, topping $100 per pound in January last year—the highest in about 16 years. While prices fell from last year’s peak, they remain more than double their levels five years ago. According to Investing.com, uranium futures (September 2025, UXXc2) traded at $74.6 on the 26th.

The price spike reflects both supply disruptions and growing demand. Kazakhstan, the top producer globally, cut 2024–2025 expansion plans due to sulfuric acid shortages. Instability in Niger risks further supply gaps. Russian sanctions have prompted many buyers to stockpile and secure long-term contracts, increasing demand-side pressure. Uranium, which was in the $20–30 per pound range until the early 2020s, more than doubled over one to two years following the Russia-Ukraine war.

Other factors are fueling the uranium bull market. Financial investors have bought up physical uranium. Sprott Inc., which manages the Sprott Physical Uranium Trust (SPUT), has continued to build inventory, at one point net buying 8.1 million pounds (about 3,100 tons) over four consecutive weeks, increasing holdings by 45%. The company held 66.2 million pounds as of early this year. CEO John Ciampaglia noted, "The long-term contract market continued to grow, supported by future reactor demand and rising geopolitical tensions, despite spot market volatility." Some have criticized "speculative capital disrupting the nuclear fuel market."

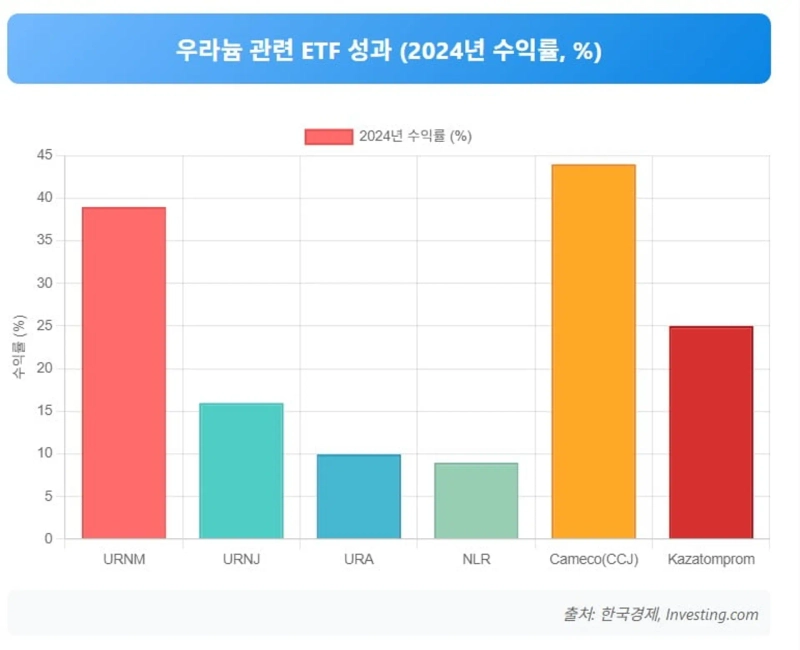

Some hedge funds have entered uranium futures and options markets to bet on higher prices, with investment banks such as Goldman Sachs launching OTC uranium options trading in 2023. Index (ETF) fund inflows have also been robust. The Uranium Miners ETF (URNM) and Global X Uranium ETF (URA), both established in 2019, saw assets soar. URNM reported hundreds of dollars in net monthly inflows in 2023–2024 as it broadened holdings, leading to talk of "Wall Street money flocking to uranium." As of this month, Kazatomprom—traded on the London Stock Exchange via GDRs—makes up more than 13% of the URNM portfolio as its second largest holding.

Uranium mining company stocks have also soared. Cameco (Canada) has seen its share price triple since 2021, with its market cap topping $15 billion on the NYSE at the end of 2023. As of the 26th, shares are up 43.7% this year. Kazatomprom (Kazakhstan), the world’s top producer, more than doubled its GDR price on the London exchange since its 2020 IPO. Australia’s Paladin Energy, once at risk of bankruptcy, revived by restarting its Namibian mine in 2023 after five years and plans to increase output to over 5 million pounds annually from this year. Paladin’s stock has risen more than 300% from five years ago.

The ‘Dilemma’ of Nuclear Powerhouse South Korea

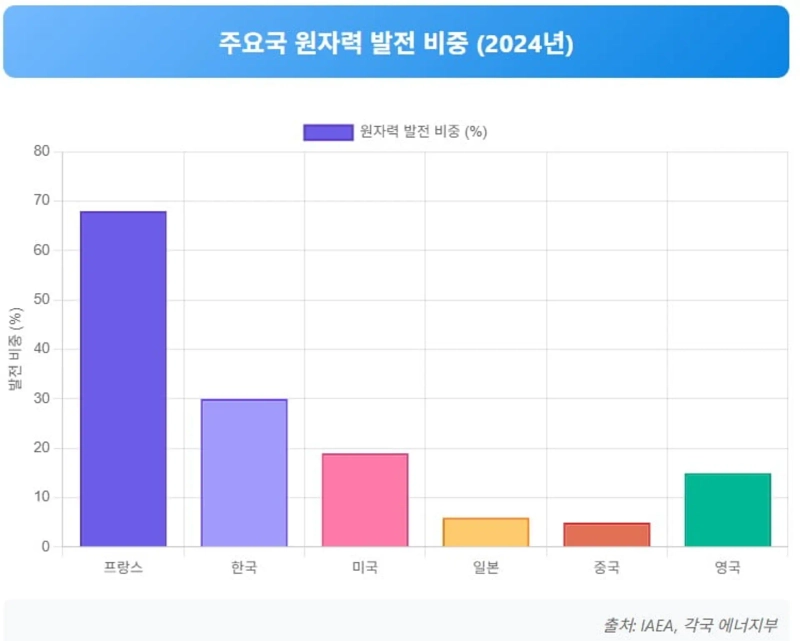

How does the situation look for South Korea? In 2024, about 31.7% of Korea’s electricity comes from nuclear—among the highest proportions globally. The Yoon Suk-yeol administration’s nuclear policy centers on continued use of existing reactors and adopting next-gen technologies like SMRs, with an emphasis on balancing renewable energy. Some call this a "pragmatic energy mix approach," aiming neither for a phaseout nor unchecked nuclear expansion, but rather pursuing extension of reactor lifespans, SMR development, and maintenance of the nuclear industry ecosystem.

Ensuring access to low-enriched uranium (HALEU) is a challenge in the SMR era. Unlike the US, Korea lacks facilities to enrich uranium above 20%—restricted by the US-Korea Nuclear Agreement. HALEU must be sourced overseas. Domestically, KEPCO Nuclear Fuel is developing re-enrichment (centrifuge technology) to upgrade 5% uranium fuel to HALEU levels, but commercialization will take time due to technical and economic hurdles. As Korea pursues SMR exports, concerns grow over heavy reliance on overseas fuel for these key components.

[Global Money X-File sheds light on important but little-known global money trends. Subscribe to the reporter’s page for your essential global economic news.]

Reporter: Juwan Kim kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.