Editor's PiCK

Altcoin Prices Surge on Increased Ethereum and XRP Trading Volumes: Korean Crypto Weekly [INFCL Research]

Summary

- Last week, Upbit and Bithumb saw significant increases in trading volume for key coins like ETH, XRP, and various altcoins, resulting in a strong market rally.

- In particular, Upbit showed continued gains in mid-cap altcoins led by QTUM, ONT, and NEO, while Bithumb exhibited extreme price swings and heightened speculative activity.

- In Korea, over 10,000 investors hold more than $7 million in cryptocurrency assets, highlighting concentrated large-scale capital as well as the ongoing impact of tax and regulatory discussions on the investment environment.

1. Market Overview

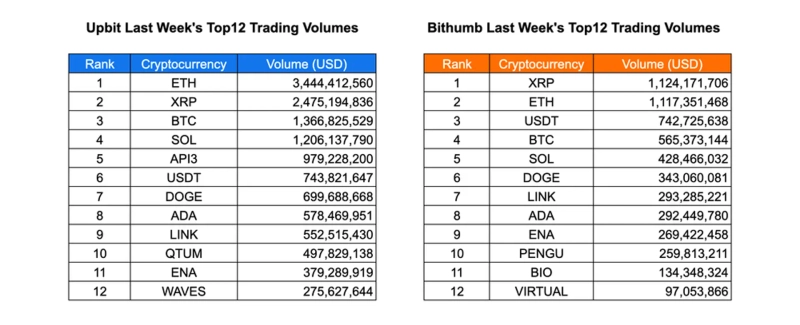

Last week, the listings of API3, Aerodrome Finance, and BIO Protocol on Korean exchanges led to rising interest in the mid-cap market. Trading activity was concentrated on key assets: at Upbit, ETH ($3.44 billion), XRP ($2.48 billion), and BTC ($1.37 billion) dominated, while Bithumb saw XRP ($1.12 billion), ETH ($1.12 billion), and USDT ($743 million) climb. Altcoins such as SOL, DOGE, ADA, and LINK also ranked among the top assets on both platforms, demonstrating consistent participation from individual investors beyond large-cap assets. Upbit maintained market dominance, peaking at $10.5 billion in trading volume on August 24, while Bithumb recorded $1.2 billion.

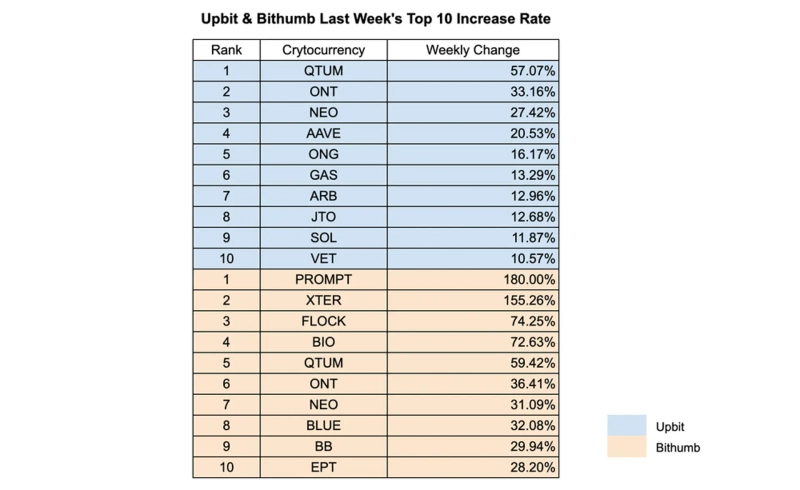

Mid-cap altcoins led the weekly gains, with QTUM (+57%), ONT (+33%), and NEO (+27%) revitalizing interest in established ecosystems on Upbit. Bithumb was dominated by speculative activity, with PROMPT (+180%) and XTER (+155%) soaring, and FLOCK, BIO, and QTUM also showing strength. The overlap in top performers such as QTUM, ONT, and NEO suggests simultaneous individual demand, while Bithumb's extreme moves highlight a high-risk trading environment.

2. Exchanges

2-1. Newly Listed Coins

Last week, several new coins were listed on major Korean exchanges.

Upbit listed API3 and Aerodrome Finance.

Bithumb listed BIO Protocol.

Key Marketing Strategies and Highlights

BIO Protocol (BIO)

BIO Protocol is a decentralized science (DeSci) platform built to fund, develop, and share biotechnology research using blockchain technology. Having established itself as the financial infrastructure layer for DeSci, BIO Protocol facilitates community-driven fundraising through a launchpad mechanism, enabling decentralized science projects to raise capital directly from participants. With backing from Binance Labs and notable figures like Arthur Hayes, who personally invested $1 million, BIO Protocol has quickly become one of the most talked-about projects in the DeSci space.

Following its exchange listing in Korea, community interest surged, with active discussions around its innovative launchpad mechanism. Similar to platforms like Virtual, users can accumulate XP through various participation activities and secure allocations for new projects by staking BIO tokens. Early adopters are already sharing participation-maximizing strategies, while KOLs have highlighted BIO's upside potential due to its similarities with previous successful cases. At the same time, Arthur Hayes’ large-scale purchases and Binance’s involvement have bolstered investor confidence, and the community now views BIO as a "smart money-approved" investment.

Despite limited marketing in the Korean market, BIO has gained attention organically, thanks to strong fundamentals, well-known backers, and the growing narrative of DeSci. Positioned at the intersection of biotech, IP commercialization, and on-chain financing, BIO continues to attract Korean traders and retail participants seeking high early-stage opportunities.

2-2. Trading Volume

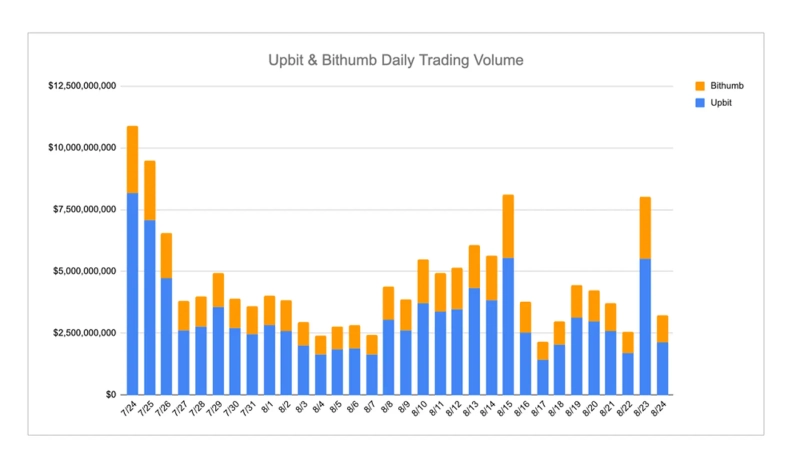

Last week, Upbit consistently maintained higher trading volumes than Bithumb on most trading days. Upbit's daily trading volume ranged from approximately $2.4 billion to $10.5 billion, setting new highs on July 24 and August 24. In contrast, Bithumb’s volume ranged from $400 million to $1.2 billion, significantly lower, underscoring Upbit’s market dominance during the period.

Looking at individual cryptocurrencies, Upbit’s volume leader was ETH at $3.44 billion, followed by XRP at $2.48 billion and BTC at $1.37 billion. Bithumb’s volume leader was XRP at $1.12 billion, with ETH ($1.12 billion) and USDT ($743 million) closely behind. Notably, altcoins like SOL, DOGE, ADA, and LINK were also actively traded on both exchanges, demonstrating broad engagement beyond the major cryptocurrencies.

Trendwise, both exchanges saw declining volume from late July to early August, but a gradual recovery mid-month. Upbit recorded a sharp rebound, reaching nearly $10 billion on August 24, while Bithumb’s trading volume rose more gently to a peak of $1.2 billion on the same day. The persistent gap between the two exchanges highlights Upbit’s strong liquidity and high trading participation during the analysis period.

2-3. Top 10 Gainers

Last week at Upbit, QTUM surged 57.07% to lead gains, with ONT up 33.16% and NEO up 27.42%. Other mid-cap altcoins such as AAVE, ONG, and GAS also saw significant recoveries. Most of the top gainers on Upbit were established altcoins, indicating strong investment focus on proven assets with liquidity and market leadership.

Bithumb, in contrast, saw even more dramatic volatility: PROMPT soared 180%, XTER 155.26%. FLOCK, BIO, and QTUM also surged between 59.42% and 74.25%. Compared to Upbit, Bithumb's top gainers showed higher volatility, with smaller and newer projects reflecting speculative activity on the platform.

The overlap of names like QTUM, ONT, and NEO between the exchanges highlights sustained interest in certain mid- and low-priced altcoins across platforms, while Bithumb’s exceptional outliers signal a distinct speculative trading environment. Overall, both exchanges displayed strong altcoin momentum, but Bithumb’s top gainers were notably more volatile than Upbit’s, with quicker price movements.

3. Korean Community

3-1. Upbit Expands Community Outreach and Announces Major Adoption Initiatives

This week, Upbit drew attention by launching its official Telegram channel, establishing a direct communication route with users alongside Bithumb. To mark the launch, Upbit held a subscriber giveaway event offering Galaxy smartphones and Bitcoin (BTC) rewards, with the group’s membership quickly surpassing 15,000.

Upbit also released a new brand campaign video, signaling the arrival of the “Age of Digital Asset Popularization.” The video was met with positive reactions across the Korean crypto community, with many users expressing ongoing interest in digital assets ahead of broader adoption.

3-2. Dunamu Attracts Investor Attention Amid Soaring Corporate Valuation

Upbit’s operator, Dunamu, has received attention after reports noted its stock price tripling over the past year, boasting a corporate valuation of approximately $7 billion. Community discussions have compared Dunamu's market cap to Circle’s $42 billion, evaluating Dunamu as an undervalued growth opportunity in the global fintech and Web3 ecosystem.

Some investors speculate that Dunamu could evolve into a mainstream “bank-like” stock, allowing Upbit to maintain dominance in the Korean exchange market and potentially serving as a stable long-term holding.

3-3. Over 10,000 Korean Investors Hold More Than $7 Million in Cryptocurrency

According to recent Financial Supervisory Service data, as of August 5, more than 10,800 domestic investors individually hold over ₩1 billion (about $7 million) in crypto assets. The group’s average holding is approximately ₩2.2 billion (about $16 million).

Demographically, investors in their 50s (3,994) make up the largest segment, followed by those in their 40s, 60s, and 30s. The report sparked renewed debate in the crypto community over tax policy, with new regulations set for 2027 creating continued uncertainty.

All information provided is for informational purposes only and does not constitute the basis for investment decisions or serve as recommendations or advice. The information herein assumes no responsibility in respect to investment, legal, or tax matters.

INF Crypto Lab (INFCL) is a consulting firm specializing in blockchain and Web3, providing one-stop solutions for Web3 entry strategies, tokenomics design, global market expansion, and related services. It supports both domestic and global securities, gaming, and platform companies, as well as major global Web3 businesses in formulating and executing strategies, leveraging accumulated expertise and references to foster sustainable digital asset ecosystem growth.

This report is unrelated to the editorial stance of the media outlet; all responsibility rests with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)