Editor's PiCK

'Ethereum Eyes 5000 dollars'… Opportunities for Latecomer Altcoins? [Kang Min-seung's Altcoin Now]

Summary

- Institutional money and whale accumulation into Ethereum have increased, with assessments that Ethereum is regaining market leadership.

- Analysts note short-term volatility and correction risk for Ethereum, while diagnosing potential to reach 5000 dollars and further upside.

- Signals for an overall altcoin season are lacking, but investor interest in major altcoins of the Ethereum ecosystem and related tokens is rising.

After U.S. Federal Reserve Chair Jerome Powell's Jackson Hole remarks, a revived preference for risk assets helped Ethereum (ETH) rebound, but after hitting a record high it entered a breather as profit-taking emerged. Market attention is focused on large market-cap 'blue-chip' altcoins as well as Ethereum ecosystem tokens.

Ethereum, the flagship altcoin, was trading at 4558 dollars (based on Upbit, 6.35 million won) as of 14:56 on the 28th on the Binance Tether (USDT) market, down 1.08% from the previous day. The ETH/BTC ratio rose to 0.04057, reflecting an independent uptrend.

Although Bitcoin (BTC) has recently rebounded slightly, the overall weak trend continues, constraining most altcoins' attempts to rise. The market's overall upside capacity appears somewhat limited.

On that day, Bitcoin dominance (BTC Dominance, the share of Bitcoin in the total crypto market cap) rebounded slightly to 58.22% since the 25th. The rise in dominance as Bitcoin's price increases indicates more capital flowed into Bitcoin than into most altcoins.

"Ethereum, Institutional Money and Whale Accumulation… Potential for Further Rally"

Recent market flows show capital moving quickly from Bitcoin to Ethereum. On the 28th, crypto media CryptoRank reported, "Some big whales are changing strategy, selling Bitcoin and quietly buying hundreds of millions of dollars worth of Ethereum." In fact, crypto asset manager CoinShares emphasized Ethereum's strength in a research report, noting, "Ethereum-based investment products saw net monthly inflows of 2.5 billion dollars, while Bitcoin products saw net outflows of 1 billion dollars."

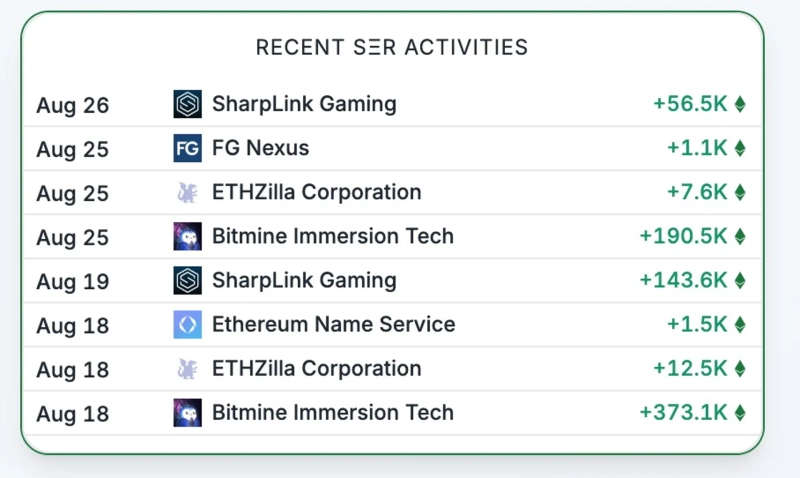

Crypto data firm Kaiko said in a report on the 25th, "Ethereum surpassed its previous 2021 all-time high driven by spot demand," and analyzed that "despite short-term adjustments, liquidity and volume for Ethereum remain robust." Indeed, Nasdaq-listed companies such as Sharplink Gaming have supported the rally by making additional Ethereum purchases through 'Digital Asset Treasury' (DAT) strategies.

Whales continue to accumulate Ethereum. On the 25th, on-chain analytics firm Santiment analyzed, "The number of whale (large holder) wallets for Ethereum has steadily increased in August, laying the groundwork for (further) market rebounds." This month, wallets holding 10000 ETH or more increased by 48 to 1275.

However, there are concerns that liquidity previously locked in Ethereum staking is gradually being released, which could increase short-term volatility. Crypto analyst Willy Woo recently appeared on the Swissblock podcast and warned, "While the Ethereum-led rally is ongoing, staking-unlock volumes may be gradually released into the market and act as selling pressure," adding, "Short-term volatility could increase as investors cash out."

"Ethereum Faces Resistance at 4630 dollars… Volatility Alert for September"

Analysts leave open the possibility of short-term corrections for Ethereum while expecting the upward trend to continue in the medium to long term.

Aayushi Jindal, a researcher at NewsBTC, analyzed, "If Ethereum breaks resistance at 4630 dollars and 4720 dollars in the short term, it could attempt to rise to 4840 dollars, and further to 4950–5000 dollars." She also noted, "If it fails to break 4630 dollars, it could retest support levels at 4450 dollars and 4320 dollars."

Rakesh Upadhyay of Cointelegraph said, "If Ethereum rebounds around 4349 dollars, it could retest 5000 dollars and possibly rise to 5500 dollars," but cautioned, "If it fails to break through, it risks falling to the 4060-dollar support." Crypto analysis platform Matrixport similarly judged that "Ethereum's price is likely to oscillate within the 4355–4958 dollar range."

Crypto analyst Benjamin Cowen said on his YouTube channel, "Ethereum is likely to undergo a correction in September," citing precedent that in September following U.S. presidential elections in 2017 and 2021, Ethereum fell 48% and 34% respectively. He projected, "Since Ethereum has broken highs in August, if it digests a seasonal correction in September, it could see an explosive rebound in October."

He added, "If Ethereum overheats in the short term and reaches 6000 dollars straightaway, that could be the end of it; subsequent upside could be limited." Having previously correctly identified this year's Ethereum bottom near 1600 dollars, his outlook draws market attention.

"Clear 'Altcoin Season' Signals Still Lacking"

Some weigh the possibility of further gains for blue-chip altcoins including Ethereum ecosystem tokens, but many say signals are still insufficient to confirm a distinct 'altcoin season.'

Alex Kuptchikevich, an FXPro market analyst, analyzed, "Each time Bitcoin dipped below the 110,000-dollar level recently, buying flowed in and led rebounds, which can be interpreted as a sign that investors still view corrections as buying opportunities." He added, "In this flow, major altcoins like Ethereum, XRP, Solana, and Dogecoin are showing relative strength."

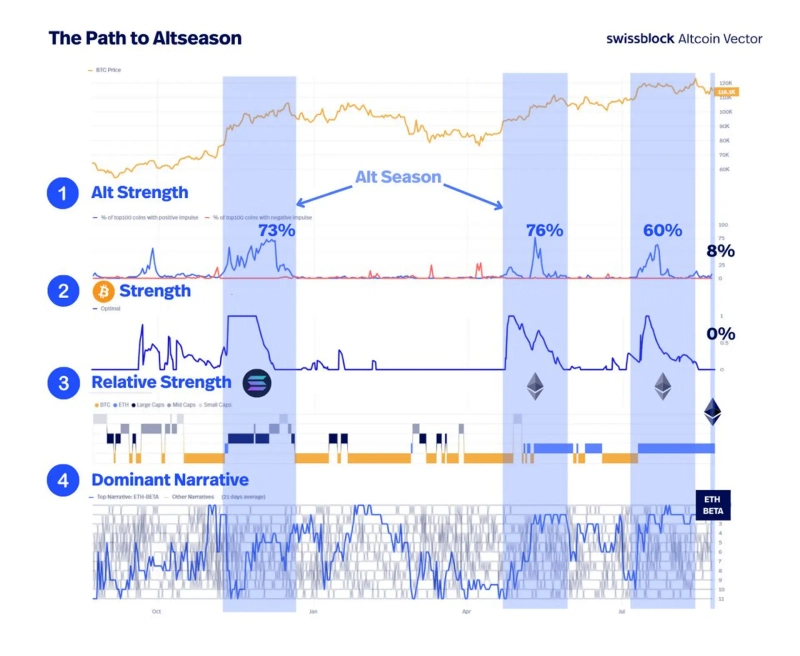

Some analyses suggest the market will flow around Ethereum for a while. Research firm Swissblock diagnosed on a podcast, "Ethereum is regaining market leadership for the first time since 2021. The market's center of gravity is shifting to Ethereum," adding, "The previous flow of 'Bitcoin → altcoins → stablecoins' is now concentrating on Ethereum." Cowen previously emphasized, "This is not an altcoin season but an Ethereum season."

Expectations for tokens in the Ethereum ecosystem are also spreading. Crypto strategist Michael van de Poppe recently said on his YouTube channel, "During this (September) correction, attention should be paid to Ethereum ecosystem altcoins," naming Optimism (OP), Arbitrum (ARB), Ethena (ENA), Giza (GIZA), Rocket Pool (RPL) as related tokens that could surge.

However, an overall 'altcoin season' remains hard to expect. Altcoin Vector X wrote via X (formerly Twitter), "Recent Bitcoin strength is not clear, and altcoin momentum is only 8%," and evaluated that "while the overall framework for an altcoin season is forming, there are still insufficient signals to confirm a bull market." It added, "Despite Bitcoin weakness and uncertainty, altcoins have already undergone corrections and entered an 'Accumulation Zone,' which could be an opportunity to prepare for further gains."

Meanwhile, expectations remain for capital rotation within the year. Crypto trading firm and market maker QCP Capital said, "Bitcoin dominance recently fell from 60% to 57%," and added, "Although this is still high compared to sub-50% levels during the 2021 bull market, expectations for an altcoin rotation persist amid forecasts that an Ethereum staking ETF could be approved this year."

Kang Min-seung, Bloomingbit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)