[Analysis] "Ethereum futures open interest decline·funding rate negative…signs of retail investor exit"

Summary

- In the Ethereum futures market, open interest decline and funding rate turning negative have appeared, signaling retail investor exit.

- The analyst stated that recently leveraged volume decrease and liquidations of existing longs have been prominent, forming a short-term structural bearish trend.

- However, the analyst also noted that the reduction in open interest could instead be a precursor to spot buying inflows and a price rebound.

Ethereum (ETH) futures market open interest has decreased and funding rates have turned negative, signaling a possible exodus of retail investors, according to analysis. As leveraged positions decline, a short-term structural bearish trend is being observed.

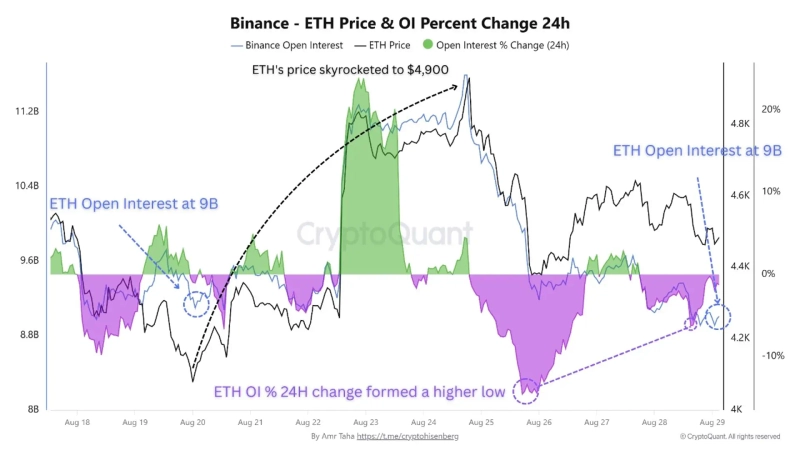

On the 29th (local time), Amr Taha, an analyst at crypto asset (cryptocurrency) analysis platform CryptoQuant, said in a QuickTake report, "Open interest in Binance's Ethereum derivatives market has shrunk to about $9 billion," adding, "This is the first time this level has been seen since mid this month." He interpreted, "Liquidations of existing longs have been more prominent than new long entries recently."

Also, across major exchanges, ETH funding rates have turned negative. Generally, a negative funding rate means short positions are dominant. Taha analyzed, "The simultaneous occurrence of open interest reduction and negative funding rates is a structural bearish signal," and "It particularly suggests that retail investors are retreating from the futures market."

However, based on past cases, a reduction in open interest could instead be a precursor to a short-term rebound. He added, "Weakness in the derivatives market can provide an environment for Ethereum price recovery and can form conditions favorable for a bullish reversal." Previously, when ETH open interest fell to about $9 billion, spot buying soon flowed in and ETH prices rose to the $4,900 level.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)