Summary

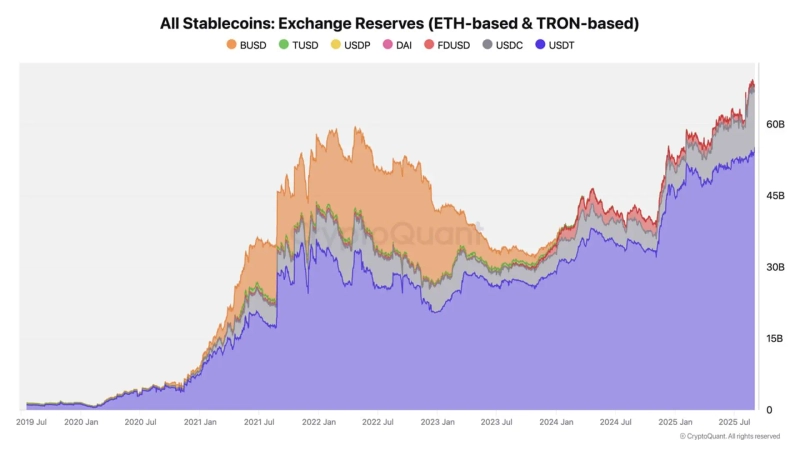

- According to CryptoQuant, centralized exchanges' stablecoin liquidity surpassed 68 billion dollars, recording a record high.

- As of the end of August, Binance's stablecoin holdings were 44.2 billion dollars, accounting for 67% of the total and showing a dominant share.

- Over the past month, liquidity growth was led by Binance and OKX, with holdings increasing by 2.2 billion dollars and 800 million dollars, respectively.

According to on-chain data analytics platform CryptoQuant, on the 4th (local time) the balance of stablecoins deposited on centralized exchanges (CEX) surpassed 68 billion dollars, recording a record high.

In particular, Binance showed a dominant share. As of the end of August, Binance's stablecoin holdings were 44.2 billion dollars, accounting for 67% of total Tether (USDT)·USD Coin (USDC) holdings. Most of the held assets are USDT, but the proportion of USDC has been expanding recently. Currently, Binance holds USDT 37.1 billion dollars and USDC 7.1 billion dollars.

Other major exchanges showed little change. OKX recorded about 9 billion dollars, while Bybit and Coinbase maintained levels of 4.2 billion dollars and 2.6 billion dollars, respectively. Market shares appeared as OKX 14%, Bybit 6%, Coinbase 4%.

Over the past month, the liquidity growth was led by Binance and OKX. During the same period Binance's holdings increased by 2.2 billion dollars, and OKX increased by 800 million dollars, driving the expansion of total stablecoin balances.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)