Summary

- "Bitcoin"'s long-term holder (LTH) risk indicator is falling, while prices continue to rise, according to a CryptoQuant analyst.

- Short-term holder (STH) Bitcoin bought at peaks are over time incorporated into the long-term holder group, improving the market structure.

- He emphasized that inflows of new funds absorb existing LTH sell volumes, so even at new all-time highs risk increases only to a limited extent.

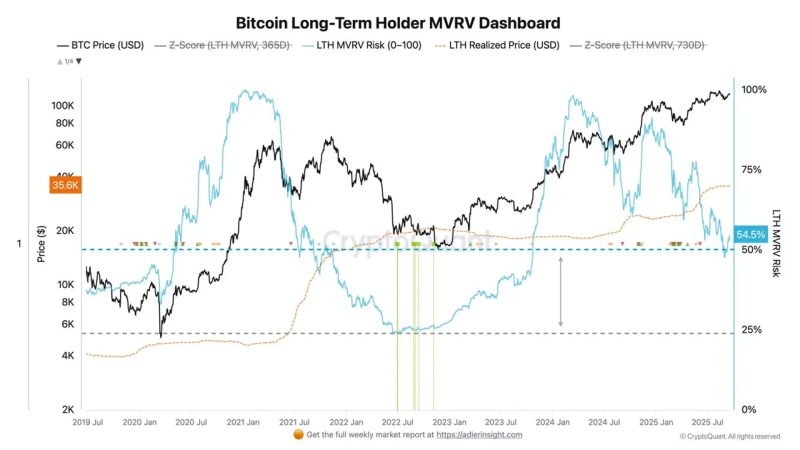

An analysis showed that Bitcoin (BTC) long-term holder (LTH) risk indicator has fallen while the price has, rather, continued its upward trend. It is assessed that short-term holders' (STH) Bitcoin bought at peaks are being classified into the long-term holder group over time, improving the market structure.

On the 18th (local time), Axel Adler Jr., an analyst at on-chain data firm CryptoQuant, stated, "Despite the recent rise in Bitcoin's price, long-term risk is decreasing," adding, "This is because the long-term holders' realized price (LTH Realized Price) is rising rapidly." He explained, "Coins purchased at high prices are reflected in the LTH indicator, and as a result the profit multiple (MVRV) does not rise, which mitigates risk."

According to Adler, since March the LTH risk has shown a steady decline. This phenomenon occurred because the LTH realized price has risen more steeply than the spot price, which is interpreted as forming a 'healthy upward structure' from the long-term holders' perspective.

Axel analyzed, "Coins bought at high prices are held for six months or more and move into the long-term holder group, and their high purchase prices are pulling up the LTH realized price," adding, "In this process, even without price adjustment, the risk indicator stabilizes."

He emphasized, "While some Bitcoin bought at low prices in the past are being released into the market, newly purchased Bitcoin at higher prices are being incorporated into the LTH group," adding, "This kind of circulation keeps long-term risk low while allowing price increases." He added, "Inflows of new funds absorb existing LTH sell volumes, extending the cycle, and even at new all-time highs risk increases only to a limited extent."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)