Editor's PiCK

"Virtual asset services, the key to attracting institutions is trust·security·regulatory alignment…Focus on AI·on-chain combination opportunities" [Eastpoint: Seoul 2025]

Summary

- Panelists said that 'trust, security, and regulatory alignment' are important for attracting institutional investors.

- Founder Kannan and co-founder Rose said AI, on-chain, privacy, and legal certainty are essential for future expansion and risk management.

- They said that for Korean institutional investors, practical use cases like stablecoins and a balance between regulation and innovation are important.

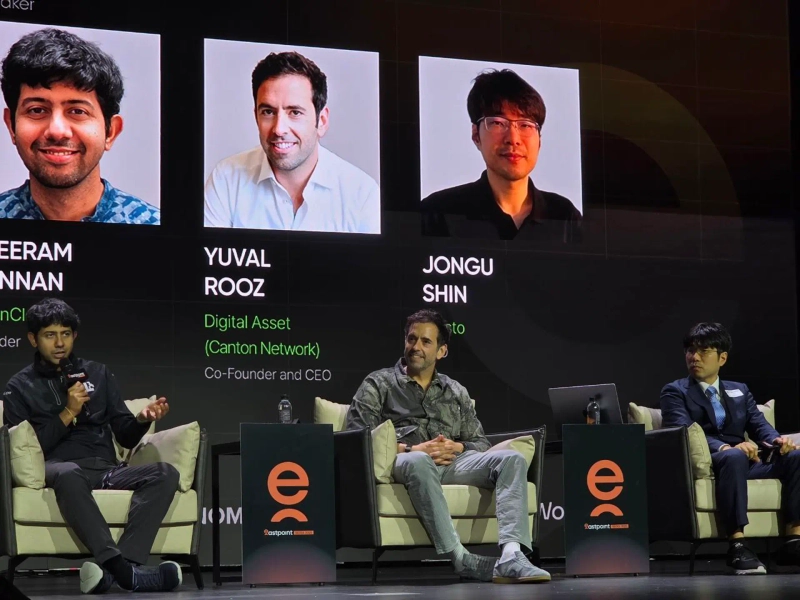

On the 22nd at the Grand Hyatt Seoul in Yongsan-gu, Seoul, the global Web3 private conference 'Eastpoint 2025' held a panel discussion on "Institutionalization and Operation of a KRW-based Stablecoin for the Korean Financial System." The panel, moderated by Kim Seong-ho, co-founder and partner of Hashed, featured Sriram Kannan, founder of EigenCloud; Yuval Rose, co-founder and CEO of Digital Asset (Canton Network); and Shin Jong-woo, CEO of Presto, who shared insights on the institutional market.

The key to attracting institutional investors is 'trust, security, and regulatory alignment'

Panelists agreed that, above all, a "trust layer" is necessary for institutions to enter virtual asset (cryptocurrency) services.

Kannan said, "The value of blockchain comes from two pillars of trust: 'immutability' and 'verifiability,'" adding, "Bitcoin is an immutable and verifiable asset; Ethereum is an immutable and verifiable computer. Smart contracts run on top of it, implementing decentralized trust."

He specifically pointed out, "The biggest issue is the security module," and said, "For large-scale institutional deployments, pre-security checks such as AI-based detection before going on-chain are necessary, and privacy systems for programmable chains must also be further advanced."

Co-founder Rose emphasized, "Technology alone is not enough. Hacking and legal risks still exist," adding, "To attract institutional participation, legal certainty and privacy requirements must be met." He added, "For example, understand the norms required by infrastructures like DTCC, the world's largest securities clearing and settlement organization, and address customer concerns in their language."

CEO Shin said, "Attracting institutions is not achieved by technology alone. Performance and regulatory compliance must be guaranteed," adding, "You must present performance metrics and risk management frameworks that institutional investors can trust." He also advised, "Ultimately, what's important is delivering performance by providing stable liquidity," and said, "Market maturity, regulatory compliance, and technological advancement must be pursued together."

Advice for Korean institutional investors... "Expand AI·on-chain opportunities; regulation needs balance"

Panelists advised Korean institutional investors that they need practical use cases such as stablecoins along with a balanced regulatory environment.

Kannan predicted, "The intersection of AI and blockchain will open new opportunities," and said, "If verifiable AI agents run on-chain, broader applications beyond stablecoins and the on-chainization of institutional assets will become possible."

Co-founder Rose said, "The case of the Japanese yen stablecoin failing to proliferate shows that mere investment hype is insufficient to drive usage," and said, "Korea should focus on creating actual use cases by leveraging U.S. technology and momentum."

CEO Shin stressed, "It is important for Korea to strike a balance between regulation and innovation," adding, "Asian countries have stricter monetary policies than the West, but cryptocurrencies can sometimes be too permissive. Avoiding extremes and finding balance is necessary for national development."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)