Summary

- Reported that a total net inflow of $302.77 million occurred in the US Ethereum (ETH) spot exchange-traded fund (ETF) market.

- BlackRock's ETHA recorded $172.77 million, more than half of the total inflows.

- It reported that major Ethereum ETF products such as Fidelity and Bitwise also recorded net inflows of tens of millions of dollars each.

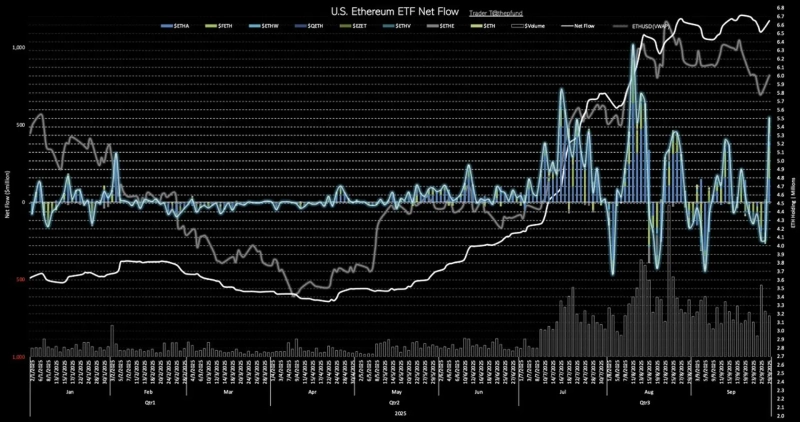

A total net inflow of $302.77 million occurred in the US Ethereum (ETH) spot exchange-traded fund (ETF) market.

According to TraderT data on the 2nd (local time), BlackRock's ETHA attracted $172.77 million, accounting for more than half of the total inflows. Fidelity's FETH recorded a net inflow of $60.7 million, and Bitwise's ETHW recorded a net inflow of $46.5 million.

In addition, 21Shares' TETH had $2.7 million, VanEck's ETHV $3.3 million, Grayscale's ETHE $4.1 million, and the Mini Trust recorded $12.7 million in net inflows. There was no change for Invesco and Franklin's Ethereum ETFs.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)