WaveBridge "Korea emerging as Asia's strategic hub for digital assets"

Summary

- WaveBridge said the introduction of spot Bitcoin ETFs and Korean won stablecoins could provide Korea an opportunity to expand into regulated financial infrastructure.

- It said the domestic scale of digital asset investors, trading volume, and ETF management experience are important foundations for future market growth.

- It said the Bank of Korea's CBDC pursuit, coordination with privately led stablecoins, and system risk management remain challenges to be addressed.

Corporate- and institution-focused digital asset financial infrastructure firm 'WaveBridge' suggested in a report released on the 3rd that Korea could, with spot Bitcoin ETFs and Korean won stablecoins as catalysts, expand beyond a retail powerhouse into regulated financial infrastructure.

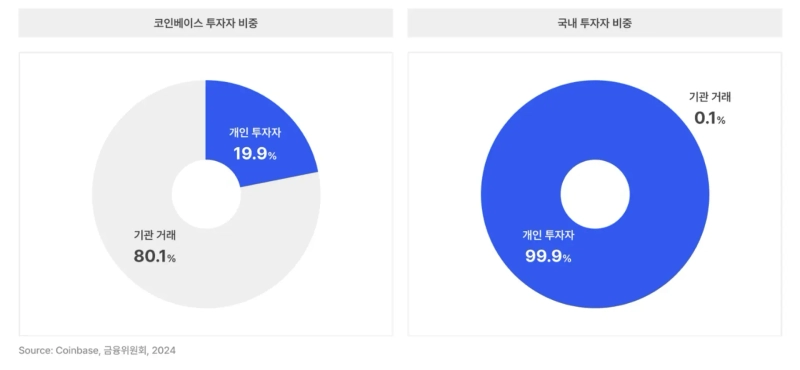

According to the report, since the implementation of the Specific Financial Information Act in 2021, Korea has established a real-name deposit and withdrawal account system and has been regarded as a global best practice in anti-money laundering and investor protection. Currently, domestic digital asset investors number about 9.7 million (32% of the population), more than four times the global average (6.8%).

WaveBridge viewed spot Bitcoin ETFs as a key gateway to entering the regulated sector. Domestic digital asset trading volume reaches 1,345 trillion won annually, and ETF managers have accumulated experience in a market worth 170 trillion won. WaveBridge estimated that by 2030 the domestic spot Bitcoin ETF market could reach up to 63 trillion won.

In addition, Korean won stablecoins were cited as a key pillar that could lead innovation in payments and remittance infrastructure. The report analyzed that rapid adoption is possible if the large domestic quick-payment ecosystem combines with an investor base founded on real-name accounts. However, the Bank of Korea's approach to pursuing a central bank digital currency (CBDC), coordination with privately led stablecoins, and the establishment of system risk management frameworks were cited as challenges to be addressed.

WaveBridge said, "Korea already has a world-class retail base," and "If the institutionalization of Bitcoin ETFs and stablecoins becomes full-fledged, it will establish itself as a strategic hub in Asia."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)