Summary

- The U.S. spot Bitcoin ETFs reportedly recorded net inflows for 9 consecutive trading days.

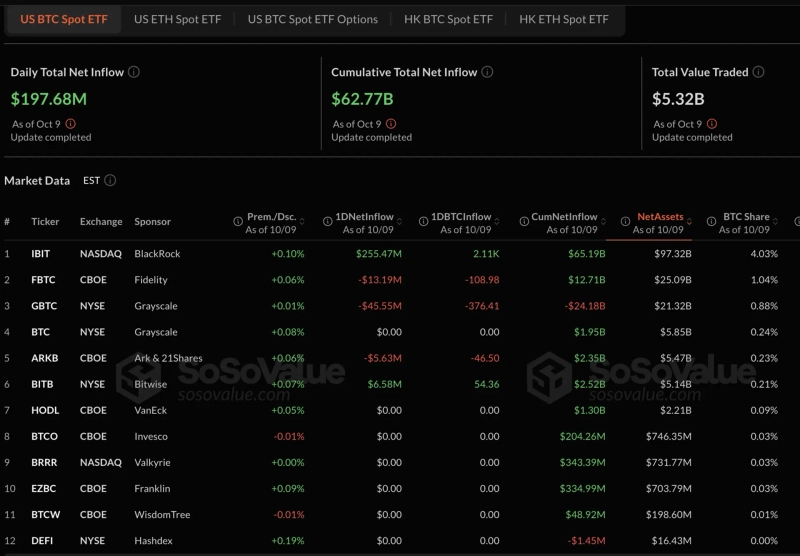

- BlackRock's 'IBIT' led the inflows with $255 million in net inflows, and its cumulative net inflows total $65.19 billion.

- The total net asset value of spot Bitcoin ETFs is $164.79 billion, and the net asset ratio relative to the total market capitalization is 6.83%.

U.S. spot Bitcoin (BTC) exchange-traded funds (ETFs) recorded net inflows for 9 consecutive trading days.

On the 9th (local time), according to data from SosoValue, the total net inflows into spot Bitcoin ETFs traded in the U.S. amounted to $198 million as of that date.

By single product, BlackRock's 'IBIT' led the inflows, attracting $255 million. IBIT's cumulative net inflows currently total $65.19 billion. Following that, Bitwise's 'BITB' recorded net inflows of $6.58 million. BITB's cumulative net inflows amounted to $2.52 billion.

The total net asset value of spot Bitcoin ETFs is $164.79 billion, and the net asset ratio relative to Bitcoin's total market capitalization stands at 6.83%. The historical cumulative net inflows are $62.77 billion.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)