Editor's PiCK

US Bitcoin spot ETF sees net outflows for two consecutive trading days

Summary

- Net outflows continued for two consecutive trading days in the US Bitcoin (BTC) spot ETF market.

- Ark Invest's ARKB recorded the largest outflow at $275.15 million, and major ETFs such as Fidelity's FBTC, Grayscale's GBTC, and BlackRock's IBIT all showed net outflows.

- That day, Bitcoin was trading in the $109,000 range on the Binance Tether (USDT) market, down 2.2% from the previous day.

Net outflows continued for two consecutive trading days in the US Bitcoin (BTC) spot exchange-traded fund (ETF) market.

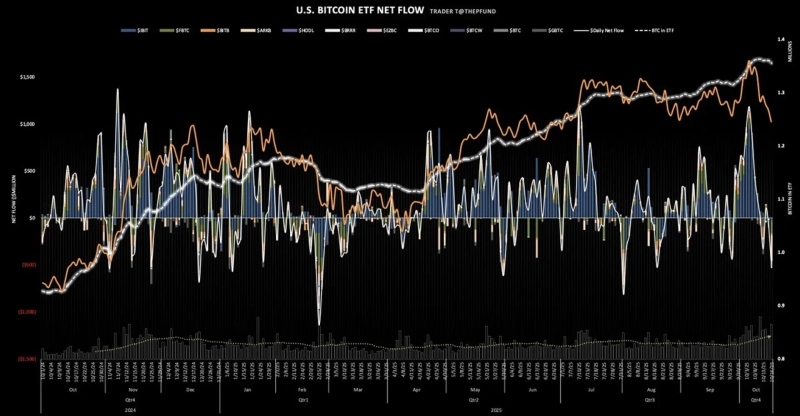

According to data from TraderT, on the 16th (local time) total net outflows from Bitcoin spot ETFs amounted to $530.71 million.

By ETF, Ark Invest's ARKB recorded the largest outflow at $275.15 million. Next, Fidelity's FBTC $132 million, Grayscale's GBTC $44.97 million, and BlackRock's IBIT $29.37 million recorded net outflows.

Bitwise's BITB recorded $20.58 million, Grayscale mini Bitcoin ETF (BTC) $22.52 million, and VanEck's HODL $6.12 million in net outflows, respectively.

Meanwhile, Invesco's BTCO, Franklin Templeton's EZBC, Valkyrie's BRRR, and WisdomTree's BTCW saw no change.

That day, Bitcoin was trading on the Binance Tether (USDT) market in the $109,000 range, down 2.2% from the previous day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)