Editor's PiCK

U.S. Spot Ethereum ETFs See Net Outflows for Two Consecutive Trading Days

Doohyun Hwang

Summary

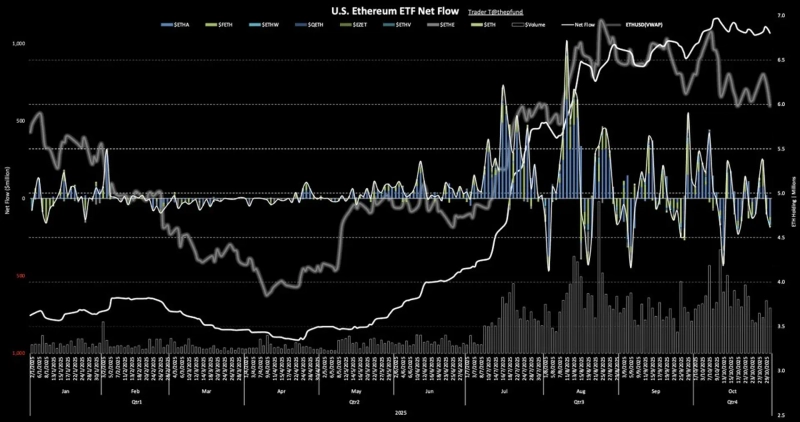

- Reported that the U.S. spot Ethereum (ETH) ETF market experienced net outflows for two consecutive trading days.

- Said that BlackRock's ETHA experienced the largest outflow of $120,250,000 in one day.

- Stated that due to major institutional selling, Ethereum's price fell to $3,800.

Net outflows occurred in the U.S. spot Ethereum (ETH) exchange-traded fund (ETF) market for two consecutive trading days. As major institutions continued selling, Ethereum's price also entered a downtrend.

According to TraderT's data on the 30th (local time), U.S.-traded spot Ethereum ETFs saw a total net outflow of $186,560,000 in a single day.

The largest outflow came from BlackRock's ETHA, which lost $120,250,000 in one day. It was followed by Bitwise's ETHW with $31,140,000 and Fidelity's FETH with $18,530,000 in net outflows, respectively.

Under this institutional selling pressure, Ethereum turned lower, falling intraday to $3,800 on the Binance Tether (USDT) market.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)