Editor's PiCK

U.S. Bitcoin and Ethereum ETFs See Net Outflows Side by Side…$230 Million Withdrawn

공유하기

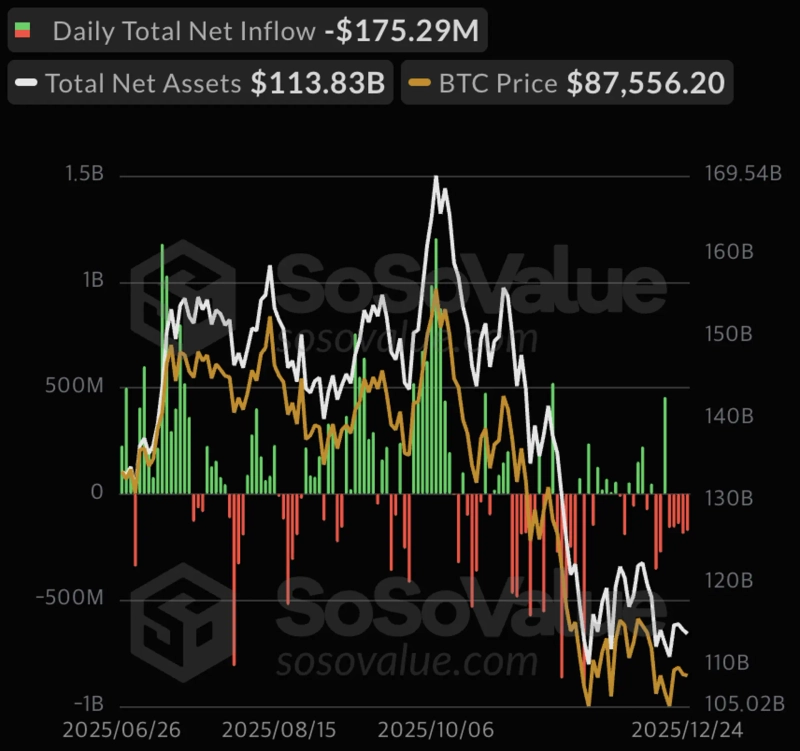

- U.S. spot Bitcoin ETFs have experienced five consecutive trading days of net outflows, with cumulative outflows this month reaching $843 million.

- U.S. spot Ethereum ETFs also saw two consecutive trading days of net outflows, with cumulative outflows this month totaling $564 million.

- Large sums have exited major ETF products such as BlackRock and Grayscale, and Bitcoin and Ethereum were trading in the $87,000 and $2,900 ranges, respectively.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

U.S. spot Bitcoin and Ethereum exchange-traded funds (ETFs) both recorded net outflows.

According to SosoValue on the 25th (local time), U.S. spot Bitcoin ETFs saw net outflows of $175.3 million (about 250 billion won) on the previous day (24th). This marks five consecutive trading days of net outflows. So far this month, spot Bitcoin ETFs have seen $843 million (about 1.22 trillion won) in outflows.

Specifically, BlackRock's IBIT alone saw net outflows of $91.4 million on the previous day (24th). Fidelity's FBTC (-$17.2 million), Bitwise's BITB (-$13.3 million), and ARK Invest's ARKB (-$9.9 million) followed. No ETFs recorded net inflows that day.

The situation for U.S. spot Ethereum ETFs is similar. Spot Ethereum ETFs recorded net outflows of $52.7 million (about 76 billion won) on the previous day (24th), marking two consecutive trading days of net outflows. The cumulative net outflow for spot Ethereum ETFs this month is $564 million (about 820 billion won).

Grayscale's ETHE led the outflows that day with $33.8 million withdrawn. BlackRock's ETHA also saw net outflows of $22.3 million.

Meanwhile, Bitcoin and Ethereum were trading on CoinMarketCap in the $87,000 range and the $2,900 range, respectively.