Editor's PiCK

Bitcoin consolidates ahead of large options expiry... Ethereum and XRP also take a breather [Lee Su-hyun's Coin Radar]

공유하기

- Bitcoin showed a range-bound market influenced by a large options expiry and supply-demand imbalances, with short-term fluctuations of around 5~7%% expected to repeat.

- Ethereum's price is heavily affected by external capital inflows such as ETFs; mixed signals include large sell-offs by certain firms and additional purchases by institutions.

- XRP's investor sentiment has weakened due to the breach of key support and whale sell concerns, but spot ETF net inflows and declining exchange balances leave room for a rebound.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

<Lee Su-hyun's Coin Radar> is a column that reviews the week's movements in the virtual asset (cryptocurrency) market and explains the background. It goes beyond simple price listings to analyze global economic issues and investor behavior in a multidimensional way, providing insights that can gauge the market's direction.

Key coins

1. Bitcoin (BTC)

Bitcoin traded around the $87,000 level throughout the week in a typical range-bound market. This is interpreted as the result of global supply-demand imbalances combined with a large options expiry event.

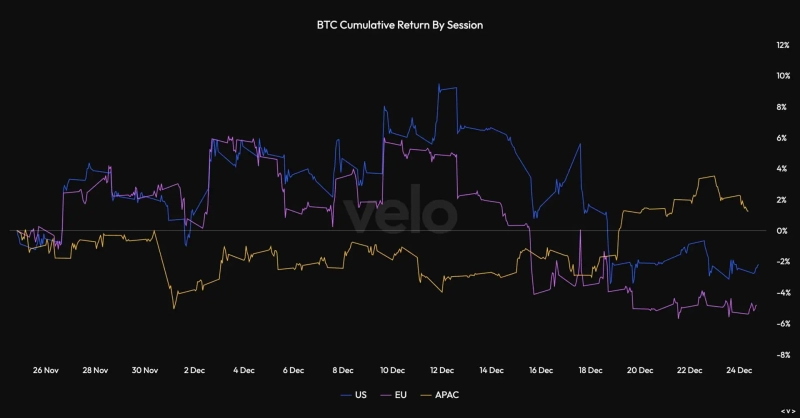

Market participants point to a clash between Asian and Western demand-supply as a primary cause. According to an AMB Crypto analysis, during recent Asia-Pacific (APAC) trading hours, buy-the-dip flows entered and defended against declines, while U.S. and European hours were dominated by selling pressure. Amid macroeconomic uncertainty, Western investors have focused on risk management, resulting in a tug-of-war between 'Eastern buying' and 'Western selling.'

The large options expiry that arrived today also appears to have limited volatility. With roughly 300,000 BTC of options expiring on Deribit, the market price was reportedly suppressed below the 'Max Pain' point of $95,000. It is believed that option sellers poured out hedge sell orders to maximize profits, limiting upward momentum.

However, immediately after the expiry on the morning of the 26th, Bitcoin briefly recovered to the $89,000 level. QCP Capital said, "After expiries, hedge positions tend to unwind, leading to short-term rebounds," and forecasted, "Until the end of the year, fluctuations of around 5~7% will repeat driven by supply-demand factors rather than fundamentals."

Outlooks diverge. Pessimists such as Peter Brandt warned of further adjustments to $58,000. Mike McGlone, Bloomberg Intelligence's senior strategist, said that, in the extreme, "we must leave open the possibility of $10,000." However, optimists like Citigroup and Cathie Wood still expect a bull market, citing accelerating institutional inflows.

2. Ethereum (ETH)

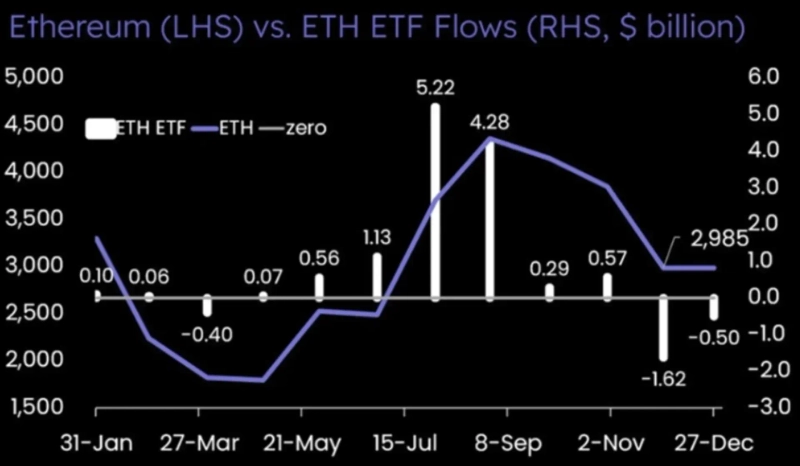

Ethereum is barely holding the $2,900 level and continues to show a sluggish trend. Whether external capital flows in has become a key variable determining price rather than ecosystem growth itself.

Matrixport diagnosed, "Recently, Ethereum's price has been more sensitive to capital flows such as ETFs than to narratives." In fact, the U.S. spot Ethereum ETF has recorded net outflows for seven consecutive trading days, and worsening supply-demand has blocked price appreciation.

Institutional investor behavior is sharply divided. Some firms have sold large amounts of Ethereum citing financial burdens. Etherzilla sold about $74,500,000 worth of Ethereum on the 23rd to repay debt. Following a $40,000,000 sell-off in October, it has been selling Ethereum consecutively, prompting market speculation that Etherzilla might be abandoning its Digital Asset Treasury (DAT) strategy.

On the other hand, there are active buyers. According to Cointelegraph, Trend Research recently added about 46,000 Ethereum in a single day. Total holdings amount to about 580,000. LD Capital founder Jack Yi said, "We are preparing an additional $1 billion in funds to buy more Ethereum." If this plan is executed, Trend Research would overtake Shaplink to become the second-largest institutional holder of ETH.

Price-wise, $2,880 is seen as the key short-term support. Crypto analyst Ted Pillows said, "If Ethereum fails to reclaim the $3,000 level by this weekend, it could be pushed down into the $2,800s in the short term."

3. XRP (XRP)

XRP was particularly weak among major coins this week. The price continued to move sideways within a narrow range and repeatedly failed to recover to $2, weakening investor sentiment. XRP is currently trading around $1.8 on CoinMarketCap.

Market participants view the collapse of a technically important support level as the biggest burden, compounded by selling anxiety. NewsBTC analyzed, "The $1.95 level, which had held strongly for about 13 months since November last year, was breached, triggering a cascade of selling that directly led to the decline."

CoinDesk offered a similar assessment, stating, "XRP encountered strong selling pressure near $1.90, breaking down through short-term support, and has since been trapped in a narrow range without finding clear direction."

Notably, trading volume surged near resistance. When price was capped around $1.906, volume jumped to about 75,300,000 XRP, nearly double the 24-hour average volume. The fact that volume spiked without price rising is interpreted as a sign that large investors were on the sell side rather than the buy side.

Concerns about whale selling grew as large transfers were detected. On the 23rd, Ripple Labs transferred about 65,000,000 XRP — roughly $121,000,000 — to an anonymous wallet. The market interpreted this as a move preparing for sales, further denting investor sentiment.

However, some positive signs have also appeared. According to CryptoQuant, exchange-held XRP balances on Binance fell to about 2,660,000,000 as of the 26th, the lowest level since July last year. A decline in exchange balances means there is less sell-side supply immediately available on the market, leaving room for a potential rebound.

Spot XRP ETF flows remain robust. According to Soso Value, the spot XRP ETF recorded net inflows for 28 consecutive trading days as of the 24th, with cumulative net inflows of about $1,140,000,000. Although the price is depressed, institutional capital continues to flow in steadily.

In the short term, $1.87 is cited as a key level. CoinDesk evaluated that this range has shifted from a simple support to a level that determines direction. If the price recovers and holds this level, a rebound toward $1.90–$1.91 could be expected. Conversely, failure to hold it could open the way to the $1.86 area and further down to around $1.855.

Issue coin

1. MediBloc (MED)

A notable mover this week was MediBloc. MediBloc surged more than 20% on Upbit on the 23rd in a single day, drawing market attention.

MediBloc is a blockchain-based medical record management project for healthcare workers and patients. It aims to securely store patients' medical data and return access rights to individuals. Domestically, it is often classified as a 'kimchi coin.'

The recent surge occurred without clear news. However, looking at the trading structure helps understand the background. About 95% of MediBloc's global trading volume occurs on domestic exchanges, and in such a structure, if domestic buying pressure concentrates at a certain time, prices can surge in a short period.

That structure also means volatility can quickly increase after a rapid rise. In the short term, it is important to see whether the price forms a stable range after the surge, and in the long term, if fundamental changes such as wider adoption by medical institutions or increased real-world use do not accompany the move, the upside momentum could be limited.

![[Analysis] "Bitcoin short-term investors move to cut losses amid continuing cold snap"](https://media.bloomingbit.io/PROD/news/cc0442d7-a697-4c0f-8f0f-b33fc1966445.webp?w=250)

![Bitcoin consolidates ahead of large options expiry... Ethereum and XRP also take a breather [Lee Su-hyun's Coin Radar]](https://media.bloomingbit.io/PROD/news/4822425f-3a76-4fb4-a4ba-6b767237a9f4.webp?w=250)

![Exchange rate that hit 1,429 won…"May fall further to 1,400 won" vs "Unsustainable" [Hankyung FX Market Watch]](https://media.bloomingbit.io/PROD/news/d553c109-58a5-4e28-a235-de52f1b7f155.webp?w=250)