Editor's PiCK

High exchange rate outlook curbed by successive market interventions…"Government will press it down to around 1,430 won"

공유하기

- Due to the government's foreign exchange market intervention and the National Pension Service's strategic currency hedging coming into full operation, the won–dollar exchange rate fell to its lowest level in about two months.

- The market said there is a high possibility that the exchange rate will fall further by year-end and the closing rate will be decided around 1430 won.

- However, experts pointed out that the effect of market intervention may be temporary in the medium to long term, and structural factors for exchange rate rises remain.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Two days, 43 won 'drop'…lowest exchange rate in two months

After volatile swings, fell to 1440 won

National Pension Service's currency hedging seems to have been activated

Due to the government's high-intensity foreign exchange market intervention, the won–dollar exchange rate fell to its lowest level in about two months (the won appreciated). As the National Pension Service's strategic currency hedging is reported to have been put into full operation, expectations of further exchange rate rises were dampened, analysts say.

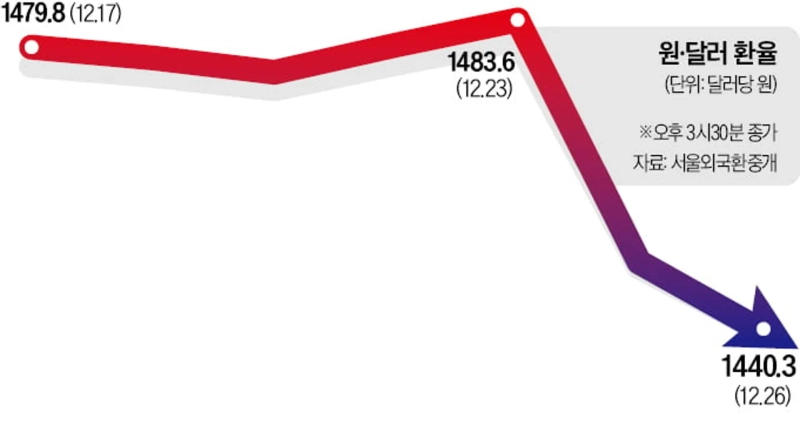

On the 26th in the Seoul foreign exchange market, the won–dollar exchange rate (as of 3:30 p.m.) finished the week at 1440 won 30 jeon, down 9 won 50 jeon from the previous trading day. Considering the 33 won 80 jeon fall on the 24th, it fell 43 won over two trading days.

That day the exchange rate opened at 1449 won 90 jeon, up 10 jeon from the previous trading day, and rose above 1450 won in the early session. When the rate reached 1454 won, concerns arose that the authorities' intervention effect might be only temporary, but a sharp decline began around 10 a.m. Around 11:35 a.m. it recorded an intraday low of 1429 won 50 jeon. That day's weekly close was the lowest since last month on the 4th (1437 won 90 jeon), and the intraday low was the lowest since the 3rd (1425 won 80 jeon), about two months ago.

Many see the exchange rate's large drop over two consecutive trading days as the result of the foreign exchange authorities' verbal intervention combined with large-scale actual intervention, and the full activation of the National Pension Service's strategic currency hedging. It is understood that the National Pension Service decided to operate strategic currency hedging as needed without a resolution from the Fund Management Committee and began execution from the 24th. The market estimates that about 2.5 billion dollars of hedging volume emerged on the 24th and that additional hedging was executed on the day as well.

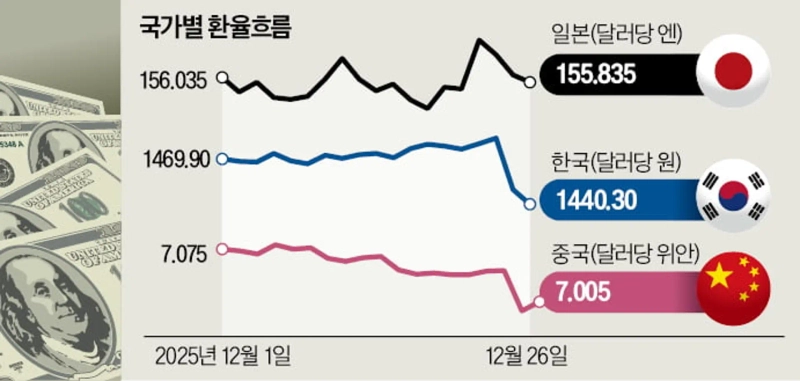

Foreign investors' net buying of listed stocks worth 1,776.3 billion won in the cash market helped strengthen the downtrend in the exchange rate. The appreciation of the Japanese yen and the Chinese yuan, which move in tandem with the won, also contributed to the exchange rate's decline.

The market expects the downtrend to continue through the end of the year. Park Hyeong-jung, an economist at Woori Bank, said, "The foreign exchange authorities' determination to manage the year-end closing rate is very strong," and added, "Over the remaining two trading days, the exchange rate may fall further and the closing rate may be decided around 1430 won."

Won–dollar rate in the 1440 won range…mixed forecasts on further declines

Government's intent conveyed to the market…"Fundamental upward factors remain"

On the 24th, when the foreign exchange authorities carried out an 'ultra-strong verbal intervention', many in the market saw 1450 won per dollar as the authorities' 'defensive line'. They thought it would not be easy to maintain the rate about 30 won lower from above 1480 won. However, as the rate fell sharply for two consecutive trading days, market expectations lowered further. Considering the authorities' strong determination, some predicted the year-end exchange rate could close in the 1430 won range.

◇"Expect entry into the 1430 won range by year-end"

On the 26th in the Seoul foreign exchange market, the won–dollar rate fell to 1429 won 50 jeon at one point in the morning. Considering that the intraday high on the 24th was 1484 won 90 jeon, it plunged 55 won 40 jeon in two trading days. The rate steadily rose just before lunch and finished the week in the 1440 won range. The market noted that the authorities pulled the rate down to the 1420 won range.

Park Hyeong-jung, an economist at Woori Bank, said, "The government's policy intention to lower the exchange rate has been strongly conveyed to the market," adding, "It appears the government is targeting the 1430 won level." He said, "There is a possibility the exchange rate will fall further over the remaining two days until year-end," and predicted, "The closing rate will be decided around 1430 won."

Experts believe that after the government's high-intensity verbal intervention on the 24th, strategic currency hedging volume from the National Pension Service has been coming into the market and affecting the exchange rate. Park Sang-hyun, a researcher at iM Securities, said, "We cannot gauge the exact volume, but it is understood that hedging is in operation," and added, "The authorities' intention to stabilize the exchange rate is influencing the market, even mobilizing the National Pension Service."

With the exchange rate plunging for two consecutive days, market expectations that the rate might rise in the future could be dampened. Kwon A-min, a researcher at NH Investment & Securities, said, "The authorities' strong determination has dampened expectations," explaining, "Even if the year-end closing rate finishes in the mid-1400 won range, it could fall further to the low-1400 won range in early next year."

The recent strengthening of the Japanese yen and the Chinese yuan, which are considered proxy currencies for the won, is also expected to contribute to exchange rate stability. The yen–dollar rate fell from 157.6 yen per dollar on the 22nd to 155.8 yen on the day. The Chinese yuan traded at 6.99 yuan per dollar on the 24th, marking its weakest level in about 15 months.

◇Will market intervention continue into next year?

Most experts expect the government's market interventions to keep the exchange rate down and stable through the end of this year. However, many experts expressed doubt about whether the stability would continue after next year. The foreign exchange authorities may feel burdened by a decline in foreign exchange reserves due to market intervention. There are also many structural factors that could sustain dollar demand, such as the Korea-US policy rate gap and differences in expected stock market returns.

Lee Yun-su, a professor of economics at Sogang University, said, "There is no reason for individuals not to invest overseas, and companies also need to increase investment in the U.S.," and added, "When all economic agents want to send money to the U.S., the exchange rate will inevitably rise in the medium to long term." He pointed out, "In this context, it is necessary to consider whether mobilizing the National Pension Service to lower the exchange rate is better for the national economy." Lee Jin-gyeong, a researcher at Shinhan Investment Corp., analyzed, "From a corporate perspective, there still does not seem to be much incentive to convert won to dollars," while also stressing, "In the short term, the exchange rate may stabilize down to the low-to-mid 1400 won range," but "in the medium to long term, fundamental economic factors are important."

There is also analysis that the government's measures are temporary. Jeong Yong-taek, an economist at IBK Investment & Securities, said, "Attention should be paid to the fact that all government measures are 'temporary'," and explained, "The government also knows that it cannot avoid a mid-to-long-term upward trend in the exchange rate." In fact, the capital gains tax benefit given when selling foreign stocks and buying domestic stocks is applied for one year. The Bank of Korea's 'foreign exchange reserve interest' that pays interest on excess foreign currency required reserves will also operate only until June next year.

Jeong the economist advised, "We should consider that the decline in the exchange rate may not be large or that the rate that falls by year-end may be reversed."

Reporter Kang Jin-gyu josep@hankyung.com

![[Analysis] "Bitcoin short-term investors move to cut losses amid continuing cold snap"](https://media.bloomingbit.io/PROD/news/cc0442d7-a697-4c0f-8f0f-b33fc1966445.webp?w=250)