Editor's PiCK

"Bitcoin continues to diverge from stocks and gold…Could be a sign of a sharp rise"

공유하기

- Analyst PlanB stated that Bitcoin prices have recently significantly deviated from their historical correlations with the stock market and gold.

- He said that in the past there were cases where Bitcoin deviated from correlations with traditional assets and afterward showed a sharp rise.

- But it is not certain whether the same pattern will repeat this time, and PlanB mentioned that the correlation may either recover or break completely.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Bitcoin (BTC) prices have significantly deviated from their historical correlations with the stock market and gold prices.

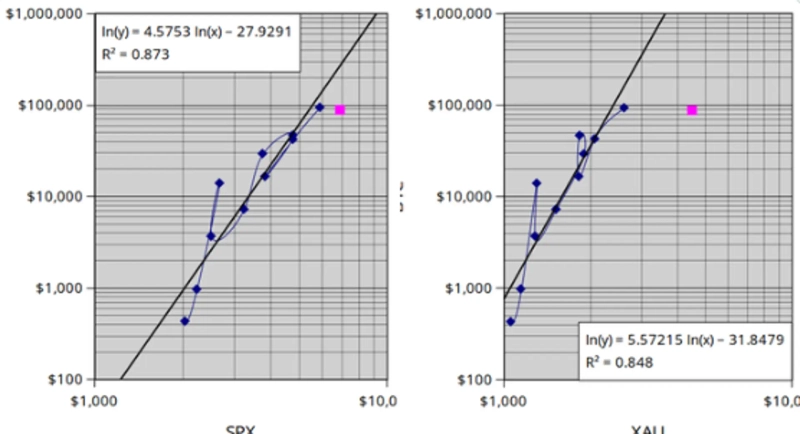

On the 27th (Korean time), well-known crypto analyst PlanB analyzed on X (formerly Twitter), "Bitcoin has currently significantly deviated from its historical correlations with the S&P500 and gold."

He mentioned, "In the past, there were cases where Bitcoin deviated from correlations with traditional assets, and at those times a significant surge followed." However, he added, "It cannot be concluded that the same trend will repeat this time."

PlanB said, "The correlation may recover, but conversely there is also a possibility that it will break completely this time," and "Only time will tell the result."