Editor's PiCK

"No Fusaka effect"…Ethereum's Q4 return 'negative' for first time in 3 years

공유하기

- Ethereum's Q4 return was -26.76%, recording the largest decline since 2018.

- U.S. Ethereum spot ETFs saw large net outflows for two consecutive months, further weakening institutional investor sentiment.

- Some DAT companies have abandoned Ethereum reserves and moved to sell, while some investors are opting for buy-the-dip strategies.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Ethereum, Q4-only -27% decline

Largest decline in 7 years since 2018

U.S. ETFs also see net outflows for 2 consecutive months

DAT companies continue 'poor performance'

Warnings that they will be 'the first to disappear'

Ethereum (ETH) posted a negative Q4 return for the first time in 3 years. As the price decline continued, some digital asset treasury (DAT) companies gave up holding Ethereum.

According to crypto analysis platform CoinGlass on the 29th, Ethereum's Q4 return was -26.76% as of that day. It returned to negative for the first time in 3 years for Q4 since 2022 (-9.94%). In terms of decline rate alone, it is the largest drop in 7 years since 2018 (-41.62%).

The largest drop was last month (-22.38%). October's decline also reached 7.02%. December recorded a 1.45% increase, managing to fare somewhat better. Ethereum's price rose more than 3% that day, recovering December's losses.

Boxed around $3,000 since November

The trigger for the Q4 downturn was the large-scale liquidation in mid-October. At that time, $20 billion (about 28.7 trillion won) worth of positions were liquidated in the crypto futures market, and Ethereum's price plunged about 12% in one day. After that, liquidity in the crypto market shrank, and Ethereum's price continued to underperform, becoming trapped in a $3,000-range box since mid-last month.

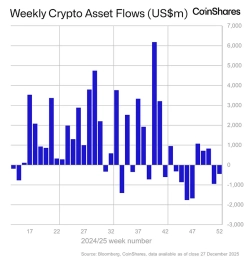

Risk-off sentiment also played a large role. In particular, crypto investor sentiment took a direct hit in Q4 as the U.S. Federal Reserve's hawkish (preference for monetary tightening) rate signals and an 'AI bubble' narrative coincided. As a result, Alternative's cryptocurrency Fear & Greed Index plummeted to the 20s in early last month and has remained mostly in the 'extreme fear' zone for the past two months. Crypto analytics firm Matrixport analyzed that "basic demand for cryptocurrencies, including Ethereum, has contracted, making prices extremely sensitive to capital flows."

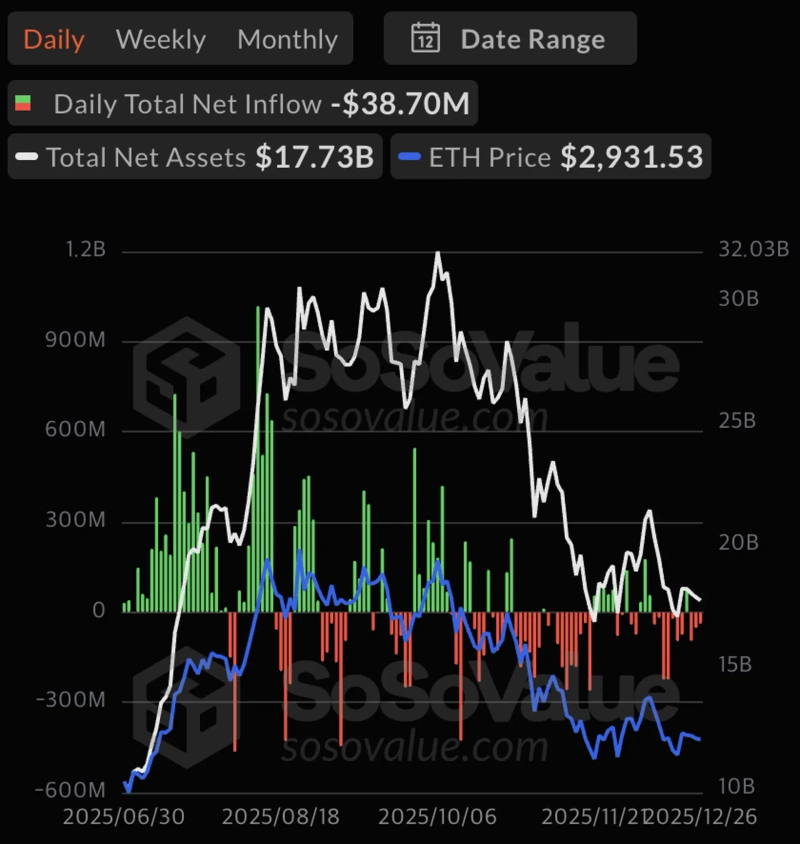

Institutional money is also leaving. According to crypto data analytics firm SosoValue, U.S. Ethereum spot ETFs recorded net outflows for two consecutive months from last month through this month. Except for March this year (-403.4 million dollars), November and December were the only months this year in which Ethereum spot ETFs reported net outflows. Last month, 1.42 billion dollars (about 2 trillion won) flowed out, marking the largest monthly net outflow on record.

The 'Fusaka effect' faded

Industry participants say the Fusaka upgrade applied to the Ethereum mainnet earlier this month had virtually no effect on the price. Fusaka is an upgrade that greatly increases Ethereum network scalability through the blockchain innovation 'PeerDAS'. Normally, network upgrades have been positive for Ethereum's price. Pectra and Dencun, implemented in May this year and March last year respectively, are representative examples. In particular, during the Pectra mainnet upgrade immediately before Fusaka, Ethereum's monthly return exceeded 40%.

This helps explain why investor expectations are muted for the large-scale upgrades scheduled next year, such as Glamsterdam and Hegota. Fundstrat, a U.S. asset manager led by Tom Lee, head of BitMine, even projected that Ethereum's price could fall to the $1,800 range next year. On Polymarket, the world's largest betting site, the probability that gold will breakeven $5,000 before Ethereum's price as of that day was calculated at 72%. Compared to 30% on the 1st of last month, it has jumped 42 percentage points in the past two months.

DAT companies also declare 'abandoning reserves'

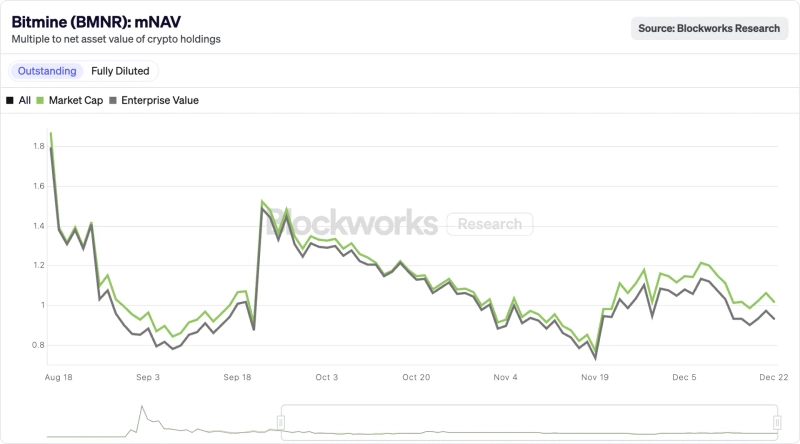

Given the situation, DAT companies that hold Ethereum have continued to show poor performance. According to Blockworks, BitMine's mNAV (company value relative to Ethereum holdings) was 0.93 as of the 22nd of this month. If mNAV falls below 1, it means the company's market value is lower than its crypto holdings. U.S. Nasdaq-listed ShaplinkGaming, second in Ethereum holdings, saw its mNAV fall to 0.77 recently.

Some DAT companies have started selling Ethereum. U.S. Nasdaq-listed ETHZilla reportedly sold about 114.5 million dollars (about 160 billion won) worth of Ethereum from October to recently. After the large Ethereum sale, ETHZilla suggested the possibility of abandoning DAT, saying, "The company's future value will be determined by the tokenization business of real-world asset (RWA)."

Nasdaq-listed FG Nexus also sold about 41 million dollars (about 60 billion won) worth of Ethereum last month. Altan Tutar, CEO of MoreMarkets, said, "The key metric that (DAT company) investors care about is mNAV," and added, "Altcoin DAT companies will find it difficult to keep mNAV above 1 and will be the first to disappear."

However, some firms view the recent price decline as a 'buy-the-dip' opportunity. TrendResearch, a subsidiary of crypto investment firm LD Capital, jumped into accumulating Ethereum last month and has secured up to 600,000 ether to date. In terms of holdings, it ranks third after BitMine and ShaplinkGaming. TrendResearch is reportedly preparing financing of 1 billion dollars (about 1.4 trillion won) to continue buying Ethereum. Jack Yi, founder of LD Capital, said, "With 1 billion dollars in funds, we will buy Ethereum whenever the price falls."

![[Analysis] Bitcoin briefly recovered $90,000… remains range-bound amid thin year-end liquidity](https://media.bloomingbit.io/PROD/news/fac68f0c-39cb-4793-8eac-de269ba2aefb.webp?w=250)