- It reported that Bitcoin's price has fallen below the 1-year moving average, indicating it has already entered a bear market.

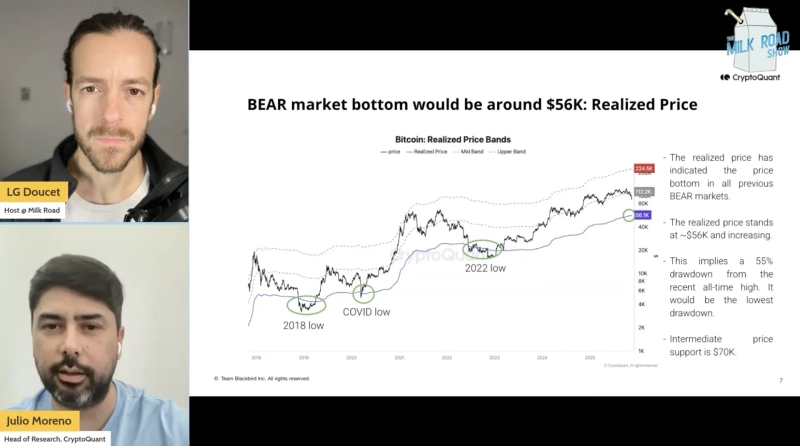

- Moreno indicated the bottom range of this bear market to be between $56,000 and $60,000.

- It said that structural demand from institutions and ETFs is currently reducing market volatility.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Analysis has suggested that Bitcoin entered a bear market already two months ago.

On the 1st (local time), Julio Moreno, head of research at CryptoQuant, appeared on the YouTube channel 'Milk Road' and said, "Bitcoin's price has moved below the 1-year moving average (12-month average price)," adding, "this is a technical indicator that confirms entry into a bear market."

He explained, "Our own 'bull market score indicator', which combines network activity, investor profitability, liquidity, etc., turned bearish from early November last year and has not yet recovered."

In fact, Bitcoin hit an all-time high of $126,199 in October last year but gave back gains afterwards and finished the year at a price lower than the year's opening price ($93,576). As of that day, Bitcoin was trading around $88,700.

Moreno suggested the bottom of this bear market would be in the $56,000 to $60,000 range. This figure is calculated based on the 'realized price (the average purchase price of all Bitcoin holders)'. He analyzed, "Looking at past cases, prices in bear markets tend to fall to the realized price level," adding, "this represents a decline of about 55% from the peak, which shows more positive resilience compared to past downturns that plunged 70~80%."

However, evaluations say that the market's structural soundness has improved compared to the past. There are no major systemic risks like the 2022 Terra-Luna incident or the FTX bankruptcy, and institutional funds through spot exchange-traded funds (ETFs) are supporting the market.

Moreno added, "In previous bear markets demand contracted sharply, but now there is structural demand from institutions and ETFs that buy periodically," adding, "they are absorbing sell pressure and reducing market volatility."

![Bitcoin Sideways, Ethereum Holding… Crypto Market Ahead of the 'Trump Variable' [Lee Su-hyun's Coin Radar]](https://media.bloomingbit.io/PROD/news/422585c1-1158-4080-94f0-cffa320d0193.webp?w=250)

![Lee Chang-yong shows vigilance over the exchange rate "Only domestically talk of 1,500 won, will manage expectations" [Hankyung Foreign Exchange Market Watch]](https://media.bloomingbit.io/PROD/news/d5df0f38-1706-41b1-9a4b-9b148d569e34.webp?w=250)