Editor's PiCK

U.S. spot Bitcoin ETFs start first trading day of the new year with net inflows...$471.14 million

공유하기

- It reported that U.S. spot Bitcoin ETFs' daily total net inflows amounted to $471.14 million.

- BlackRock's IBIT recorded the largest net inflow at $287 million, and Fidelity's FBTC and Bitwise's BITB also recorded net inflows.

- Grayscale's GBTC, its mini trust product, Franklin Templeton, VanEck, ARK 21Shares and several other ETFs also showed capital inflows on the order of millions of dollars.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

U.S. spot Bitcoin exchange-traded funds (ETFs) started the first trading day of the new year with net inflows.

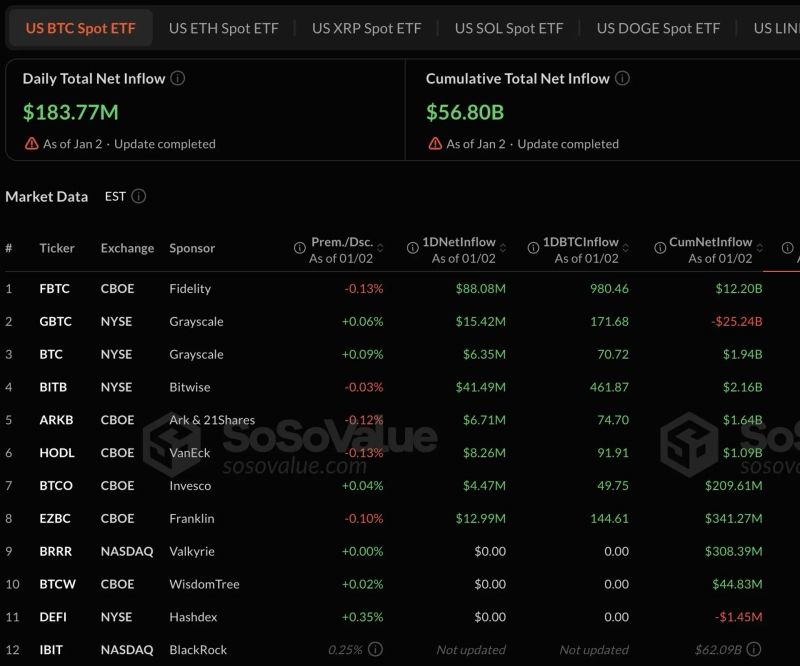

On the 2nd (local time), according to on-chain data platform SosoValue, the daily total net inflows for the 11 spot Bitcoin ETFs traded in the U.S. were $471.14 million.

The inflows that day were led by BlackRock's 'IBIT', which saw net inflows of $287 million. Following it were Fidelity's 'FBTC' with $88.08 million and Bitwise's 'BITB' with $41.49 million in net inflows.

Grayscale's 'GBTC' also showed a buying advantage that day. GBTC received $15.42 million, and Grayscale's lower-fee mini trust product 'BTC' saw $6.35 million in inflows.

In addition, Franklin Templeton (EZBC) received $12.99 million, VanEck (HODL) $8.26 million, and ARK 21Shares (ARKB) $6.71 million, respectively.

![Mixed finish in the first trading day of the new year…Tech stocks' mixed fortunes [New York market briefing]](https://media.bloomingbit.io/PROD/news/afe6ce3f-2551-41c7-80b4-2991d95ecfc1.webp?w=250)